Many of you have evinced interest investing in long-term gilt funds in recent months and have written to us. Returns as high as 16% showcased by top funds in this category in the last one year, together with a downward interest rate movement (which typically triggers a bond price rally), does coax you to conclude that this class of funds can return well.

Tactical play

But we have maintained that gilt funds are high risk and are meant only as a tactical play for investors who can track them and book profits at the right time. We have, instead, more actively advocated short-term debt funds/income funds for medium to long-term portfolios.

Read on to know why we say that. I am not going to deal with complicated yield curve theories. Let us simply look at past performance to make out how these funds behave.

Before we move to returns, a quick recap on what gilt funds are. Gilt funds seek to invest in government securities (gilts). While these can be short-term securities, a good number are long-term gilts. Income fund, on the other hand, is a broad category that represents funds that invest in a combination of bonds, certificates of deposits, commercial paper as well as gilts.

These can be short term or long term and can be low on credit risk or hold high risks. These funds look for interest income from holding debt instruments till maturity and also look for capital appreciation coming from price rallies in the instruments.

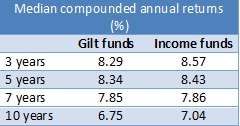

Given below is a table of average returns of the above-discussed category. Here, by gilt funds, we mean medium and long-term gilt funds.

The table amply illustrates that the spurts seen in gilt funds over the short term (of 1 year) are clearly absent in the long term and they tend to behave like a regular bond fund.

For an investor with a long-term time frame, this means that you are not better off holding a gilt fund. While what we have in the table is the median returns, established income funds have, in fact, beaten gilt funds by a decent margin. Moreover, the volatility faced by income funds is much lower than gilt funds.

Just to provide an illustration, take one of the top performing gilt funds – IDFC GSF PF. In early 2009, when there was an unexpected yield move, causing gilt prices to fall, the fund actually returned negatively. It fell 8.1% that year after an astounding 33% return the previous year. It may well be that many investors joined the bandwagon after seeing the 2008 returns only to lose money in 2009.

On the contrary, another income fund from the same fund house IDFC SSI Medium Term managed a decent 6% in 2009, after a 16% rally in 2008. The recovery was even better in 2010 with the income fund while this was not the case with the gilt fund.

Negative returns

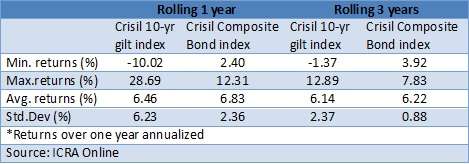

This trait of negative returns in gilt funds becomes more evident if we look at the rolling one year return of Crisil 10-year gilt index (representing long-term gilt). If we take the period between April 2008-2013, there was a 10% chance that your one-year return would have been negative for investments made on any day.

If we roll this over a longer period between 2003-13, the chances of negative returns goes up to 15%. This is not the case if you take the Crisil Composite Bond index, which is the benchmark for most income funds.

If you are an equity investor, here’s a simplistic (although not equivalent) comparison of gilt funds: gilt funds require the kind of skills equity theme funds would need – know when to play them and know when to walk away.

Short-term and income funds are like diversified equity – they have varying risks too but are diversified. Just as a diversified equity fund may go marginally overweight on certain sectors, an income fund may up its stake on gilt at times and corporate bonds in other times based on opportunities. That means you get the best of various options.

If you are a long-term investor, you are better off with tested income funds or short-term debt funds based on your requirement. What you see as returns in gilt today may well not be what you will eventually get.

Outlook

All that said, if you are asking what the debt market holds from here for those looking for opportunistic returns, this is my take: unlike late 2008 when yields crashed leading to a rally, the gilt yields have gradually moved down with repo rate cuts.

A combination of rates cuts (that started in April 2012) and lowering of cash reserve ratio (from January 2012) have led to a falling yield, thus triggering a price rally. The result is what you are seeing in term of high 1-year returns of gilt funds. 10-year gilts have moved from 8.6% to 7.7% currently.

Experts feel that while there would be some scope for yields to soften, the room is limited. That means you cannot expect any extraordinary rally in gilt funds. But there still appears enough scope for returns from corporate bonds (currently 8.6) as spreads narrow between corporate bonds and gilt over the course of the next 12 months at least.

