How to Choose the Right Mutual Fund Based on Your Life Stage

As we journey through life, our financial priorities evolve. From early career savings and marriage planning to buying a house or preparing for retirement, each phase brings its own set of goals and challenges. Choosing the right mutual fund based on your life stage can be a game-changer in your wealth-building journey.

With thousands of mutual fund schemes available in the market, finding the right one can seem overwhelming. But don’t worry—this guide will help simplify your decision-making process by walking you through the key parameters to consider.

Step 1: Define Your Life Goals

Before you even begin investing, the first step is to ask yourself: What am I investing for?

Life goals can range from:

- Building a retirement corpus

- Saving for your child’s higher education or wedding

- Buying a home or a vehicle

- Funding a world tour or sabbatical

- Creating an emergency or medical fund

Each goal will have a different time horizon, urgency, and return expectation. Categorize your goals into:

- Short-term goals (less than 3 years)

- Medium-term goals (3 to 5 years)

- Long-term goals (more than 5 years)

Understanding the nature of your goals allows you to match them with suitable investment products. For example, a long-term goal like retirement planning can afford more volatility and hence, can benefit from equity investments.

Pro tip: Use tools like the FundsIndia SIP Calculator to determine the monthly investment required to meet your goal based on timeline and expected returns.

Step 2: Assess Your Risk Tolerance

Risk tolerance is your ability and willingness to endure the ups and downs of the market. It is influenced by factors such as:

- Age

- Income level

- Existing liabilities

- Financial dependents

- Investment experience

- Psychological comfort with market fluctuations

Based on this, investors generally fall into three categories:

| Investor Type | Preferred Asset Class | Expected Return Range | Risk Level |

| Conservative | Debt Funds | Up to 8% | Low |

| Moderate | Hybrid Funds | 8% to 12% | Medium |

| Aggressive | Equity Funds | Over 12% | High |

If you are a conservative investor, you may lean toward stable returns even if it means earning less. On the other hand, if you are young, earning well, and willing to take some risk, equity-oriented schemes could be your best friend.

Step 3: Align Your Investment Horizon with the Right Asset Class

Time plays a vital role in determining the success of any investment. Mutual funds offer different options based on tenure:

- Equity Funds: Suitable for long-term goals (5 years or more). Though volatile in the short run, they have historically delivered superior returns over the long term.

- Debt Funds: Ideal for short- to medium-term goals. These offer relatively stable returns with lower risk.

- Hybrid Funds: These invest in a mix of equity and debt, balancing risk and return. Great for moderate investors with a 3–5 year time horizon.

Remember, investing in equity for short-term goals may lead to unpredictable outcomes due to market fluctuations.

Step 4: Evaluate Fund Performance Metrics

Once you have shortlisted a category (equity, debt, or hybrid), the next step is to evaluate specific funds.

Key parameters to review:

- Calendar Year Returns: Analyze how the fund has performed in different market cycles.

- Rolling Returns: Indicates how consistently the fund has been delivering returns.

- Standard Deviation & Sharpe Ratio: Measures of risk-adjusted performance.

- Benchmark Comparison: Ensure the fund consistently outperforms its benchmark index.

