If How You Earn Returns Matter

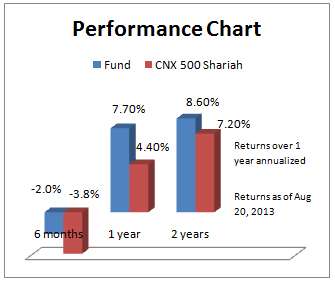

If you had been looking at the last one year’s equity returns chart, Tata Ethical may be one of the funds that attracted your attention. Being a fund that is Shariah compliant, the fund’s portfolio remained insulated from the severe volatility faced by the banking sector, as Shariah funds do not take exposure to the finance space. With a return of 7.7% in the last one year, the fund was possibly among a handful of equity funds that delivered positive returns despite the market rout.

The Fund

Tata Ethical is a Shariah compliant fund. That means the fund follows the principle of Islam when investing in stocks. It cannot therefore invest in sectors categorized as morally deficient, such as tobacco, alcohol, gambling and lottery, and sectors that deal with interest-bearing securities.

Tata Ethical will therefore not invest in companies with stakes in tobacco or liquor, select consumer goods, and banking and finance.

That leaves it with sectors such as auto, oil and gas, metals, petrochemicals, cement, capital goods, engineering, infrastructure, power and textiles. Even within this space, the fund may consciously avoid companies with high debt.

Suitability

Tata Ethical adopted the Shariah principle of investing only 2 years ago. Until then, it was a diversified equity fund under the name ‘Tata Select Equity’. That means the fund’s track record under its new avatar is yet to be sufficiently tested.

A long track record is paramount to testing this fund given that it cannot take exposure to the banking space. Banking and financial service sectors account for a chunk of all key indices (besides the fact that the banking sector is a long-term outperformer) and non-exposure to the sector in the long run can make it difficult for a fund to outperform broad markets.

The fund is therefore an option only for investors who wish to adopt Shariah investing, or those who strongly feel how they earn returns matters as much as how much returns they earn. Such investors may take the SIP route and keep track of the fund’s performance against its benchmark. Comparison with diversified equity funds may not be appropriate to assess the fund’s calibre.

Performance

Given that Tata Ethical has only a 2-year record after it became Shariah compliant, we have restricted to highlighting its record post its changed strategy. The fund delivered 8.6% annually in the last 2 years, higher than the 7.2% annual return of its index – the CNX 500 Shariah. Broad benchmark indices delivered marginally lower than that.

Given that Tata Ethical has only a 2-year record after it became Shariah compliant, we have restricted to highlighting its record post its changed strategy. The fund delivered 8.6% annually in the last 2 years, higher than the 7.2% annual return of its index – the CNX 500 Shariah. Broad benchmark indices delivered marginally lower than that.

While it is true that the fund outperformed diversified equity funds over this period, we took the CNX 500 Shariah index to see if it beat funds over a 3-year period (We did not compare Tata Ethical’s 3-year return as the fund did not follow shariah principle 3 years ago).

Data suggests that while Tata Ethical did outperform the category average by about 5 percentage points, established large-cap funds such as ICICI Pru Focused Bluechip, as well as opportunity funds such as UTI Opportunities managed better returns.

That perhaps is some evidence to the limitation of not having key sectors such as banking in a portfolio.

Tata Ethical is among the top five funds in the one-year diversified equity fund returns chart. With a return of 7.7% over the last 1 year, it comfortably beat its benchmark return of 4.4%. The few others that managed to beat it did so either by holding higher cash or using derivatives to a limited extent.

While Tata Ethical too, held over 10% in cash as of July, it largely avoided the bear attack in 2013 merely by staying away from the banking space. Other diversified funds can ill-afford to do this, as banking forms a chunk of any index.

Taurus Ethical is the only peer for Tata Ethical in the Indian mutual fund universe at present; the other one being an ETF (Goldman Sachs Shariah BeES). Tata Ethical comfortably outperformed both its peers.

Portfolio

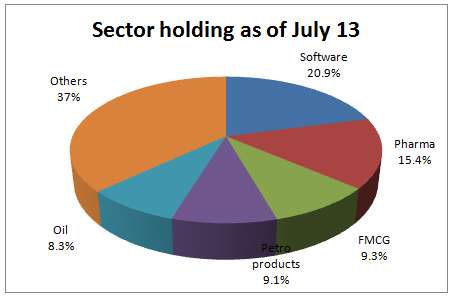

Tata Ethical has over a fifth of its holding in its top sector – IT, evidently increasing exposure to this sector with the advent of a depreciating rupee (against the dollar). The IT sector was its second top holding a year ago, with exposure limited to about 14% then. The fund considerably reduced exposure to the auto ancillary space, which was among the top 3 sectors a year ago. This move proved to be right what with the auto space reeling under a slowdown.

