Given a choice, we would prefer to have the best in everything – buy the best car, get the best job, eat the best food, watch the best content… you get the drift!

This is perfectly obvious. After all, why should we go for things that do not meet the best standards especially when we can afford the best.

Most of us tend to apply the same ‘best’ filter to choose our equity funds. We google for funds that have given exceptional returns in the past and invest in them.

On paper, choosing funds based on past performance sounds quite logical.

But, has this strategy worked in the past?

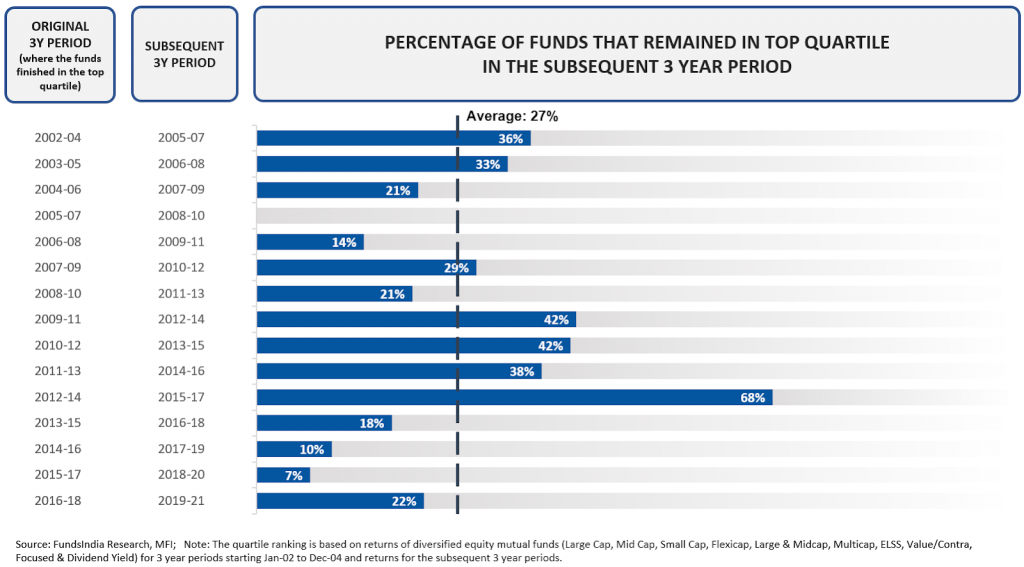

Let us take the top quartile performers (funds in the top 25% on the basis of returns) for the 3 year period from Jan-16 to Dec-18.

Can you guess what percentage of them held on to the top spot in the next 3 year period (Jan-19 to Dec-21)?

a) 60 to 100%

b) 30 to 60%

c) 0 to 30%

If we think about it, at least 60% of the funds should have managed to retain the top position. All said and done, why would more than 40% of the top performers be underperforming.

Going by this, it should be Option A.

But here comes the shocker – The correct answer is not Option A and it is not even B.

The answer is C!

Just 22% of the 2016-18 top quartile performers remained in the top spot during 2019-21.

What if this was just a one-off?

Let’s look at what happened for different 3-year periods in the past 20 years.

The percentage of the top quartile performers that continued to be in the top quartile in the subsequent 3 years has varied significantly.

In the past two decades, the odds of making a successful investment purely based on past performance swung between 0% (none of the 2005-07 top quartile performers made it to the top in the next 3 years!) and 68%.

On average, only 27% of the funds that finished in the top quartile continued to be top performers in the subsequent 3 year periods.

This means that you just had a 27% chance of investing in a top performing fund by basing your decision on past performance.

