You might be familiar with the Motilal Oswal house-slogan of ‘Buy right, sit tight’. The fund house does not only preach this to its investors, but follows it in its own fund investing style as suggested by its portfolios.

Motilal Oswal MOSt Focused Multicap 35 Fund (Focused 35 Fund) is one of the diversified fund offerings from the Motilal Oswal house. As the fund was launched only in April 2014, it gives us little by way of track record to assess its performance. However, its performance and portfolio warranted a notice and hence this review, even as we remain neutral and watchful on the fund’s performance.

This write-up will seek to provide some interesting insights on the fund’s strategy and portfolio.

The Fund

As is the case with other funds from the Motilal Oswal stable, the Focused 35 Fund too seeks to run a compact portfolio of stocks. The fund can invest in a maximum of 35 high-conviction stocks across market caps. That means owning as high or close to even the 10 per cent stock limit allowed by the regulator per stock. Currently, the top holding in the fund (Maruti Suzuki India) accounts for 8.98 per cent of the portfolio.

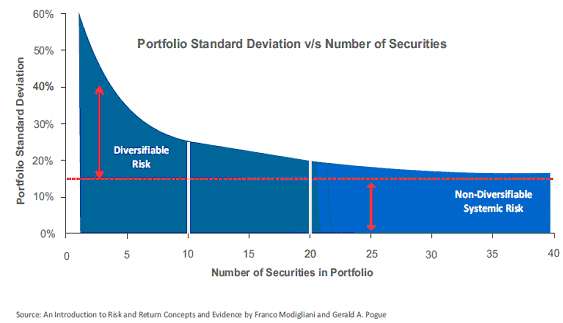

The general hypothesis behind a compact portfolio is that over-diversification does not necessarily reduce risk, and on the contrary, can dilute returns.

The Portfolio and Strategy

The Focused 35 Fund has only about 20 stocks in its portfolio at present, suggesting that it has high conviction in the stocks that it holds. While the concentrated portfolio may carry risks, we notice that over 95 per cent of the portfolio consists of stocks with a market cap of Rs. 10,000 crore.

That means the fund hardly has any concentrated exposure in the smaller market cap segment. This, to some extent, reduces the risk of volatility, and also significantly reduces the impact cost on exits – risks that are present in a focused portfolio approach.

The fund’s portfolio turnover is low at 0.22 times (June 2015); however, a look at the portfolio over the past year suggests that while there aren’t too many entries and exits, the fund has been adept in pruning and increasing exposure at all the right opportunities in its stocks.

For instance, while stocks such as Tech Mahindra and TCS, which were among the top 5 holdings a year ago, continue to remain in the portfolio, they account for lower weight in the portfolio now; not necessarily from selling the stock, but by increasing exposure in other stocks. On the other hand, it used corrections in large-cap stocks to up exposure in holdings such as HDFC Bank and Eicher Motors.

The portfolio strategy of the Focused 35 Fund over the year appears to give an impression of pure bottom-up stock picking, and less of sector-based stock picking. That it moved away from top sector holdings such as Information Technology (IT), banks and pharma a year ago, to auto, banks and consumer non-durables currently appears to be merely a fallout of its stock strategies.

Still, the semblance of a consumption-tilted approach can be seen in the portfolio now. The entry of winners such as Maruti Suzuki India and Britannia Industries in early 2015 speak of a consumption bias. This is stemming from both a bet on urban consumption pick up, as well as lower crude oil price. So was the well-timed entry into HPCL in September 2014.

It is interesting to note how the fund built positions in these stocks gradually, entering reasonably ahead, and buying itself time to still capitalise from the upsurge. The group’s Portfolio Management Service (PMS) approach to building portfolios is reflected in its funds’ portfolios as well.

Performance

Focused 35 Fund’s 1-year returns of 52 per cent beat its benchmark’s (CNX 500) return of 16.6 per cent, as well as the category performance of 24.6 per cent convincingly. CNX 500 is a diversified index as against the fund’s focused approach. A few winners can make all the difference in a concentrated portfolio, and that can be seen in Focused 35’s performance.