Tata Ethical has over a fifth of its holding in its top sector – IT, evidently increasing exposure to this sector with the advent of a depreciating rupee (against the dollar). The IT sector was its second top holding a year ago, with exposure limited to about 14% then. The fund considerably reduced exposure to the auto ancillary space, which was among the top 3 sectors a year ago. This move proved to be right what with the auto space reeling under a slowdown.

The fund took selective exposure to consumer goods stocks such as Emami, Dabur India, Agro Tech Foods and P&G Hygiene, ensuring that such companies are mostly in Shariah-compliant businesses.

Tata Ethical has about a fourth of its assets in mid-cap stocks with market capitalization of less than Rs. 10,000 crore. Info Edge, KPIT Cummins and Zydus Wellness are some of the interesting picks.

The fund is managed by Pradeep Gokhale.

Hello Vidya,

As always, great information. Thnx for the timely article.

I am requesting you to kindly shed some light on US Equity focused Funds like ICICI Pru US Bluechip Equity and JP Morgan US Value Equity Off-shore as the later is a fund of funds.

My question is should one build a portfolio of 5000 INR for a long term (10~20 years) with the above two funds of 20% each? Also, the rest of the funds in the portfolios are UTI Opportunities, IDFC Premier Equity and Canara Rebeco Indigo of 20% each.

Please advise kindly that if the above portfolio is suitable for around 10~20 Years with 5000 INR per month. Especially, I am concerned about the US focused Equity funds which are of 40% of the portfolio.

Please also note that this is a secondary portfolio and a Primary is going on with fundsIndia SMART SOLUTIONS at 10000 INR per month. So, can one go with this portfolio for an experiment?

I know the ask advisor route but I am requesting you to give a quick expert thought on the above.

Regards,

Sanjoy Bose

Hello Sanjay, When you invest in an international fund, remember there are 2 factors at play: one is the performance of the fund, based on the international market and the other being the more unpredictable factor, currency movement. It is for this reason,a 40% exposure would be taking too much of a gamble, unless you are well versed in both these subjects. We do not normally recommend over 10-15% (20% at your own risk) exposure to intl. markets. Also, remember much of the gains is from currency. In the long term, Indian markets ought to outperform developed markets.

As for funds, only if you believe in value investing as a theme, you should go for the JP Morgan fund. Otherwise stick to a broad based fund. In the US value indices have marginally underperformed over longer time frames (over 3 years). FT India Feeder – Franklin India US Opportunities would be an option for broad based investing in US(we would prefer fund houses intl. presence when it comes to investing abroad). Your other fund choices are ok. You should go for Indigo only if you feel you need gold exposure. Otherwise an income funds like Birla Dynamic or Templeton India Income Opportunities should suffice. Thanks, Vidya

Dear vidya,

Thanks for the articles as they are very informative.

I have 2 questions.

1. Banking stocks are doing badly. Is it a good time to invest in banking funds in a staggered manner until the elections are over .

2. Midcap sector is also very low. I have SIP in HDFC Midcap Opportunities,IDFC Sterling, SBI emerging business fund, Reliance Equity Opportunities and ICICI Pru. Discovery fund (20,000/- altogether). I plan to run for another yeae to accumulate the units in cheaper valuations , stop it and then redeem it when i get about 15 – 20% whever be it.

When i stop the SIP’s in midcap fund, I plan to continue my SIP in large cap funds like FI bluechip, UTI Opportunities, Quantum Long term And BSL Frontline equity (presently it is 25,000) with incresed allocation. Is it a right way?

Hello Ajith, I would urge you to use our Ask Advisor feature to reply to portfolio-related queries for funds in your FundsIndia portfolio. It would provide us with a systematic tracking of your queries and our own suggestions.

1. I would think buying selective banking stocks (if you can pick the right ones) may be a better aproach at this point to buying a banking fund. If you had a 5-10 year view with SIPs, then banking funds should be fine.

2. One need not play specific market-caps if the investment time frame is long term. We would suggest a combination of large-cap and mid-cap funds for a long-term portfolio. You can always rebalance the portfolio if the mid-cap exposure becomes high. And also slowly reduce mid-cap exposure if you want to reduce risk as you near the goal. Tks, Vidya

Thnx a lot Vidya for your time.