That means funds that hold slightly long-dated corporate bonds and even state development loans, besides some gilt may actually benefit more than pure gilt funds.

Simply put, you may have to sift through the income fund category to look for specific opportunities.

We shall also do the sifting and present such funds in our future weekly fund reviews.

madam,

the article is informative and a guide to investors.i will invest in income funds rather than gilt funds after reading the article.thanks for bringing to notice risk involved in investing in gilt funds

madam,

the article is informative and a guide to investors.i will invest in income funds rather than gilt funds after reading the article.thanks for bringing to notice risk involved in investing in gilt funds

So is this a good time to pull out funds from Gilt funds since the chance of further rate cuts look weak…

One other aspect of the comparison is – over a period of 5 years the returns of Gilt funds are actually more than Income funds! So, are the Income funds not doing their job well in general or the interest rate changes (either up or down) are actually beneficial in the long term for a Gilt fund? (compared SIP for Kotak Gilt vs. SBI Dynamic Bond)

Hi Sheetal, on a fund to fund basis, there will always be difference. SBI Dynamic was never a top fund in the income fund category and has gained popularity in last 3 years, merely by riding on gilt. The data we have provided (am afraid the blog some times does not show the image), clearly suggests that the avg. median returns of income funds is actually higher than gilt funds. Hence, I don;t think income funds have slipped in their job of doing well across interest rate cycles. Thanks, Vidya

Hi Sheetal, There will be some more steam left in gilt funds (as we stated in the outlook that some restricted rally can happen) although not as much as earlier years. But if you cannot time your exits, it is best to move to income funds. tks, vidya

Is it good time to invest in Long term Gilt Funds now?

Hello Sarang,

Sorry for the delayed response.

We have stated that they are risky bets unless you can time your entry and exits. We do not recommend that to retail investors. There is returns t be made in gilt still and same can be done through dynamic bond funds.

Vidya

I would like to know more about consistent performers in the genre of funds that invest in Gilts, T bills, Corporate debt, GOI instruments, State Govt debt, CP etc. Liquid, ST Debt, LT debt, Gilts. I am looking for consistency over higher returns. Are returns in such categories consistently over 11%.

Hello Sir,

Returns as high as 11% on a long-term consistent basis is not possible in debt category (in rare cases this is possible if credit risk is also taken together with interest rate risk). Evidently, such returns come by at the turn of an interest rate cycle and not always.

We do not think gilt funds are for passive investors. They require active calls of playing the rate curve and exiting.

In the other categories, FundsIndia’s ‘Select Funds’ are picked on the basis of consistency (usin several metrics – rolling returns, standard deviation to name a few) over chart topping returns. You may refer to them in http://www.funds.com/select-funds . For any specific portfolio/fund query, we reach out to our investors through FundsIndia’s ‘Ask Advisor’ feature (available to all its investors). Thanks, Vidya

Thank you very much for the reply. I shall visit http://www.facebook.com/niranjan.niru.50?fref=ts

Really Mam, the aforesaid article written by you is quite informational for investors preferring to invest elsewhere in mutual funds rather in bank deposits (as you know these days bank interest rates are even not on lower side but meager as well for survival), and I express my gratitude for the same for writing aforesaid article for retail investors.

I would not forget my financial consultant at this juncture who indeed suggested me in line with your aforesaid comments recently and I am also grateful to him for his timely and worthy advise for investment. I invested in Dynamic Bond Fund Scheme with minimum lock-in period on his advise.

I completely relied upon his advise but alerting him by putting a condition that I don’t want to earn less than the bank provides interests income to me on yearly basis. He acted accordingly in line with your aforementioned article. Hence, he deserves appreciation from my side at his back.

I earlier thought that why should I come out from a debt fund (dynamic bond fund) if it is performing well, at present. But after having gone through your article, I am convinced now that I have been advised correctly by my financial adviser. I realize, by investing in Dynamic Bond Fund, in the last year (March, 2012), I must now exit from the same. I earned 16% P.A. yield on my investment in Dynamic Bond Fund and cumulative 18% for 14 months and 6 days resulting into 16% yield per annum. I am satisfied since its proven better investing in banks. Now I have been advised to exit and take position in Short Term Fund.