While data is skeletal for us to meaningfully roll the returns of this fund, the quarterly returns below suggest that the fund has been fairly consistent in its outperformance, particularly in managing positive returns in the June 2015 quarter when indices were down.

The fund is managed by Gautam Sinha Roy, with co-fund manager Taher Badshah joining him from May 2015.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. To know how to read our weekly fund reviews, please click here.

I remember reading another article about low beta vs high beta fund returns recently on your site. I would like to know if this fund is a high beta or a low beta fund/

This fund’s beta is less than 1 (at about 0.8 in our calculation). Not high. thanks, Vidya

Hi Vidya,

How is the current state of this mutual Fund. Is it a worthy fund like franklin Prima Plus or Kotak Select Focus in the Category ?

Hello Satyajit, Since its track record is limited it is not far to compare it with those that have survived harder markets. But thus far MO’s performance is inspiring.

Vidya

Well researched article.

Thanks, Rajiv.

I want to invest 1 lac to 1.70 lac(only in motilal oswal mutual fund)with horizon of minimum 30 month and may be more through STP now and thereafter through SIP

So advise me.

Hello Sir, if you need advice or help investing through your FundsIndia account, we could ask one of our advisors to help you, once your account is activated. I will be constrained from advising otherwise. As for your time frame, 60 months is the minimum horizon with which we would recommend investment in any equity mutual fund. thanks, Vidya

Good to know about motilal oswal MF, as I am investing regularly in this fund

I want to start SIP for 2000 rs monthly, Is this good fund to start SIP?

Currently my SIP as display below

HDFC mid cap opp. growth – 2k per month

Birla MNC growth – 2k per month

and other funds are tax saver which are lump sum

Please suggest.

Hello manoj, recommendations are not given by us to our investors through this forum. I shall ask our advisor to contact you. Please state your requirements/goal/time period and they will help you with choices. Also, ensure that you have all your investments in the platform so that it is easy for you to track/plan and review. thanks, Vidya

How is PPFAS for long term equity mutual fund ?

Hello Anil, It is a value fund. It seeks to invest in undervalued stocks. That means it can take time to outperform. The strategy is a promising one. But since the fund does not have sufficient track record (at least 3 years), we will be unable to provide more comments. thanks, Vidya

it is a good article and gives an encouragement in my decision to invest in this fund.

there is typing error in the table indicating quarterly returns. in stead of showing sep 15 & dec 15 u should show it as Sep 14 & dec 14. not that i want to crticise but to make the whole write up as an excellent one.

Hello Sir, Yes it is a typo. Regret it. I have asked the publishing team to get it corrected. thanks for pointing out. Vidya

I have started an SIP of Rs. 3500 since last month and planning to increase it up to 10,000 within next month. i am looking at long term aspect i.e at least 5 years.

My portfolio is under.

Already invested from last Month

ELSS Birla Sun Life Tax Relief 96 (G) – 1000

Large Cap – ICICI Prudential Focused Bluechip Equity Fund (G) – 1500

Hybrid – Reliance Retirement Fund – Wealth Creation Scheme (G) – 1000

Planning to Invest in coming Month

Multicap – Motilal Oswal MOSt Focused Multicap 35 Fund – Direct Plan (G) – 2000

MidCap – BNP Paribas Midcap Fund – Direct Plan – 2000

ELSS – Axis Long term Equity – 2000

I have already opened an account with Motilal Oswal with Rs. 5000 for MOSt Focused Multicap 35 Fund – Direct Plan (G).

I am thinking to switch from Reliance Retirement Fund. would that be a right decision?

How my remaining fund selection looks like? is it well balanced? Any change is required?

Secondly, i am thinking to do do lumsum investment around 10-20 K in Motilal Oswal MOSt Shares NASDAQ – 100 ETF Fund. would that be wise decision?

Hello Sir, Sorry about the delayed response. If you are a FundsIndia Investor, please route your query through your account. We will be constrained from providing advice otherwise. thanks, Vidya

I have started an SIP of Rs. 3500 since last month and planning to increase it up to 10,000 within next month. i am looking at long term aspect i.e at least 5 years.

My portfolio is under.