I am dropping the idea of exposure to US funds too much, after your thoughts, I have removed both the US funds from the list but adding FT India Feeder – Franklin India US Opportunities as only 20%. I will see if a 10~15% is allowed (less than 1000 INR per month), I will go for lesser.

Then any thoughts on where should I invest the rest 20% amount, should I add it to the UTI Opportunities or any other fund (ICICI Pru focused bluechip Equity is already on my Primary Portfolio).

Thnx for your time again.

Regards,

Sanjoy Bose

Hi Sanjat, you can increase by 5% in IDFC Premier Equity and rest in UTI Opportunties. tks, Vidya

Thnx a lot Vidya for your time and help.

Regards,

Sanjoy Bose

Hello Vidya,

As always, great information. Thnx for the timely article.

I am requesting you to kindly shed some light on US Equity focused Funds like ICICI Pru US Bluechip Equity and JP Morgan US Value Equity Off-shore as the later is a fund of funds.

My question is should one build a portfolio of 5000 INR for a long term (10~20 years) with the above two funds of 20% each? Also, the rest of the funds in the portfolios are UTI Opportunities, IDFC Premier Equity and Canara Rebeco Indigo of 20% each.

Please advise kindly that if the above portfolio is suitable for around 10~20 Years with 5000 INR per month. Especially, I am concerned about the US focused Equity funds which are of 40% of the portfolio.

Please also note that this is a secondary portfolio and a Primary is going on with fundsIndia SMART SOLUTIONS at 10000 INR per month. So, can one go with this portfolio for an experiment?

I know the ask advisor route but I am requesting you to give a quick expert thought on the above.

Regards,

Sanjoy Bose

Hello Sanjay, When you invest in an international fund, remember there are 2 factors at play: one is the performance of the fund, based on the international market and the other being the more unpredictable factor, currency movement. It is for this reason,a 40% exposure would be taking too much of a gamble, unless you are well versed in both these subjects. We do not normally recommend over 10-15% (20% at your own risk) exposure to intl. markets. Also, remember much of the gains is from currency. In the long term, Indian markets ought to outperform developed markets.

As for funds, only if you believe in value investing as a theme, you should go for the JP Morgan fund. Otherwise stick to a broad based fund. In the US value indices have marginally underperformed over longer time frames (over 3 years). FT India Feeder – Franklin India US Opportunities would be an option for broad based investing in US(we would prefer fund houses intl. presence when it comes to investing abroad). Your other fund choices are ok. You should go for Indigo only if you feel you need gold exposure. Otherwise an income funds like Birla Dynamic or Templeton India Income Opportunities should suffice. Thanks, Vidya

Dear vidya,

Thanks for the articles as they are very informative.

I have 2 questions.

1. Banking stocks are doing badly. Is it a good time to invest in banking funds in a staggered manner until the elections are over .

2. Midcap sector is also very low. I have SIP in HDFC Midcap Opportunities,IDFC Sterling, SBI emerging business fund, Reliance Equity Opportunities and ICICI Pru. Discovery fund (20,000/- altogether). I plan to run for another yeae to accumulate the units in cheaper valuations , stop it and then redeem it when i get about 15 – 20% whever be it.

When i stop the SIP’s in midcap fund, I plan to continue my SIP in large cap funds like FI bluechip, UTI Opportunities, Quantum Long term And BSL Frontline equity (presently it is 25,000) with incresed allocation. Is it a right way?

Hello Ajith, I would urge you to use our Ask Advisor feature to reply to portfolio-related queries for funds in your FundsIndia portfolio. It would provide us with a systematic tracking of your queries and our own suggestions.

1. I would think buying selective banking stocks (if you can pick the right ones) may be a better aproach at this point to buying a banking fund. If you had a 5-10 year view with SIPs, then banking funds should be fine.

2. One need not play specific market-caps if the investment time frame is long term. We would suggest a combination of large-cap and mid-cap funds for a long-term portfolio. You can always rebalance the portfolio if the mid-cap exposure becomes high. And also slowly reduce mid-cap exposure if you want to reduce risk as you near the goal. Tks, Vidya

Thnx a lot Vidya for your time.

I am dropping the idea of exposure to US funds too much, after your thoughts, I have removed both the US funds from the list but adding FT India Feeder – Franklin India US Opportunities as only 20%. I will see if a 10~15% is allowed (less than 1000 INR per month), I will go for lesser.

Then any thoughts on where should I invest the rest 20% amount, should I add it to the UTI Opportunities or any other fund (ICICI Pru focused bluechip Equity is already on my Primary Portfolio).

