SIPs (Systematic Investment Plans) are increasingly getting popular as the preferred mode of investment today. Investors are ready to keep aside a minimal amount every month for SIPs, rather than investing lump sums. When you are given a provision to make good returns through a regular, timely, and affordable method, who would not prefer it?

One such strategy that helps with tax-saving is ELSS (Equity Linked Saving Schemes). These schemes invest in Equity-oriented funds. They have a lock-in period of 3 years, which is much lesser when compared to other tax-saving counterparts such as PPF and NPS. As this mode of investment comes under Section 80C of the Income Tax Act, 1961, it helps investors save up to ₹1,50,000 of their income from taxes. Click here to know more about ELSS.

Problems with planning at the last minute:

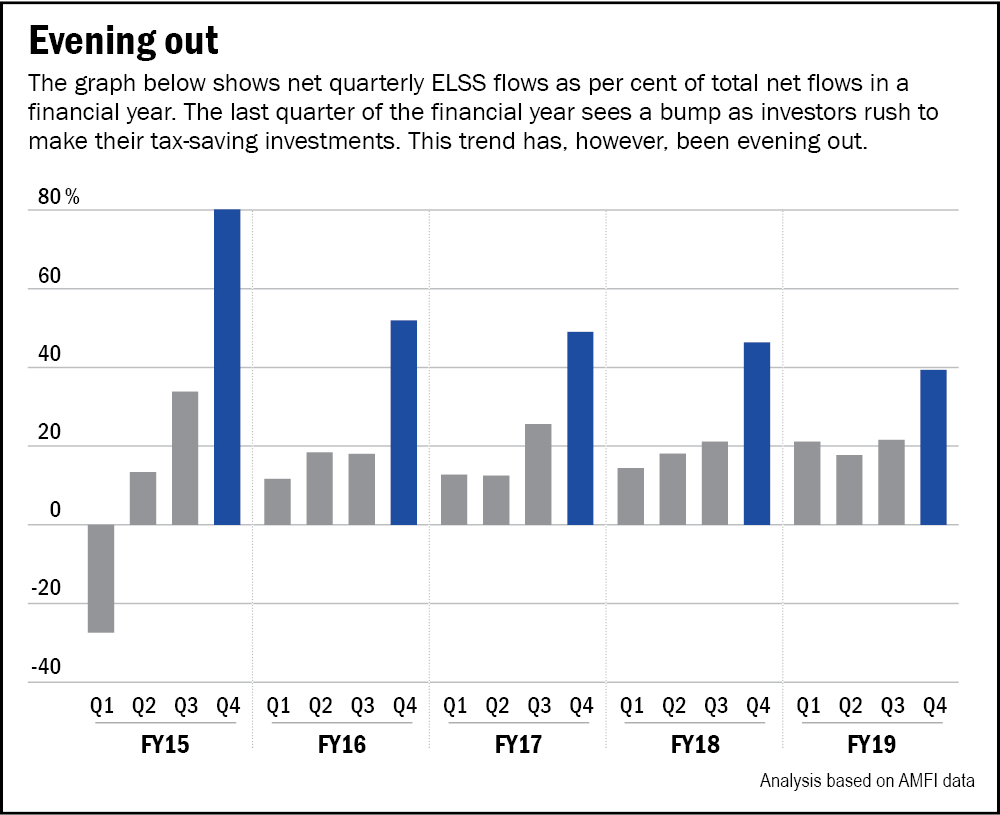

People’s attention moved towards tax-saving instruments as time passed. But earlier, the way they chose their attention to turn were hasty, unfortunately. Only when they had to file their taxes, their concentration moved towards such investments. From the graph below, it can be seen that a pile of investors entered the ELSS scene only in the last quarter of the financial year.

Source: Value Research

Though it helped them save taxes, the returns and the investment behaviour would not have been disciplined.

Investing lump sums in ELSS funds in the last quarter can lead to two problems:

- Markets are volatile in general. If you are planning to invest in the last quarter, you might be forced to invest at higher valuations.

- Lumpsum investments tend to create a dent in your pocket. SIPs, on the other hand, will not only diversify the investments but also help you invest smaller amounts at regular intervals.

Change in trend:

But now, the trend is changing. People are starting to invest with expert recommendations. Instead of starting tax-saving investments only when the need arises, they are doing it in an organized and educated manner.

ELSS schemes invest in equity-oriented funds. As “long” is the name of the equity game, it is better to start your investments early in the financial year than wait until the last quarter. In addition, holding SIPs would not only regularize the investments but also reap the benefits of rupee cost averaging.

As FundsIndia’s Head of Research, Arun Kumar, quotes, “The markets are volatile and the outcome/returns made in the past year may not reflect in the current year. In order to plan your tax-saving better, start early and distribute your investments through SIPs.”

Better planning = better results! So, plan and start your tax-saving investments this quarter.