Have you missed your deadline for submitting tax-saving investment option proofs to your employer? Not to worry; you still have a good week to go to make your investments. Yes, you can invest anytime up to March 31 and still claim the same when you file your returns.

This may either result in your claiming a refund or reducing any tax outgo you will have to pay at the time of filing. Whichever way, if you intend to utilize this deduction option, you may still go for it and save taxes.

If you are game for equity investing, then tax-saving funds (ELSS) provide you the required deduction under Section 80C of the Income Tax Act, besides the benefit of capital gain exemption at the time of redemption. This is also one of the quickest options you can resort to, if you are convinced, to gain the benefit before the year ends.

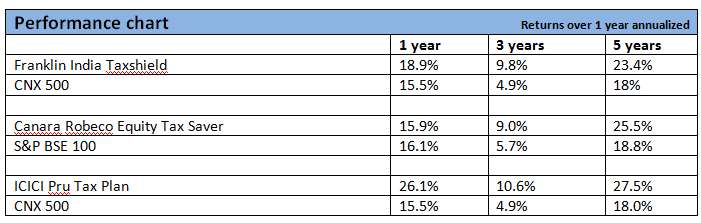

We had, in November, stated our core tax-saving recommendations but elaborated on a few other tax-saving funds that showcased promise. This time, we will revisit our core funds. While these may not be top-notch performers, they are relatively low risk, ride more on large-cap stocks and have shown lower volatility. They are: Franklin India Taxshield, ICICI Pru Tax Plan and Canara Robeco Equity Tax Saver.

Usually known to hold bias for large caps, this fund has now decided to hold a little over a fourth of its portfolio in stocks with market capitalization of less than Rs 10,000 crore. This move may have been required given the fast paced rally in the mid-market cap segment since October 2013.

But this fund is not for those with high risk appetite as it may not take a mid-cap bias. The fund is suitable for those looking for limited volatility, as its risk-adjusted score suggests that it compensates adequately with limited risks. That it is a consistent fund is also evident when one looks at its rolling 1-year returns over the last 3 years; the fund beat its benchmark a good 90% of the times.

This fund is known to declare steady dividends every year. The fund house too, has in the past, declared dividends from profits, when it thinks markets have peaked. Those looking for some payout, given the 3-year lock-in, may choose the dividend payout option.

Canara Robeco Equity Tax Saver

This fund too, is for those with limited risk appetite. It presently holds 80% of its assets in large-cap stocks. While the fund is known to be a mediocre performer sometimes over shorter periods, its performance picks pace with time. For instance, over a 5-year period, the fund’s compounded annual return of 26% comfortably beat the category average by 5 percentage points and the benchmark, S&P BSE 100, by 7 percentage points.

The fund underperformed a bit with higher exposure to the financial services space, leading to marginally lower returns than its category in the past 1 year. However, with the financial sector’s prospects improving, at least in the stock market, the fund may be on a comeback mode.

If you are among the slightly more aggressive kind, then ICICI Pru Tax Plan may be a better fit for you. This fund can ride well on a rally, but also take a hard knock during falls. Just to give an example, in the last 3 years, on a rolling 1-year return, the fund’s worst fall was 23%, compared with Franklin India Taxshield’s 15% and Canara Robeco Equity Tax Saver’s 16%.

On the other hand, on similar parametres, the fund delivered almost 39% as its best rolling return as against 30% for the Franklin fund and 32.6% for the Canara Robeco fund. The fund is well placed to ride the current market wave, with sufficient weights to finance and energy – 2 sectors that are currently receiving market’s favour.

Investors may note that going for dividend reinvestment option with tax-saving funds will lock-in the dividend reinvestment units again for another 3 years. Growth would be preferred if you do not want a dividend payout.

Why axis long term equity fund not considered which has given fantastic return for the last 2 years.

hello sir, We had covered the fund in November 2013 (https://blog.fundsindia.com/blog/mutual-funds/fundsindia-recommends-tax-saving-funds/3793) as mentioned in the article and is part of our select funds list. However, we will still not call it a core fund as of the 4-odd years (since dec 2009 launch), it was close-ended entirely for 3 years (being an ELSS) and hence immune to shocks such as redemption pressure. Hence we would be more comfortable after it completes at least 5 years of similar performance to be called a core fund. thanks, Vidya

hi vidya i am investing 2000 pm via sip in can robeco tax saver(G) for this fin year i want to invest 36000 in elss.should i go for icici pru tax plan or axis long term equity for 1000? or to reduce can robeco to 1000 and add new sip of 2000 of any of these two? thanks

sharad

Pls comment on your views on reliance tax saver fund which has been there for 9 years or so and may be more rewarding given India growth story for next 5 to 10 years for mid caps

Hi Vijay, Pl. read our view on Reliance Tax Saver here: https://blog.fundsindia.com/blog/mutual-funds/fundsindia-recommends-reliance-tax-saver/5786

Vidya

Why axis long term equity fund not considered which has given fantastic return for the last 2 years.

hello sir, We had covered the fund in November 2013 (https://blog.fundsindia.com/blog/mutual-funds/fundsindia-recommends-tax-saving-funds/3793) as mentioned in the article and is part of our select funds list. However, we will still not call it a core fund as of the 4-odd years (since dec 2009 launch), it was close-ended entirely for 3 years (being an ELSS) and hence immune to shocks such as redemption pressure. Hence we would be more comfortable after it completes at least 5 years of similar performance to be called a core fund. thanks, Vidya

hi vidya i am investing 2000 pm via sip in can robeco tax saver(G) for this fin year i want to invest 36000 in elss.should i go for icici pru tax plan or axis long term equity for 1000? or to reduce can robeco to 1000 and add new sip of 2000 of any of these two? thanks

sharad

Pls comment on your views on reliance tax saver fund which has been there for 9 years or so and may be more rewarding given India growth story for next 5 to 10 years for mid caps

Hi Vijay, Pl. read our view on Reliance Tax Saver here: https://blog.fundsindia.com/blog/mutual-funds/fundsindia-recommends-reliance-tax-saver/5786

Vidya