Thnx for your time again.

Regards,

Sanjoy Bose

Hi Sanjat, you can increase by 5% in IDFC Premier Equity and rest in UTI Opportunties. tks, Vidya

Thnx a lot Vidya for your time and help.

Regards,

Sanjoy Bose

madam,

happy to see that you are back again with us after the vacation.another timely and informative article from you. thanks again.i presonally think such funds are not for genuine investors.

Hi Vidya,

Really liked your article on Shariah compliant MF. its been a while since I was looking for options like this for my investments. Currently I only have SIP in Quantum Gold and I want to go with either Tata Ethical or Taurus Ethical. My time frame would be for at least 5 yrs and amount begin with would be Rs.1000 pm.

Can you please help me out selecting? And I am FundsIndia delighted customer 🙂

Regards,

Tausif

Hello Tausif, If you wish to hold a shariah compliant fund then Tata Ethical should be your first choice. It performance metrics score over Taurus Ethical. Use the SIP mode to invest and compare performance occasionally with the index. Thanks, Vidya

Hi Vidya,

VRO says it’s category as Equity:Multi-cap & the style box is large-blend. So, it is a large cap based diversified equity? ICICI pru focussed is equity:large cap & UTI Opportunities is equity: large & midcap. So, I got a little confused when you were comparing these three funds above. I was comparing it against ICICI pru discovery/IDFC Premier Equity. I am sure there is lot more research & info available at your end than what I could see. So, if you could please help me where is the disconnect in my analysis?

And secondly if you see, all the large/midcap based funds historically had a high around 2011 and they have been declining since Jan’2013 where as this fund’s 52wk high is today. This got me totally surprised. Is it that banking is doing bad & this fund is completely void of banking the only reason for it’s good performance at present?

I have a initial 10K + 1K SIP running in this fund(started from last month) as I wanted to be involved with a Sharia fund. Seeing it’s current good health, is it a good idea to invest some 10-20k more at one time investment now? ( in addition to continuing the SIP?)

Hello Rahaman, First, one should not merely go by category avg. to compare. Investment strategy adopted is also important. Having said that, the point we were trying to make is that large-cap biased funds (with lower risk) actually managed better returns than a more diversified Tata Ethical.

Secondly, yes, nil exposure to banking and finance is the key reason for outperformance. And the fund has enough large-caps. Hence it is not hurt much my mid-cap fall.

If you are investing for the long term (5 years pus), it can be very challenging for a fund without banking and fin. stocks to beat good diversified funds. hence, we would not suggest higher allocation if you already have enough exposure. The fund s suitable for those who are particular that they should follow shariah principle for investing.

Thanks

Hi Vidya,

VRO says it’s category as Equity:Multi-cap & the style box is large-blend. So, it is a large cap based diversified equity? ICICI pru focussed is equity:large cap & UTI Opportunities is equity: large & midcap. So, I got a little confused when you were comparing these three funds above. I was comparing it against ICICI pru discovery/IDFC Premier Equity. I am sure there is lot more research & info available at your end than what I could see. So, if you could please help me where is the disconnect in my analysis?

And secondly if you see, all the large/midcap based funds historically had a high around 2011 and they have been declining since Jan’2013 where as this fund’s 52wk high is today. This got me totally surprised. Is it that banking is doing bad & this fund is completely void of banking the only reason for it’s good performance at present?

I have a initial 10K + 1K SIP running in this fund(started from last month) as I wanted to be involved with a Sharia fund. Seeing it’s current good health, is it a good idea to invest some 10-20k more at one time investment now? ( in addition to continuing the SIP?)

Hello Rahaman, First, one should not merely go by category avg. to compare. Investment strategy adopted is also important. Having said that, the point we were trying to make is that large-cap biased funds (with lower risk) actually managed better returns than a more diversified Tata Ethical.

Secondly, yes, nil exposure to banking and finance is the key reason for outperformance. And the fund has enough large-caps. Hence it is not hurt much my mid-cap fall.

If you are investing for the long term (5 years pus), it can be very challenging for a fund without banking and fin. stocks to beat good diversified funds. hence, we would not suggest higher allocation if you already have enough exposure. The fund s suitable for those who are particular that they should follow shariah principle for investing.

Thanks

dear vidya,

can you tell me investment options/ pension plans shariah based available in india.

Regards

abid

dear vidya,

can you tell me investment options/ pension plans shariah based available in india.