Already invested from last Month

ELSS Birla Sun Life Tax Relief 96 (G) – 1000

Large Cap – ICICI Prudential Focused Bluechip Equity Fund (G) – 1500

Hybrid – Reliance Retirement Fund – Wealth Creation Scheme (G) – 1000

Planning to Invest in coming Month

Multicap – Motilal Oswal MOSt Focused Multicap 35 Fund – Direct Plan (G) – 2000

MidCap – BNP Paribas Midcap Fund – Direct Plan – 2000

ELSS – Axis Long term Equity – 2000

I have already opened an account with Motilal Oswal with Rs. 5000 for MOSt Focused Multicap 35 Fund – Direct Plan (G).

I am thinking to switch from Reliance Retirement Fund. would that be a right decision?

How my remaining fund selection looks like? is it well balanced? Any change is required?

Secondly, i am thinking to do do lumsum investment around 10-20 K in Motilal Oswal MOSt Shares NASDAQ – 100 ETF Fund. would that be wise decision?

Hello Sir, Sorry about the delayed response. If you are a FundsIndia Investor, please route your query through your account. We will be constrained from providing advice otherwise. thanks, Vidya

Registered member of funds india wanted to open an equity account , talked with lekha banu.list of documents required gave all my details and meeting time still no response. mailed twice.i think it’s better to buy motilal directly from them

Hi, Savni. Sorry for the inconvenience caused. Our equity team reports that they have been trying to get in touch with you over phone and through email to take the process further, but haven’t been able to reach you. Could you please drop us a mail at support@fundsindia.com, or call us on (0) 7667 166 166? We’ll work to resolve this issue ASAP.

Registered member of funds india wanted to open an equity account , talked with lekha banu.list of documents required gave all my details and meeting time still no response. mailed twice.i think it’s better to buy motilal directly from them

Hi, Savni. Sorry for the inconvenience caused. Our equity team reports that they have been trying to get in touch with you over phone and through email to take the process further, but haven’t been able to reach you. Could you please drop us a mail at support@fundsindia.com, or call us on (0) 7667 166 166? We’ll work to resolve this issue ASAP.

Hi vidya

Greetings

Thanks for the writeup

Kindly provide some writeup for motilal most focussed mid cap 30 fund.

I have not seen any proper review for this fund in internet.

Hoping to see a review on this fund.

Regards

Manjunatha

Hi vidya

Greetings

Thanks for the writeup

Kindly provide some writeup for motilal most focussed mid cap 30 fund.

I have not seen any proper review for this fund in internet.

Hoping to see a review on this fund.

Regards

Manjunatha

Dear Sir,

I want to invest in SIP . please suggest minimum how much amount we should start and what return will come for the period of five years only.

Dear Sir,

I want to invest in SIP . please suggest minimum how much amount we should start and what return will come for the period of five years only.

Hello Suresh, We cannot make any forecasts on returns. It is not permitted as well, in the law. Vidya

I wish to invest Rs75,000 monthly is sip in the below 3 funds for around 5 to 8 years.

Motilal oswal focused 35 fund Rs 35000

DSP Black rock most focused 25 fund Rs 25000and

Birla sunlife generation next fund Rs 20000

Kindly suggest.

Thanks.

Hello Sir, Please get in touch with us through your FundsIndia account for specific recommendations. We are constrained from providing them on the blog. thanks, Vidya

I wish to invest Rs75,000 monthly is sip in the below 3 funds for around 5 to 8 years.

Motilal oswal focused 35 fund Rs 35000

DSP Black rock most focused 25 fund Rs 25000and

Birla sunlife generation next fund Rs 20000

Kindly suggest.

Thanks.

Hello Sir, Please get in touch with us through your FundsIndia account for specific recommendations. We are constrained from providing them on the blog. thanks, Vidya

Deat Vidhya, thanks for yet again a nice article. Is kotak select focus MF, a value fund? Thanks

Hi,

Kotak Select Focus is not strictly a value fund. You can read our blog on it, here.

Thanks,

Bhavana

Deat Vidhya, thanks for yet again a nice article. Is kotak select focus MF, a value fund? Thanks

Hi,

Kotak Select Focus is not strictly a value fund. You can read our blog on it, here.

