You have chosen your equity funds and are ready to start your monthly equity SIPs.

But now comes the question…!

Which date should you choose to start your monthly Equity SIP?

There are diverse views regarding the date to choose for an SIP. Some say the 1st of the month is the best date for an SIP while some say the 5th of the month is the best date for an SIP and so on.

So, what is the best date for an SIP?

Is there really an ideal date to select for an SIP?

Do the dates really matter over a long period of time?

Let’s find out…

Assume you have been investing Rs 10,000 via SIP every month in Nifty 50 TRI for different time frames – the last 10 years, 15 years, and 20 years.

Now, let us check your SIP returns for different starting dates.

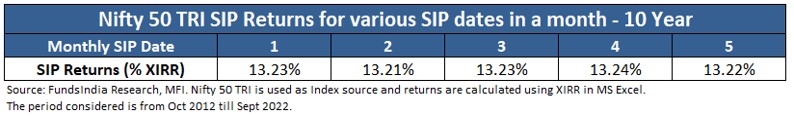

Equity SIP Returns from different starting dates over a 10-year time frame

Over a 10-year time frame, if you were investing every month on the same date, let’s say on the 1st of every month then your SIP returns (% XIRR) would have been 13.23%.

What do you think would have been the returns if you had instead invested on the 2nd or the 3rd or 5th of the month?

Take a guess.

The returns would have been as below,

The returns are almost similar even if you had invested on the 2nd, 3rd, 4th, or 5th of the month!

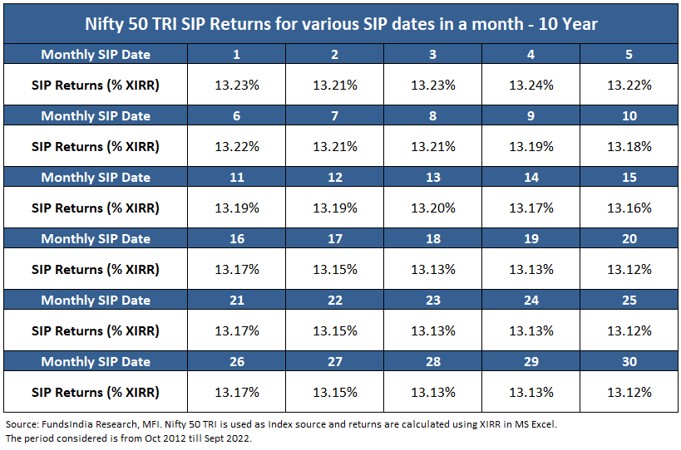

What about the other days of the month?

Again, the returns are more or less the same.

Let’s extend this to see how the SIP returns across different dates look over a 15-year time frame.

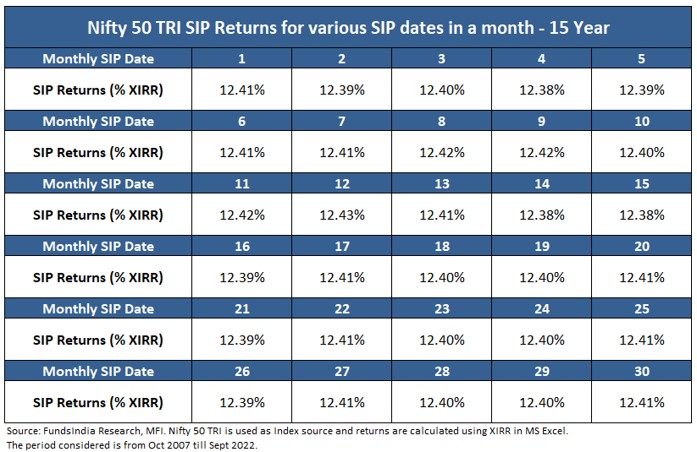

Equity SIP Returns from different starting dates over a 15-year time frame

Over a 15-year time frame, if you were investing every month on the same date then the returns would have been like the below,

Similar to the conclusion we drew from the 10-year data, even over a 15-year time frame the returns are almost similar irrespective of which day of the month you start your SIP.

Let’s extend this to see how the SIP returns across different dates look over a 20-year time frame.

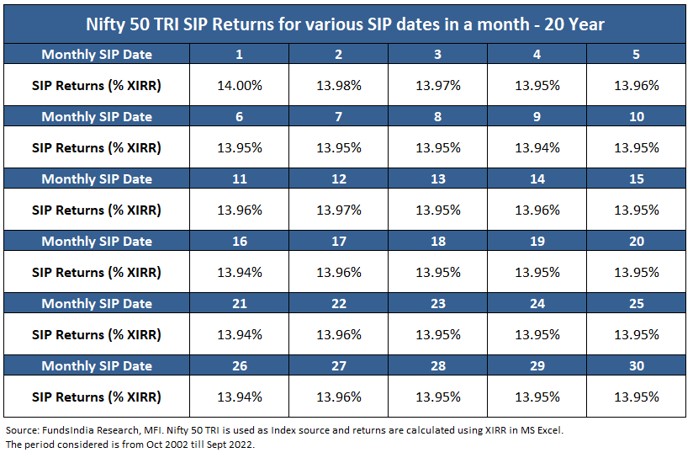

Equity SIP Returns from different starting dates over a 20-year time frame

Yet again, the returns are almost similar across all dates in a month. There is no significant advantage gained by selecting any particular date.

Insight: There is no such thing as an “ideal date” or “best date” for an Equity SIP. Over long periods of time, your SIP date does not make much of a difference.

All said and understood, you might still be thinking…

Is there a simple thumb rule to choose your Equity SIP date?

We suggest setting your SIP date within 2-3 days of your salary credit.

Why?

Setting your SIP date within 2-3 days of your salary credit helps ensure financial discipline and creates a habit of saving before spending. This means your salary first goes towards savings (i.e your investments) and then with the balance you are free to spend.

Summing it up

- Over long periods of time, the Equity SIP date does not make any significant difference to overall returns. The returns are almost similar across all dates of a month.

- That said, try to set your SIP date within 2 -3 days of your salary credit. This will help you create a habit of saving before spending.