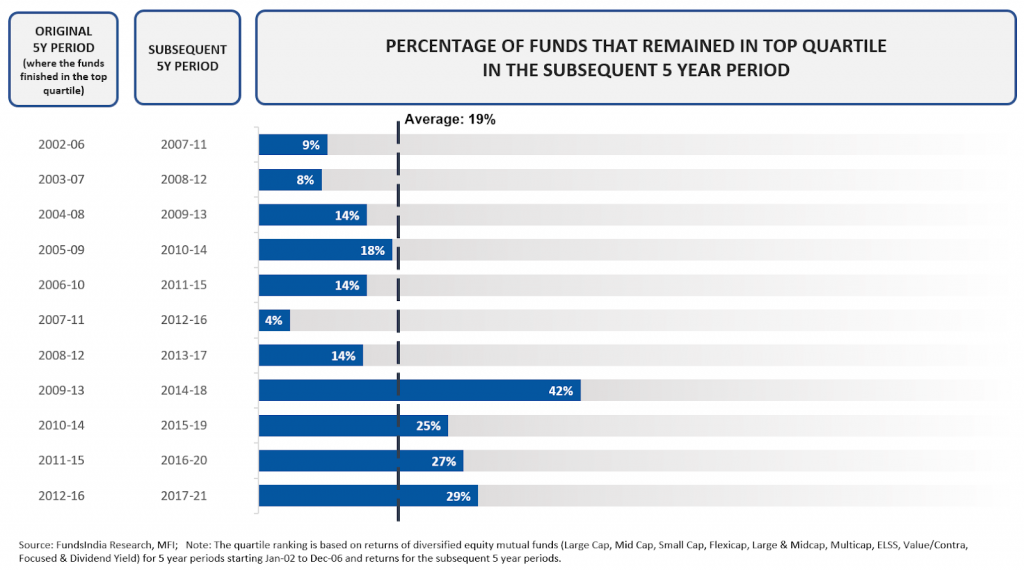

Not convinced yet?

The consistency drops even further when seen from a 5 year perspective.

The odds of picking a successful fund was a mere 19%.

Some more evidence…

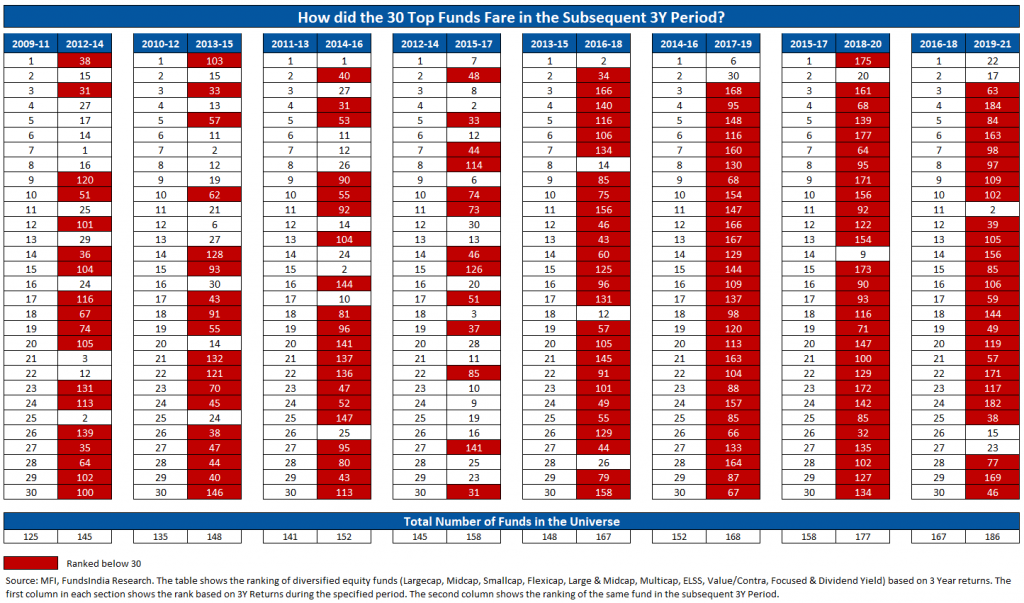

To add more context, we can now take a look at the same thing at a fund level.

Let us take the top 30 funds (ranked on the basis of returns) for different 3 year periods and find out where those funds had ranked in the next 3 years.

The top performers during any given period have largely dropped down the pecking order in the subsequent periods.

All the above evidence makes it very clear that investing in equity funds ONLY based on past performance rarely works.

Why does this happen?

Like most things in life, equity funds go through their cycles i.e. they go through a good period followed by a bad period, and then they go through the cycle again.

These cycles can be viewed under 4 lenses –

- Cycles in different Investment Styles (Quality, Growth, Value etc)

