Tags: Personal Finance

RSS feed for this sectionFundsIndia Reviews: Franklin India High Growth Companies

March 29, 2018Franklin India High Growth Companies (Franklin HG), an equity fund that invests across market capitalisations, was once among those that delivered outsized returns compared to peers and the market. In…Continue Reading

FundsIndia Recommends: Mirae Asset India Equity

March 7, 2018Mirae Asset India Equity (earlier Mirae Asset India Opportunities) ticks all the boxes that characterize a good equity fund. One, it stays ahead of the market and peers across timeframes.…Continue Reading

FundsIndia Recommends: DSP BlackRock Opportunities

February 21, 2018Opportunistic is a good way to describe DSP BlackRock Opportunities (DSPBR Opportunities). This equity fund aims at identifying stocks with potential, booking profits in them quickly, and moving on to…Continue Reading

FundsIndia Recommends: Reliance Medium Term Fund

February 14, 2018Investors with a minimum 2-year time frame and with some risk appetite can consider investing in a short-term debt fund like Reliance Medium Term. Given the present high yield scenario,…Continue Reading

FundsIndia Explains: Rebalancing a Mutual Fund Portfolio

February 12, 2018When you start to invest in Mutual Funds, you build a diversified, asset-allocated portfolio. This allocation is based on your goal timeline, your risk appetite, and other factors. That is,…Continue Reading

FundsIndia Views: Why markets fell and what you should do

February 7, 2018On Tuesday morning, stock market investors woke up to a sea of red. The Sensex plunged 1000 points in a matter of minutes. The Nifty 50 was down 3%. The…Continue Reading

FundsIndia Recommends: Aditya Birla Sun Life Short Term Fund

January 31, 2018In our Debt outlook for 2018, earlier this month, we discussed about the need for an income accrual strategy going forward. At this point in time, we think such a…Continue Reading

Why SIP when markets are going higher

January 29, 2018Systematic Investment Plan (SIP) enables you to buy mutual fund units periodically. Rupee-cost averaging is one of the widely known benefits of a SIP. Instead of buying 10 units at…Continue Reading

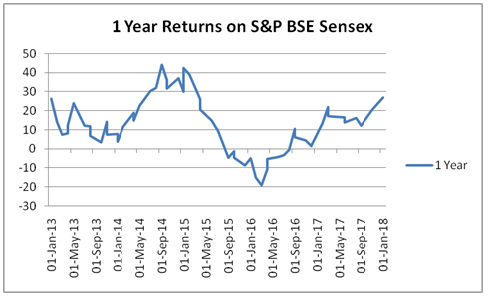

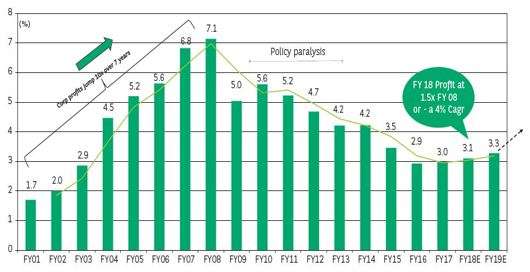

FundsIndia Views: Equity Outlook for 2018

January 24, 2018The Sensex has galloped nearly 10,000 points in the space of just over a year. This incredible run has come in even as reforms disrupted the corporate and economic recovery…Continue Reading

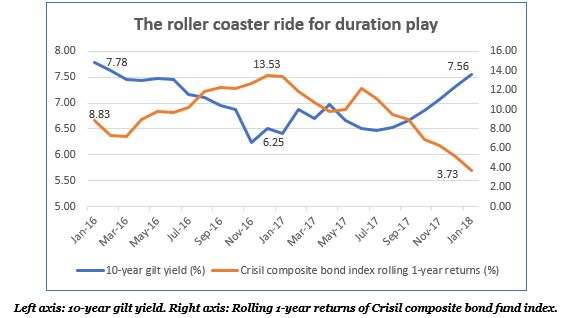

FundsIndia Views: 2018 Debt Market Outlook

January 17, 2018These are extraordinary times. The equity market has rallied without earnings entirely coming on-board with hope that there would be an economic revival. The debt market on the other hand,…Continue Reading