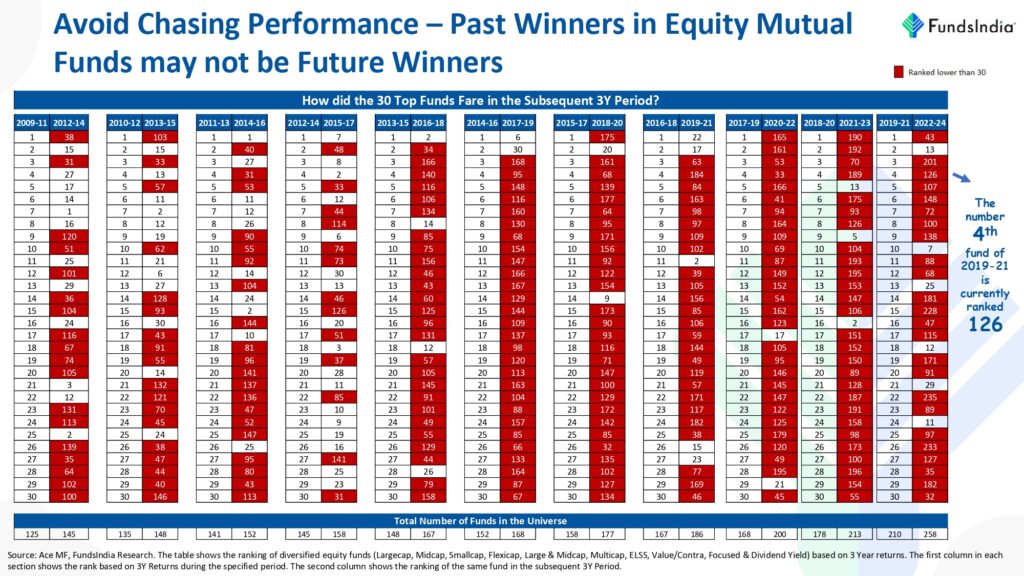

However, it is essential to note: past performance is not a guarantee of future results. Use it as a reference point, not a decision-maker.

Source: Wealth Conversation Report, FundsIndia Research.

Step 5: Consider the Fund Manager’s Experience

The expertise of the fund manager is crucial, especially in actively managed funds. An experienced manager with a solid track record can help a fund navigate market volatility and seize opportunities.

Review:

- Years of experience

- Performance of other funds managed

- Strategy during downturns

Good fund management often plays a role in delivering consistent long-term returns.

Step 6: Diversify Your Portfolio

“Don’t put all your eggs in one basket” holds true in investing. Diversifying across asset classes, sectors, geographies, and fund types helps:

- Minimize risk

- Manage market volatility

- Create a balanced return profile

For example

- Combine large-cap, mid-cap, and small-cap equity funds

- Add debt funds for capital preservation

- Include international funds for global exposure

Diversification can help you achieve a smoother investment experience.

Still confused? We made it easy. Just sign in and access the Five Finger strategy’s diversification tweaked by FundsIndia, especially for clients.

Step 7: Understand Tax Implications

Taxation plays a major role in your net returns. Here’s a simplified breakdown:

Equity Mutual Funds

- LTCG (Long-Term Capital Gains): 12.5% on gains over ₹1.25 lakh (holding >1 year)

- STCG (Short-Term Capital Gains): 20% on gains (holding <1 year)

Debt Mutual Funds (Post-April 1, 2023)

- All gains are treated as short-term, taxed as per your income tax slab.

- The benefit of indexation for long-term holdings (available earlier) is no longer applicable for investments made after April 1, 2023.

For investments made before April 1, 2023, old rules apply:

- STCG (≤36 months): taxed as per slab

- LTCG (>36 months): taxed at 20% with indexation

Knowing these rules helps you optimize post-tax returns and choose suitable funds for your tax bracket.

Case Study: The Impact of Asset Allocation on Returns

Let’s assume an investor contributes ₹25,000/month for 10 years. Based on different asset allocations and expected returns, take a look at what the final corpus would look like:

| Investor Type | Asset Allocation | Expected Returns | Corpus After 10 Years |

| Conservative | Debt Funds | 7.5% | ₹44,76,060 |

| Moderate | Hybrid Funds | 10% | ₹51,63,801 |

| Aggressive | Equity Funds | 12.5% | ₹59,84,533 |

(The above is an illustration and provided for understanding purposes. The returns can vary depending on the market conditions.)

Clearly, the choice of fund and return expectation significantly influences your wealth-building journey.

Final Thoughts

Investing in mutual funds is no longer a luxury—it’s a necessity for anyone aiming to achieve financial freedom. However, each life goal deserves a unique strategy. Whether you’re planning a family vacation in two years or saving for your child’s college education in 15 years, tailor your mutual fund choices based on:

- Goal timeline

- Risk appetite

- Expected returns

- Tax considerations

- Fund performance

Also, don’t ignore short-term goals—debt or liquid funds can help manage cash efficiently. Funds like overnight or arbitrage funds can provide liquidity with minimal risk.

Whether you’re just starting out or are an experienced investor, there is a mutual fund suited to your needs. And if you’re ever in doubt, don’t hesitate to consult a financial advisor.

Start your journey today with FundsIndia.

Explore India’s most trusted online mutual fund platform for curated funds, expert guidance, and smart investing tools—all in one place.

Need help building your portfolio? Talk to our advisor today.

Related Articles

View All

Keep an eye on your inbox—your first digest will be arriving soon!