Tags: tax

RSS feed for this sectionThe impact of Budget 2018 on your investments

February 2, 2018The Budget 2018 proposal does not seek to leave more money in your hands. But by not pleasing you much, it has sought to keep its fiscal situation from deteriorating…Continue Reading

Why should you invest in ELSS

November 10, 2017By now, most of you might agree that Mutual Funds Sahi Hai. You now probably know that mutual funds are a great way to build wealth, but did you know…Continue Reading

All you wanted to know about ELSS funds

November 6, 2017You have a choice of several investments under the Section 80 C’s capacious umbrella, in order to cut tax payments. Among these is ELSS, or equity-linked savings schemes. Here’s all…Continue Reading

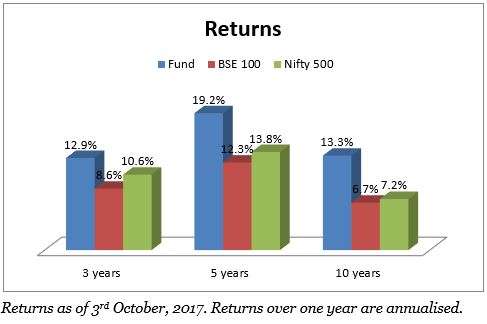

FundsIndia Recommends: Invesco India Tax Plan

October 4, 2017Short on time? Listen to a brief overview of this week’s review. Traditional go-to options to save on taxes are bank or post office deposits, public provident fund, or national…Continue Reading

Avoid mistakes while filing your tax returns this year

June 26, 2017As you near the deadline for filing your returns for FY-17 (AY 2017-18), make sure you pay attention to changes in filing requirements this year and avoid the common mistakes…Continue Reading

FundsIndia Views: What to expect from GST – the ‘One India tax’

May 31, 2017The Goods and Services Tax (GST) will be a reality in India from July 1. GST can be a gamechanger in the way India does business in the long term.…Continue Reading

FundsIndia Explains: Section 80 C investments

November 7, 2016Reducing taxes is at the forefront of our minds. Section 80 C plays the most important role in our tax-saving efforts. The list of deductions allowed under Section 80C is…Continue Reading

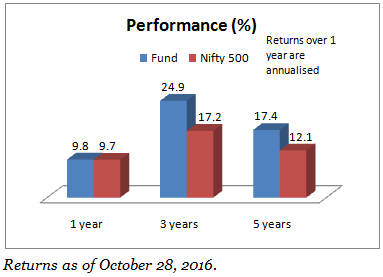

FundsIndia Recommends: Franklin India Taxshield

November 2, 2016It’s around this time that most of us begin to think about tax planning. Among the options allowed under Section 80C deductions, Franklin India Taxshield is a good one. An…Continue Reading

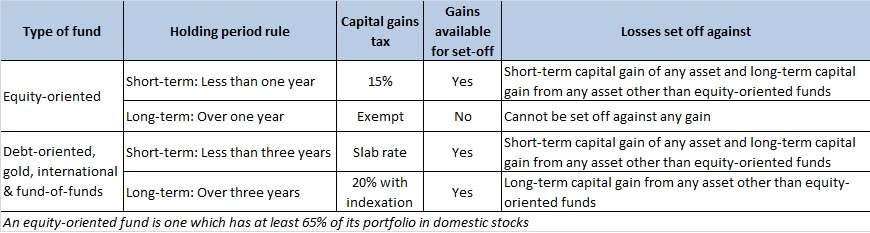

FundsIndia Explains: Capital gains set off

June 21, 2016We covered taxation on mutual funds in detail last month, over two different posts. This week, we will go a bit more into detail, especially as many of you had…Continue Reading

FundsIndia Explains: How are mutual funds taxed? Part I

May 16, 2016Please note – With the proposals detailed in the 2018-19 budget, the rules regarding equity fund taxation as explained in this article do not apply any longer. Click here for the…Continue Reading