Thanks,

Bhavana

hello vidya

i need to more information about Motilal oswal focused 35 fund .

i choose this fund for invest., but i have doubt for that. i already inverst L &T fund. now i have an idea to invest another one. please give for your suggestion

Hello,

We have a more recent analysis of this fund, here However, since then, the fund suffered a severe blow from a swift and steep fall in a couple of its stocks. This has weighed on recent returns and the fund can continue to underperform until its other picks help it pull back. Due to its strategy, it does require a slightly higher risk appetite than usual large-cap biased multi-cap funds. We do not know what other funds you hold – L&T is an AMC and has several equity funds. We also cannot provide portfolio-specific advice on this forum. It is meant for discussions only. Please talk to your advisor for a review and recommendations. If you’re a FundsIndia customer, please use the Talk to my advisor feature on your portfolio page.

Thanks,

Bhavana

hello vidya

i need to more information about Motilal oswal focused 35 fund .

i choose this fund for invest., but i have doubt for that. i already inverst L &T fund. now i have an idea to invest another one. please give for your suggestion

Hello,

We have a more recent analysis of this fund, here However, since then, the fund suffered a severe blow from a swift and steep fall in a couple of its stocks. This has weighed on recent returns and the fund can continue to underperform until its other picks help it pull back. Due to its strategy, it does require a slightly higher risk appetite than usual large-cap biased multi-cap funds. We do not know what other funds you hold – L&T is an AMC and has several equity funds. We also cannot provide portfolio-specific advice on this forum. It is meant for discussions only. Please talk to your advisor for a review and recommendations. If you’re a FundsIndia customer, please use the Talk to my advisor feature on your portfolio page.

Thanks,

Bhavana

I want to invest 1 lac to 1.70 lac(only in motilal oswal mutual fund)with horizon of minimum 30 month and may be more through STP now and thereafter through SIP

So advise me.

Hello Sir, if you need advice or help investing through your FundsIndia account, we could ask one of our advisors to help you, once your account is activated. I will be constrained from advising otherwise. As for your time frame, 60 months is the minimum horizon with which we would recommend investment in any equity mutual fund. thanks, Vidya

I remember reading another article about low beta vs high beta fund returns recently on your site. I would like to know if this fund is a high beta or a low beta fund/

This fund’s beta is less than 1 (at about 0.8 in our calculation). Not high. thanks, Vidya

Hi Vidya,

How is the current state of this mutual Fund. Is it a worthy fund like franklin Prima Plus or Kotak Select Focus in the Category ?

Hello Satyajit, Since its track record is limited it is not far to compare it with those that have survived harder markets. But thus far MO’s performance is inspiring.

Vidya

Good to know about motilal oswal MF, as I am investing regularly in this fund

Well researched article.

Thanks, Rajiv.

it is a good article and gives an encouragement in my decision to invest in this fund.

there is typing error in the table indicating quarterly returns. in stead of showing sep 15 & dec 15 u should show it as Sep 14 & dec 14. not that i want to crticise but to make the whole write up as an excellent one.

Hello Sir, Yes it is a typo. Regret it. I have asked the publishing team to get it corrected. thanks for pointing out. Vidya

How is PPFAS for long term equity mutual fund ?

Hello Anil, It is a value fund. It seeks to invest in undervalued stocks. That means it can take time to outperform. The strategy is a promising one. But since the fund does not have sufficient track record (at least 3 years), we will be unable to provide more comments. thanks, Vidya

I want to start SIP for 2000 rs monthly, Is this good fund to start SIP?

Currently my SIP as display below

HDFC mid cap opp. growth – 2k per month

Birla MNC growth – 2k per month

and other funds are tax saver which are lump sum

Please suggest.

Hello manoj, recommendations are not given by us to our investors through this forum. I shall ask our advisor to contact you. Please state your requirements/goal/time period and they will help you with choices. Also, ensure that you have all your investments in the platform so that it is easy for you to track/plan and review. thanks, Vidya

Dear Sir,

I want to invest in SIP . please suggest minimum how much amount we should start and what return will come for the period of five years only.

Hello Suresh, We cannot make any forecasts on returns. It is not permitted as well, in the law. Vidya