Hope I would be capable to read your articles more from in future. Lots of advises, I really thirst to seek from eminent financial advisers likewise you in order to learn more and follow the same, but since no regular connectivity, I may miss your advises and articles written by you on the net as I am not regular internet visitor. I shall keep update myself for reading your more articles on the net which would be worth knowing and full of correct information for investors like me.

For your worthy comments in aforesaid article written in the interests of innocent retail investors, I pay my best regards to you.

From: Sudhir Kapoor from Panipat

Email: sudhir.kapoor@rediffmail.com

******************************************************************************************************************

This is my confirmation to notify me of “follow-up comments” by email as well as to notify me of “new posts” by email.

From: Sudhir Kapoor.

Email: sudhir.kapoor@rediffmail.com

Hello Sir, thank you for your comments. If you have entered your email on the right side of the article which says” subscribe via email” you will get all forthcoming blogs. Thanks, vidya

Hello Mam. After withdrawal from Reliance Dynamic Bond Fund approx. two months back when I responded to your article, I made my investment in “Reliance Short Term Fund (Growth)” with expectation for a lesser risk free returns. The decision taken by me is not apprearing to be incorrect as Reliance Dynamic Bond Fund comparatively has fallen more in comparison to Reliance Short Term Fund in the last two months but my investment is not growning since two months back and is almost at par or below minutely.

Will you advise me to stay in aforesaid debt fund keeping in veiw rupee weakening internationally ?. Needless to say that lock-in period is for another four months out of total six months and if I exit at this stage, I have to suffer half percent exit load on whole of my investment. Best Regads.

SUDHIR KAPUR.

Short-term funds typically require 1-1.5 year holding to make the best of them. hence it would be ideal to hold. Vidya

Hi Vidya,

Very informative article.

i have 90% of my debt portfolio in income funds since oct 2012 which has fetched me absolute returns in the range of 11-12%. I am pretty satisfied with the returns.

Want to know if this will be a good time to shift from dynamic bond funds to long duration income funds, read an article in ET which still suggests investing in duration income funds.

http://articles.economictimes.indiatimes.com/2013-05-27/news/39557348_1_bond-yields-benchmark-10-year-bond-bond-prices

please suggest.

Hi Piyush,

Dynamic bond funds are also one type of income funds. But if you are in less aggressive dynamic bond funds (which have limited exposure to gilt and medium portfolio maturity of say 4-5 years), then those funds should be good enough for the long term. If you wish to take expsure to more risky longer tenure bond funds (other than pure gilt fund), then the next one year may present an opportunity. You may read more on this in: https://blog.fundsindia.com/blog/mutual-funds/fundsindia-strategies-funds-for-risk-taking-debt-investors/2663

Tks

Vidya

Dear Vidya,

I join the list of your fan followers… compliments on a very well written article.

My specific questions are;

1. Should i invest in income fund or dynamic bond fund or short term fund at this juncture, to ride the possible interest rate cut. Assuming that the tenure of holding is not a problem.

2. I am not sure how dynamic bond funds are different from income funds, if you could please elaborate.

3. I get employee rate of 10% for HDFC deposits of 1 year. Post tax 7% assured. Do you still recommend a debt fund?

Thanks,

Ullas

Hello Ullas,

Thank you.

1. If you can hold for a 3-year period, income funds (which includes dynamic bond funds) would be good at this juncture. Dynamic bonds are just a sub-sect of income funds.

2. Income funds are debt funds that hold various debt instruments, bonds, debentures, CDs for accrual income (interest income from the underlying instruments). Of course, in reality, income funds generate both accrual returns and capital appreciation by trading the instruments on price rallies. Income funds can come in various forms – those that hold short-term instruments, or those that have a longer portfolio maturity or those that play on credit opportunities and so on. Dynamic bond fund is an income fund that seeks to play the interest rate curve by straddling across the curve based on the rate scenario.

