Tags: returns

RSS feed for this sectionFundsIndia Recommends: Kotak Emerging Equity Scheme

April 24, 2019If you are an aggressive investor and building a long-term portfolio, this may be a good time to invest in a midcap fund like Kotak Emerging Equity. This aggressive fund…Continue Reading

FundsIndia Recommends: Axis Banking & PSU Debt

April 11, 2019Amidst all the risks that transpired in the debt space, in the last 6 months, Axis Banking & PSU Debt was among the few funds that remained steady and unhurt…Continue Reading

Why looking at 1-year returns can misguide you

January 28, 2019Whenever you are looking for funds to invest and look at the performance screen of a fund, the 1-year returns is the number that registers and also influences decision. There…Continue Reading

FundsIndia Views: The final debate on FD vs. Debt funds

June 27, 2018For many of you, looking at the latest FD interest offered by banks and comparing it with the past 1 year returns of debt funds serves up an easy conclusion.…Continue Reading

FundsIndia Views: Why you should not be exiting debt funds now

May 30, 2018If you were to look at the year-ago returns of many of your debt funds and the current returns, you will wonder if you made a wrong choice in investing…Continue Reading

FundsIndia Reviews: Mutual fund round-up for 2017

December 27, 20172017 saw equity markets give a stiff competition to the heady 2014 market, clocking in returns excess of 30%. For debt funds though, the 2017 calendar was one of second-guessing…Continue Reading

FundsIndia Views: Why you can go wrong with point-to-point returns

December 13, 2017Today, the 1-year return of BNP Paribas Midcap looks to be among the best at 40%. L&T India Value sports a 1-year return of 31.7%. On a 3-year basis too,…Continue Reading

Reading between the past returns of mutual funds

December 4, 2017‘Past returns are not indicative of future returns’ is a disclaimer you would have come across often. The reason why past returns cannot be taken as a yardstick is because…Continue Reading

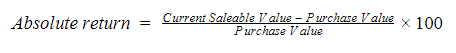

FundsIndia explains: What are absolute returns

October 23, 2017“My investment in that Bombay house grew to Rs.85 lakhs from when I bought it back in 2000 for just Rs.25 lakhs. My investment has tripled!” That’s a declaration that…Continue Reading

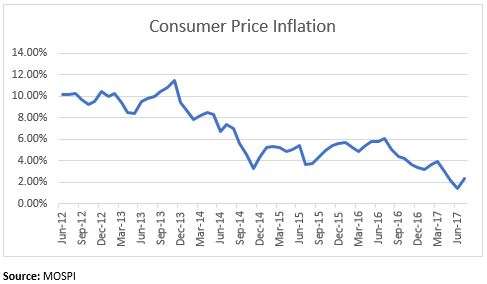

FundsIndia Views: Reset your return expectations

August 16, 2017Short on time? Listen to a brief overview of this week’s review. [soundcloud url=”http://api.soundcloud.com/tracks/338109395″ params=”color=ff5500&auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false” width=”100%” height=”166″ iframe=”true” /] With the markets delivering close to 20% returns on a year-to-date…Continue Reading