Regards

abid

Hi Abid, Other than the 2 funds (tata Ethical and Taurus Ethical), there is the Shariah ETF in NSE. Other than these there are no public investment channels available specifically for shariah investing.

Hi Vidya,

Are investments into these funds claimed for tax saving benefit-80C

If not are there any other Shariah Compliant funds which can be claimed under 80C.

Tata Ethical, Taurus Ethical & Shariah ETF .

Rgds,

Suhail.

Hello Suhail, There are no such funds at present with Shariah compliance and with 80C benefit. thanks, Vidya

Hi Vidya,

I’m completely new to mutual fund .I’m intrested in investing my money in tata ethical fund i saw the reviews and it looks good can you suggest me the minimum amount i should invest and step by step how can i maximisie my return on the investement .I’m looking for return on 1 year basis in your opinion which is the safest option where i can get maximum return on investment .I plan to invest initially 5000 and then after monitoring the performancce will invest more and one more question can i get tax benifit in this fund?

Hi Vidya,

I’m completely new to mutual fund .I’m intrested in investing my money in tata ethical fund i saw the reviews and it looks good can you suggest me the minimum amount i should invest and step by step how can i maximisie my return on the investement .I’m looking for return on 1 year basis in your opinion which is the safest option where i can get maximum return on investment .I plan to invest initially 5000 and then after monitoring the performancce will invest more and one more question can i get tax benifit in this fund?

Hello Atish, Our advice and review is available for investors in our plaform. Kindly open an account for us to enable us to provide you with MF advice. If you are already an investor you can use the ‘advisory appointment’ feature in help tab and our advisors will help you. Separately, pl. note that equity investing should be with a longer time frame. One year is not a time frame for equity funds. In a year like 2008, 1-year returns would only have been negative. thanks, Vidya

Hi vidya….

M new in mf market…bt only want to invest in sariah mf as per islam..

Last mnt I hv strted tata ehical fund sip of 10 k pm..

Plz suggest about this mf or switch to oder mf…bt I cn only invest in sariah fund…

Whts yr perception abt this fund in long n short term..

Plz suggest…

Hello sir,

Tata Ethical and Taurus Ethical are the only options you have. Not having financial services means that these funds can underperform in the logn term. There is one Shariah index ETF that Goldman Sachs has called GS Shariah BEES. thanks, Vidya

Dear Vidya,

Could you guide me the entire process of investments in mutual funds but plz be assure that the investment funds you recon should be strictly Shariah compliant.I am curious to know how does these actually works and lures us profit or earning.

Q1) It would be highly helpfull if you can provide me a demostration chart keeping the capital as INR 20,000,

Q2) What would be the earning from these investment

Q3) Tenure of investment

Q4) Does the Earnings/Profit would be paid Monthy/yearly or when ?

Q5) What are the risk factors involved ?

Looking forward to receive your response soon .

Thanks.

Md.Muneer

Hello Muneer, Pl. visit our tutorials about mutual funds: http://pages.fundsindia.com/pages/learning/using-fundsindia/#3

or visit Franklin Templeton’s site for learning on funds: http://www.franklintempletonindia.com/en_IN/investor/investor-education/ft-academy. It will explain the risk factors, how your money is invested and so on.

Mutual funds are invested in markets. What you get is the gains or losses the market makes. There is no fixed interest. And to answer your specific need, only Shariah based fudns such as Tata Ethical or Taurus Ethical or the Shariah BEES ETF follow shariah principles. No other fund can guarantee strictly following shariah principles in India.

thanks, Vidya

Hello Vidya,

Can you please suggest me ways to save tax under Shariah principles, I am ok to take risk even.

Thanks,

Saif

Hello Saif,

If you mean tax saving for the purpose of claiming under Section 80C of Income Tax act, then I am afraid there are no ELSS funds that follow shariah principles. However, if is to invest tax efficiently, then funds such as Tata Ethical qualify as an equity fund and gains are exempt after 1 year. Vidya

Hi Vidya,

I really appreciate your replies over all queries. As you must have seen that lot of investors from muslim community have started entering MF route for investing and for many the source of income matters more than the returns over it. Same is for me, I have been investing via FundsIndia for quite a while now and have referred many people to your awesome services.

Currently I have invested Rs.25000 in Tata Ethical and also Rs. 2500 as SIP in both Tata Ethical and Taurus Ethical. I wanted to know if there is any MF house which has some offering in ELSS with Shariah Compliant? The closest I came to was Reliance but even that has some holding in SBI. Can your organization get in touch with Tata and Taurus and put a proposal for starting an ELSS with Shariah Compliant, it would be great.

Thank you.