3. If you ask me whether you can diversify to debt funds, it would be a yes. Instead of viewing them as either or, look at the possibility of diversifying. Mutual funds can certainly not assure you returns. Yes, they have provided superior returns in the past and can help prop returns of your overall portfolio, if held for longer periods (3 years or more). I would urge you to read this article on how income funds performed over longer time frames when compared with FD rates. https://blog.fundsindia.com/blog/mutual-funds/income-funds-score-over-fixed-deposits/1324

Thanks,

Vidya

Good Stuff !!! I like It !!

My dad has invested a year back in bond funds short term long term. .now the portfolio is divided into income fund and bonds. .he wanted a fixed income after retirement with minimum risk bt more Dan a f.d. His age is 58 years. .currently the portfolio has BSL income plus retail divident payout,icici bond fund plan A Q dividend,icici pru income reg fun Q dividend payment. .what views u have about my portfolio and is there any better invest with minimum risk of capital invested. .

Hi Rohit,

Short-term debt funds are suitable for those with low risk. For fund-specific advice and review, you will have to use the ‘Ask Advisor’ feature available for FundsIndia customers in their account (click help tab). This is a free service available at all points in time to customers. Thanks, Vidya

And also tell me as the tax bracket has increased how much difference will it make to returns quaterly. .

Hello Rohit, There is no increase in tax bracket. The DDT on dividend payout options of debt funds have only increased. That is not going to make any difference to fund returns. The diff. it makes to individual’s can be suitably overcome by using right strategies. Pl. read this link to knwo more: https://blog.fundsindia.com/blog/advisory/should-you-choose-the-dividend-option-or-the-growth-option/1757 Tks, Vidya

Finally a site which offers some pragmatic insights into the fixed income world. I plan to read through the existing material before popping up my questions….

Finally a site which offers some pragmatic insights into the fixed income world. I plan to read through the existing material before popping up my questions….

Respected All,

Now a day I am searching for best mutual fund compare to saving bank account which are Liquid fund and not Ultra Liquid Fund. I want to just know that How much Liquid funds are risky ? as compare to Gilt Fund, I always used to invest in Growth Plan & request to all please suggest some informative and experienced person blogs and advice and also learing knowledge website addresses.

Recently I invested in Reliance Liquid Fund – Treasury Plan – Growth – DIRECT and it is good going, I studied well also compare to its peer.

Please also give information about how I get NAV on which day ? and also cut off time of purchase NAV and Sell NAV.

Mr.Mahendra k. Tita

Thanking you all

Hello sir, Request you to acitivate your free FundsIndia account for us to be able to service you/provide advice. thanks, Vidya

Respected All,

Now a day I am searching for best mutual fund compare to saving bank account which are Liquid fund and not Ultra Liquid Fund. I want to just know that How much Liquid funds are risky ? as compare to Gilt Fund, I always used to invest in Growth Plan & request to all please suggest some informative and experienced person blogs and advice and also learing knowledge website addresses.

Recently I invested in Reliance Liquid Fund – Treasury Plan – Growth – DIRECT and it is good going, I studied well also compare to its peer.

Please also give information about how I get NAV on which day ? and also cut off time of purchase NAV and Sell NAV.

Mr.Mahendra k. Tita

Thanking you all

Hello sir, Request you to acitivate your free FundsIndia account for us to be able to service you/provide advice. thanks, Vidya

Hello can you please tell me whether can I invest now in gilt funds

Hello can you please tell me whether can I invest now in gilt funds

I would like to know more about consistent performers in the genre of funds that invest in Gilts, T bills, Corporate debt, GOI instruments, State Govt debt, CP etc. Liquid, ST Debt, LT debt, Gilts. I am looking for consistency over higher returns. Are returns in such categories consistently over 11%.

Hello Sir,

Returns as high as 11% on a long-term consistent basis is not possible in debt category (in rare cases this is possible if credit risk is also taken together with interest rate risk). Evidently, such returns come by at the turn of an interest rate cycle and not always.

We do not think gilt funds are for passive investors. They require active calls of playing the rate curve and exiting.