- Cycles in Small Cap vs Mid Cap vs Large Cap

- Cycles in different Sectors

- Cycles in Equity Markets of Different Countries

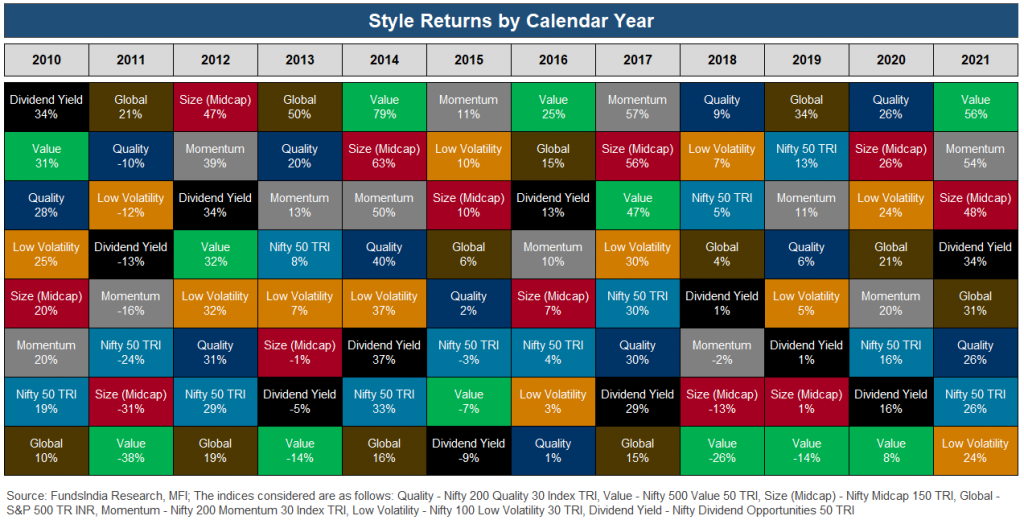

Different investments styles do well at different times

History and global evidence shows us that a group of stocks with specific characteristics and styles such as Quality, Value, Size (Mid/Small Cap), Momentum, Low Volatility and Dividend Yield have delivered superior returns over the long run.

However, not all investment styles work well at a given time. Each style exhibits phases of strong returns followed by phases of poor returns and vice versa. This goes on and the styles keep moving in and out of favour (as can be seen from the below table).

Over the long run most styles do well as their outperformance during good phases compensate for their weak performance in bad phases.

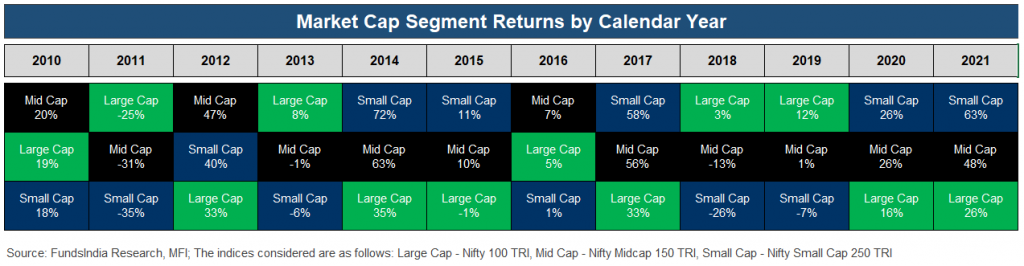

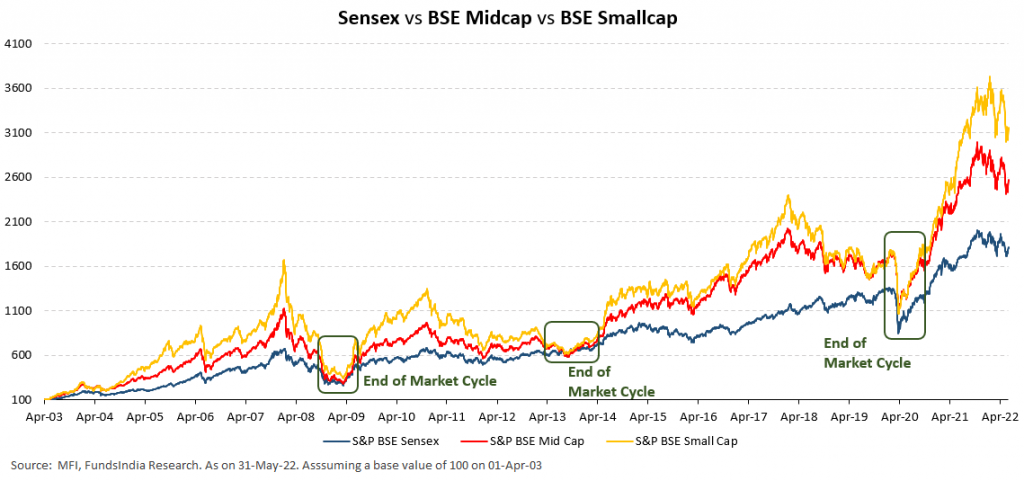

Different market cap segments do well at different times

Like styles, the performance of different market cap segments i.e. large cap, mid cap and small cap vary with time. The market sometimes favours larger companies and sometimes the smaller ones.