Hello Tausif, I understand and appreciate your requirement. There is unfortunately no fund house with a Shariah compliant ELSS product at present. Since banking receives the max. weight in all key indices, fund houses are reluctant to keep it away from their portfolios. We shall definitely pass the requirement/feedback to AMCs. regards, Vidya

How can Oil and Petro and Pharmaceutical investement ever be considered ethical in the big scheme of things?

What are the tax benefits of joining this mutual fund? Pls throw some light on the same.

Hello, Sorry for the delayed response. Gain on investments held for over 1 year, when sold, are exempt from tax. For holding period of less than 1 year, gains are taxed at 15%. But ideally equity funds need to be held for 5 years at least. thanks, Vidya

Is this inherently a good fund? I mean if you forget the fact that this is a Shariah compliant fund, and don’t care for Shariah compliance, is this still a good fund? Sounds like the real opinion is that this is the best Shariah fund; well to be more accurate a better Shariah fund than the only other shariah fund.

I was wondering if this makes for a good diversified fund (albeit without banking exposure). As practically every other diversified fund has very heavy exposure to the banking sector.

Hello Fahd, Tat Ethical is a good fund if you leave out the fact that it cannot invest in banks. However, in a rallying market it will underperform peers with banks as it is very tough for a fund to outperform in a market rally without banks.

thanks, Vidya

Hello … As there are only 2 mutual funds which follow sharian laws in India 1) Tata Ethical fund and 2) Tarus fund , as I am a beginner in investing in mutual fund… Through my financial knowledge I selected Tata Ethical fund – Regular plan ..which follows Sip and my investment duration will be for 10years … And now my question is as I have to invest only in one mutual fund …. What are the best way to buy it … directly from AMC or web portals or from distributor/ agent .. Remember that I will only invest in one mutual fund … ..

Zaheer, Sorry about the delayed response. you have to try the convenience and ease of use of an online platform like ours and also experiment with direct investments in AMCs before deciding what you want. thanks, Vidya

hi,

i am new to mutual funds. I want to invest in tata ethical MF. is it a good idea to invest 10K per month for 15 years? This would be my first investment. I have no other savings. please guide me if this would be profitable for me at the end. how much percentage of profit can i expect at the end of 15 years. iam strictly looking for Shariah compliant ways of investing.

what is shariah ETF. how to invest in it?

thanks

zainab

Hello Zainab, Sorry for the delayed response. We are constrained from provided recommendation for individual investments through the blog. Please use your FundIndia account to send your query and our advisors will help you. thanks, Vidya

hello vidya bala.. i hope you are fine. i want to get some idea from you

very soon with in 5 to 6 six month i will come back to India on final exit. ( from K.S.A )

and i would like to invest some amount 2 to 3 lack to get monthly or quarterly sharia based income.

kindly assist /advice me where i have to invest.

thanks

regards

Nazir.

Hello Sir,

thank you for writing us. You can consider investing in low risk short-term debt funds and do a systematic withdrawal plan. But before that we need to udnerstand your requirements, your profile etc. If you already have an account with FundsIndia, please write to us through your account and we will help you design a portfolio to yield you income. Youc an also open one anytime and our advisors will help you. thanks, Vidya

Hi,,

Assalamalik .I being a muslim was always looking for such a fund.Than you very much for this information.

Hi vidya

i am shams i want to get monthly 5000 how much to invest purly according to shariah

Hi Sham, yes this fund will fit your bill. Please ensure you invest adequately based on how much you can save and your own goals. Thanks,Vidya

Hi vidya

i am shams i want to get monthly 5000 how much to invest purly according to shariah

Hi Sham, yes this fund will fit your bill. Please ensure you invest adequately based on how much you can save and your own goals. Thanks,Vidya

Thanks a lot Vidya. This blog really helped me alot. very informative and you have cleard many doubts.

thanks

Waseem

Thanks a lot Vidya. This blog really helped me alot. very informative and you have cleard many doubts.

thanks

Waseem

I do agree with all of the ideas you have offered for your post. They’re very convincing and can definitely work. Still, the posts are too short for novices. Could you please lengthen them a bit from subsequent time? Thanks for the post.

I do agree with all of the ideas you have offered for your post. They’re very convincing and can definitely work. Still, the posts are too short for novices. Could you please lengthen them a bit from subsequent time? Thanks for the post.

How GST will effect the fund performance?I am investing 18000 rupees per month in TATA.How much will be average return from it after 3 years ?I am happy if it hit interest value or if it beat the inflation.average how much percentage I should expect as return after 3 years.