In the other categories, FundsIndia’s ‘Select Funds’ are picked on the basis of consistency (usin several metrics – rolling returns, standard deviation to name a few) over chart topping returns. You may refer to them in http://www.funds.com/select-funds . For any specific portfolio/fund query, we reach out to our investors through FundsIndia’s ‘Ask Advisor’ feature (available to all its investors). Thanks, Vidya

Thank you very much for the reply. I shall visit http://www.facebook.com/niranjan.niru.50?fref=ts

My dad has invested a year back in bond funds short term long term. .now the portfolio is divided into income fund and bonds. .he wanted a fixed income after retirement with minimum risk bt more Dan a f.d. His age is 58 years. .currently the portfolio has BSL income plus retail divident payout,icici bond fund plan A Q dividend,icici pru income reg fun Q dividend payment. .what views u have about my portfolio and is there any better invest with minimum risk of capital invested. .

Hi Rohit,

Short-term debt funds are suitable for those with low risk. For fund-specific advice and review, you will have to use the ‘Ask Advisor’ feature available for FundsIndia customers in their account (click help tab). This is a free service available at all points in time to customers. Thanks, Vidya

Good Stuff !!! I like It !!

Dear Vidya,

I join the list of your fan followers… compliments on a very well written article.

My specific questions are;

1. Should i invest in income fund or dynamic bond fund or short term fund at this juncture, to ride the possible interest rate cut. Assuming that the tenure of holding is not a problem.

2. I am not sure how dynamic bond funds are different from income funds, if you could please elaborate.

3. I get employee rate of 10% for HDFC deposits of 1 year. Post tax 7% assured. Do you still recommend a debt fund?

Thanks,

Ullas

Hello Ullas,

Thank you.

1. If you can hold for a 3-year period, income funds (which includes dynamic bond funds) would be good at this juncture. Dynamic bonds are just a sub-sect of income funds.

2. Income funds are debt funds that hold various debt instruments, bonds, debentures, CDs for accrual income (interest income from the underlying instruments). Of course, in reality, income funds generate both accrual returns and capital appreciation by trading the instruments on price rallies. Income funds can come in various forms – those that hold short-term instruments, or those that have a longer portfolio maturity or those that play on credit opportunities and so on. Dynamic bond fund is an income fund that seeks to play the interest rate curve by straddling across the curve based on the rate scenario.

3. If you ask me whether you can diversify to debt funds, it would be a yes. Instead of viewing them as either or, look at the possibility of diversifying. Mutual funds can certainly not assure you returns. Yes, they have provided superior returns in the past and can help prop returns of your overall portfolio, if held for longer periods (3 years or more). I would urge you to read this article on how income funds performed over longer time frames when compared with FD rates. https://blog.fundsindia.com/blog/mutual-funds/income-funds-score-over-fixed-deposits/1324

Thanks,

Vidya

Really Mam, the aforesaid article written by you is quite informational for investors preferring to invest elsewhere in mutual funds rather in bank deposits (as you know these days bank interest rates are even not on lower side but meager as well for survival), and I express my gratitude for the same for writing aforesaid article for retail investors.

I would not forget my financial consultant at this juncture who indeed suggested me in line with your aforesaid comments recently and I am also grateful to him for his timely and worthy advise for investment. I invested in Dynamic Bond Fund Scheme with minimum lock-in period on his advise.

I completely relied upon his advise but alerting him by putting a condition that I don’t want to earn less than the bank provides interests income to me on yearly basis. He acted accordingly in line with your aforementioned article. Hence, he deserves appreciation from my side at his back.

I earlier thought that why should I come out from a debt fund (dynamic bond fund) if it is performing well, at present. But after having gone through your article, I am convinced now that I have been advised correctly by my financial adviser. I realize, by investing in Dynamic Bond Fund, in the last year (March, 2012), I must now exit from the same. I earned 16% P.A. yield on my investment in Dynamic Bond Fund and cumulative 18% for 14 months and 6 days resulting into 16% yield per annum. I am satisfied since its proven better investing in banks. Now I have been advised to exit and take position in Short Term Fund.

Hope I would be capable to read your articles more from in future. Lots of advises, I really thirst to seek from eminent financial advisers likewise you in order to learn more and follow the same, but since no regular connectivity, I may miss your advises and articles written by you on the net as I am not regular internet visitor. I shall keep update myself for reading your more articles on the net which would be worth knowing and full of correct information for investors like me.