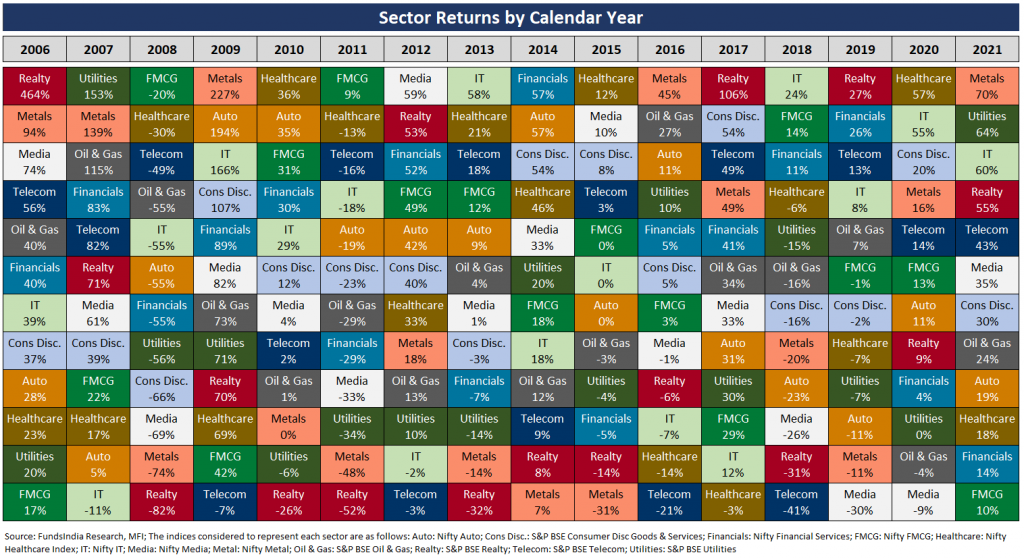

Different sectors do well at different times

Even the best performing sectors keep rotating. Most sectors that have featured at the top in a particular year have also ended up at the bottom during other years.

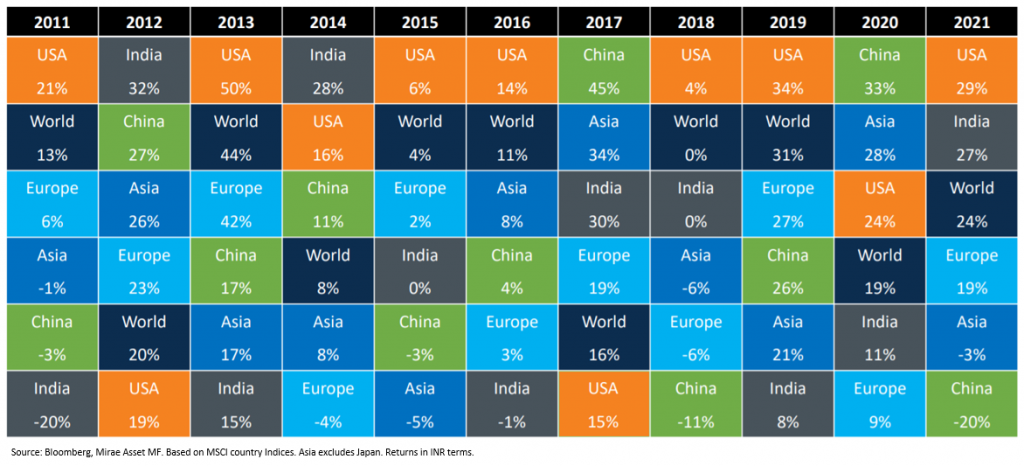

Different geographies do well at different times

Likewise, there is no single best investment country that consistently offers the highest returns. Different equity markets have done well at different points.

When you invest ONLY based on recent performance, your portfolio is likely to be biased towards specific styles, market cap segments, sectors and geographies. And when the cycle turns, your entire portfolio could go through prolonged underperformance.

So, how should you invest?

1. Do not choose Equity funds ONLY based on past performance

While past performance is a useful metric to evaluate a fund, it can never be the only one. Ideally, you should look at a number of quantitative and qualitative factors to derive conviction on the future potential of a fund.

Quantitatively, you can look for the following in a fund

- Consistency in Outperformance on a Rolling Basis versus Benchmark over 1-2 market cycles

- Consistency in Performance on a Rolling Basis versus Peers over 1-2 market cycles

- Ability to contain Downside during Market Declines over 1-2 market cycles

- Preferably Low Churn

- No Over-Concentration in the Portfolio

- Reasonable Size

- Reasonable Liquidity Among Portfolio Constituents

Qualitatively, you can look for the following in a fund

- Robust Investment Process (and the ability to stick to the style even when it is not in favour)

- Track Record of the Fund Management Team

- Clear Communication of Strategy and Process (especially during periods of underperformance)

- Pedigree of the AMC

2. Diversify! Diversify!! Diversify!!!

Diversify your equity funds across investment styles, market caps, sectors and geographies.

Internally, we use a portfolio construction strategy called the 5 Finger Framework where the investments are made equally into funds that follow five different investment styles – Quality, Value, Blend, Mid/Small and Global. You can read our detailed blog to know more on this.

Summing it up

Choosing funds with the highest recent returns intuitively seems like a logical approach.

However, historical evidence makes it clear that the odds of picking a future top performer only based on past performance is staggeringly low.

A better approach to build your equity fund portfolio would be choosing funds using quantitative and qualitative parameters and diversifying your investments across different styles, market caps, sectors and geographies.

Happy Investing 🙂

Really well presented guys. Great work..!