Aslam, sorry for the delayed response. Forget GST and it’s imapct continue your SIPs. GST’s imapct is too macro to be narrowed into returns. Have a 5-year time frame in equity funds in general. You will have inflation-beating, FD-beating returns. Vidya

How GST will effect the fund performance?I am investing 18000 rupees per month in TATA.How much will be average return from it after 3 years ?I am happy if it hit interest value or if it beat the inflation.average how much percentage I should expect as return after 3 years.

Aslam, sorry for the delayed response. Forget GST and it’s imapct continue your SIPs. GST’s imapct is too macro to be narrowed into returns. Have a 5-year time frame in equity funds in general. You will have inflation-beating, FD-beating returns. Vidya

Dear Vidya,

Could you guide me the entire process of investments in mutual funds but plz be assure that the investment funds you recon should be strictly Shariah compliant.I am curious to know how does these actually works and lures us profit or earning.

Q1) It would be highly helpfull if you can provide me a demostration chart keeping the capital as INR 20,000,

Q2) What would be the earning from these investment

Q3) Tenure of investment

Q4) Does the Earnings/Profit would be paid Monthy/yearly or when ?

Q5) What are the risk factors involved ?

Looking forward to receive your response soon .

Thanks.

Md.Muneer

Hello Muneer, Pl. visit our tutorials about mutual funds: http://pages.fundsindia.com/pages/learning/using-fundsindia/#3

or visit Franklin Templeton’s site for learning on funds: http://www.franklintempletonindia.com/en_IN/investor/investor-education/ft-academy. It will explain the risk factors, how your money is invested and so on.

Mutual funds are invested in markets. What you get is the gains or losses the market makes. There is no fixed interest. And to answer your specific need, only Shariah based fudns such as Tata Ethical or Taurus Ethical or the Shariah BEES ETF follow shariah principles. No other fund can guarantee strictly following shariah principles in India.

thanks, Vidya

Hi Vidya,

I really appreciate your replies over all queries. As you must have seen that lot of investors from muslim community have started entering MF route for investing and for many the source of income matters more than the returns over it. Same is for me, I have been investing via FundsIndia for quite a while now and have referred many people to your awesome services.

Currently I have invested Rs.25000 in Tata Ethical and also Rs. 2500 as SIP in both Tata Ethical and Taurus Ethical. I wanted to know if there is any MF house which has some offering in ELSS with Shariah Compliant? The closest I came to was Reliance but even that has some holding in SBI. Can your organization get in touch with Tata and Taurus and put a proposal for starting an ELSS with Shariah Compliant, it would be great.

Thank you.

Hello Tausif, I understand and appreciate your requirement. There is unfortunately no fund house with a Shariah compliant ELSS product at present. Since banking receives the max. weight in all key indices, fund houses are reluctant to keep it away from their portfolios. We shall definitely pass the requirement/feedback to AMCs. regards, Vidya

Hello … As there are only 2 mutual funds which follow sharian laws in India 1) Tata Ethical fund and 2) Tarus fund , as I am a beginner in investing in mutual fund… Through my financial knowledge I selected Tata Ethical fund – Regular plan ..which follows Sip and my investment duration will be for 10years … And now my question is as I have to invest only in one mutual fund …. What are the best way to buy it … directly from AMC or web portals or from distributor/ agent .. Remember that I will only invest in one mutual fund … ..

Zaheer, Sorry about the delayed response. you have to try the convenience and ease of use of an online platform like ours and also experiment with direct investments in AMCs before deciding what you want. thanks, Vidya

How can Oil and Petro and Pharmaceutical investement ever be considered ethical in the big scheme of things?

Hello Vidya,

Can you please suggest me ways to save tax under Shariah principles, I am ok to take risk even.

Thanks,

Saif

Hello Saif,

If you mean tax saving for the purpose of claiming under Section 80C of Income Tax act, then I am afraid there are no ELSS funds that follow shariah principles. However, if is to invest tax efficiently, then funds such as Tata Ethical qualify as an equity fund and gains are exempt after 1 year. Vidya

Hi vidya….

M new in mf market…bt only want to invest in sariah mf as per islam..

Last mnt I hv strted tata ehical fund sip of 10 k pm..

Plz suggest about this mf or switch to oder mf…bt I cn only invest in sariah fund…

Whts yr perception abt this fund in long n short term..