For your worthy comments in aforesaid article written in the interests of innocent retail investors, I pay my best regards to you.

From: Sudhir Kapoor from Panipat

Email: sudhir.kapoor@rediffmail.com

******************************************************************************************************************

This is my confirmation to notify me of “follow-up comments” by email as well as to notify me of “new posts” by email.

From: Sudhir Kapoor.

Email: sudhir.kapoor@rediffmail.com

Hello Sir, thank you for your comments. If you have entered your email on the right side of the article which says” subscribe via email” you will get all forthcoming blogs. Thanks, vidya

Hello Mam. After withdrawal from Reliance Dynamic Bond Fund approx. two months back when I responded to your article, I made my investment in “Reliance Short Term Fund (Growth)” with expectation for a lesser risk free returns. The decision taken by me is not apprearing to be incorrect as Reliance Dynamic Bond Fund comparatively has fallen more in comparison to Reliance Short Term Fund in the last two months but my investment is not growning since two months back and is almost at par or below minutely.

Will you advise me to stay in aforesaid debt fund keeping in veiw rupee weakening internationally ?. Needless to say that lock-in period is for another four months out of total six months and if I exit at this stage, I have to suffer half percent exit load on whole of my investment. Best Regads.

SUDHIR KAPUR.

Short-term funds typically require 1-1.5 year holding to make the best of them. hence it would be ideal to hold. Vidya

So is this a good time to pull out funds from Gilt funds since the chance of further rate cuts look weak…

Hi Sheetal, There will be some more steam left in gilt funds (as we stated in the outlook that some restricted rally can happen) although not as much as earlier years. But if you cannot time your exits, it is best to move to income funds. tks, vidya

Is it good time to invest in Long term Gilt Funds now?

Hello Sarang,

Sorry for the delayed response.

We have stated that they are risky bets unless you can time your entry and exits. We do not recommend that to retail investors. There is returns t be made in gilt still and same can be done through dynamic bond funds.

Vidya

One other aspect of the comparison is – over a period of 5 years the returns of Gilt funds are actually more than Income funds! So, are the Income funds not doing their job well in general or the interest rate changes (either up or down) are actually beneficial in the long term for a Gilt fund? (compared SIP for Kotak Gilt vs. SBI Dynamic Bond)

Hi Sheetal, on a fund to fund basis, there will always be difference. SBI Dynamic was never a top fund in the income fund category and has gained popularity in last 3 years, merely by riding on gilt. The data we have provided (am afraid the blog some times does not show the image), clearly suggests that the avg. median returns of income funds is actually higher than gilt funds. Hence, I don;t think income funds have slipped in their job of doing well across interest rate cycles. Thanks, Vidya

And also tell me as the tax bracket has increased how much difference will it make to returns quaterly. .

Hello Rohit, There is no increase in tax bracket. The DDT on dividend payout options of debt funds have only increased. That is not going to make any difference to fund returns. The diff. it makes to individual’s can be suitably overcome by using right strategies. Pl. read this link to knwo more: https://blog.fundsindia.com/blog/advisory/should-you-choose-the-dividend-option-or-the-growth-option/1757 Tks, Vidya

Hi Vidya,

Very informative article.

i have 90% of my debt portfolio in income funds since oct 2012 which has fetched me absolute returns in the range of 11-12%. I am pretty satisfied with the returns.

Want to know if this will be a good time to shift from dynamic bond funds to long duration income funds, read an article in ET which still suggests investing in duration income funds.

http://articles.economictimes.indiatimes.com/2013-05-27/news/39557348_1_bond-yields-benchmark-10-year-bond-bond-prices

please suggest.

Hi Piyush,

Dynamic bond funds are also one type of income funds. But if you are in less aggressive dynamic bond funds (which have limited exposure to gilt and medium portfolio maturity of say 4-5 years), then those funds should be good enough for the long term. If you wish to take expsure to more risky longer tenure bond funds (other than pure gilt fund), then the next one year may present an opportunity. You may read more on this in: https://blog.fundsindia.com/blog/mutual-funds/fundsindia-strategies-funds-for-risk-taking-debt-investors/2663

Tks

Vidya