Plz suggest…

Hello sir,

Tata Ethical and Taurus Ethical are the only options you have. Not having financial services means that these funds can underperform in the logn term. There is one Shariah index ETF that Goldman Sachs has called GS Shariah BEES. thanks, Vidya

hi,

i am new to mutual funds. I want to invest in tata ethical MF. is it a good idea to invest 10K per month for 15 years? This would be my first investment. I have no other savings. please guide me if this would be profitable for me at the end. how much percentage of profit can i expect at the end of 15 years. iam strictly looking for Shariah compliant ways of investing.

what is shariah ETF. how to invest in it?

thanks

zainab

Hello Zainab, Sorry for the delayed response. We are constrained from provided recommendation for individual investments through the blog. Please use your FundIndia account to send your query and our advisors will help you. thanks, Vidya

What are the tax benefits of joining this mutual fund? Pls throw some light on the same.

Hello, Sorry for the delayed response. Gain on investments held for over 1 year, when sold, are exempt from tax. For holding period of less than 1 year, gains are taxed at 15%. But ideally equity funds need to be held for 5 years at least. thanks, Vidya

Is this inherently a good fund? I mean if you forget the fact that this is a Shariah compliant fund, and don’t care for Shariah compliance, is this still a good fund? Sounds like the real opinion is that this is the best Shariah fund; well to be more accurate a better Shariah fund than the only other shariah fund.

I was wondering if this makes for a good diversified fund (albeit without banking exposure). As practically every other diversified fund has very heavy exposure to the banking sector.

Hello Fahd, Tat Ethical is a good fund if you leave out the fact that it cannot invest in banks. However, in a rallying market it will underperform peers with banks as it is very tough for a fund to outperform in a market rally without banks.

thanks, Vidya

Hi,,

Assalamalik .I being a muslim was always looking for such a fund.Than you very much for this information.

hello vidya bala.. i hope you are fine. i want to get some idea from you

very soon with in 5 to 6 six month i will come back to India on final exit. ( from K.S.A )

and i would like to invest some amount 2 to 3 lack to get monthly or quarterly sharia based income.

kindly assist /advice me where i have to invest.

thanks

regards

Nazir.

Hello Sir,

thank you for writing us. You can consider investing in low risk short-term debt funds and do a systematic withdrawal plan. But before that we need to udnerstand your requirements, your profile etc. If you already have an account with FundsIndia, please write to us through your account and we will help you design a portfolio to yield you income. Youc an also open one anytime and our advisors will help you. thanks, Vidya

Hi Vidya,

I’m completely new to mutual fund .I’m intrested in investing my money in tata ethical fund i saw the reviews and it looks good can you suggest me the minimum amount i should invest and step by step how can i maximisie my return on the investement .I’m looking for return on 1 year basis in your opinion which is the safest option where i can get maximum return on investment .I plan to invest initially 5000 and then after monitoring the performancce will invest more and one more question can i get tax benifit in this fund?

Hello Atish, Our advice and review is available for investors in our plaform. Kindly open an account for us to enable us to provide you with MF advice. If you are already an investor you can use the ‘advisory appointment’ feature in help tab and our advisors will help you. Separately, pl. note that equity investing should be with a longer time frame. One year is not a time frame for equity funds. In a year like 2008, 1-year returns would only have been negative. thanks, Vidya

dear vidya,

can you tell me investment options/ pension plans shariah based available in india.

Regards

abid

Hi Abid, Other than the 2 funds (tata Ethical and Taurus Ethical), there is the Shariah ETF in NSE. Other than these there are no public investment channels available specifically for shariah investing.

Hi Vidya,

Are investments into these funds claimed for tax saving benefit-80C

If not are there any other Shariah Compliant funds which can be claimed under 80C.

Tata Ethical, Taurus Ethical & Shariah ETF .

Rgds,

Suhail.

Hello Suhail, There are no such funds at present with Shariah compliance and with 80C benefit. thanks, Vidya

Hi Vidya,

Really liked your article on Shariah compliant MF. its been a while since I was looking for options like this for my investments. Currently I only have SIP in Quantum Gold and I want to go with either Tata Ethical or Taurus Ethical. My time frame would be for at least 5 yrs and amount begin with would be Rs.1000 pm.

Can you please help me out selecting? And I am FundsIndia delighted customer 🙂

Regards,

Tausif

Hello Tausif, If you wish to hold a shariah compliant fund then Tata Ethical should be your first choice. It performance metrics score over Taurus Ethical. Use the SIP mode to invest and compare performance occasionally with the index. Thanks, Vidya

madam,

happy to see that you are back again with us after the vacation.another timely and informative article from you. thanks again.i presonally think such funds are not for genuine investors.