Cummins India Limited – Power with Purpose

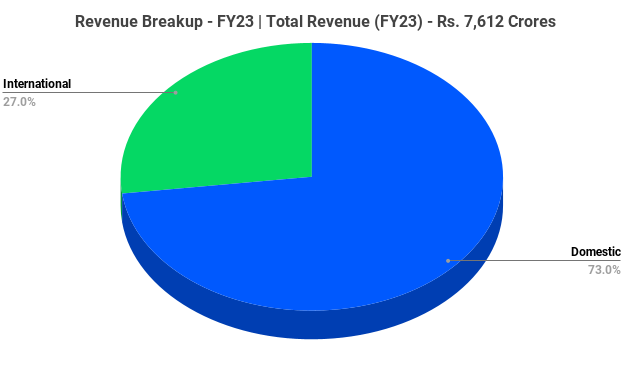

Cummins India Limited, the largest entity of Cummins in India, is the country’s leading manufacturer of diesel and natural gas engines for power generation, industrial and automotive markets. It is a group of complementary business units that design, manufacture, distribute and service – engines, generator sets and related technologies. The company was formed in 1962 and headquartered in Pune. It serves markets in India, Nepal and Bhutan and exports its products to various countries across the globe with USA, Europe, Mexico, Africa, Middle East and China being the top destinations. As of 31 March 2023, the company had 3161 permanent employees and workers, 5 world class factories and 1 part distribution centre. It caters to end markets such as construction, compressor, mining, marine, railway, oil and gas, pumps, defence and power generation.

Products & Services:

The company sells various products under its three business units – Engine, Power Systems, and Distribution. The Engine Business manufactures engines from 60 HP for low, medium and heavy-duty on-highway commercial vehicle markets and off-highway commercial equipment industry spanning construction and compressor. The Power Systems Business designs and manufactures high horsepower engines from 700 HP to 4500 HP as well as power generation systems comprising of integrated generator sets in the range of 7.5 kVA to 3750 kVA including transfer switches, paralleling switchgear and controls for use in standby, prime and continuous rated systems. The Distribution Business provides products, packages, services and solutions for uptime of Cummins equipment.

Subsidiaries: As on FY23, the company has one wholly owned subsidiary, two joint ventures and one associate company.

Key Rationale:

- Market Leader – In FY23, the company supported Indian Railways (IR) in achieving its Mission of Electrification through ‘Make in India’ products; secured order for the design and development of ‘Make in India’ Hotel Load Converter. The company also received ‘Green Channel Status’ from the Ministry of Defence, Government of India, for a period of five years to supply diesel engines and related parts. The company secured many projects in defence – for example, light tank project, the Project Zorawar to name a few. The company successfully launched CPCB-IV emission norms compliant products. During FY23, it launched new products such as Retrofit Emission Control Kit (RECD), Cummins Brake Lining, Cummins Funnel Fuel Filter, New range of Clutches, Power Booster Kit. The company moved to new-generation electronic 4-cylinder and 6-cylinder engines (from mechanical) to meet CEV Bharat Stage IV/V emission norms for Construction Equipment Vehicle (CEV) applications. Cummins has launched Gensets fit for the Low Horsepower (LHP) rental segment and also launched New Series of Fit-for-Market Gensets powered by B3.3, 6B, QSB7 and QSL9 engines for unregulated markets.

- Q2FY24 – For the Q2FY24, the company posted a consolidated revenue of Rs.1922 crores, a decline of 1.79% from the Q2FY23 revenue. Domestic and export sales were lower by 2% and 4% respectively. However, the profitability margins improved due to favourable material costs, pricing, and product mix. The operating profit stood at Rs.346 crores, marking an increase of 19.31% in Q2FY24 as compared to the same period in FY23. As compared to Q2FY23, net profit in Q2FY24 increased by 23.22% to Rs.329 crores. The operating and net profit margin for the period is 18.00% and 17.12% respectively.

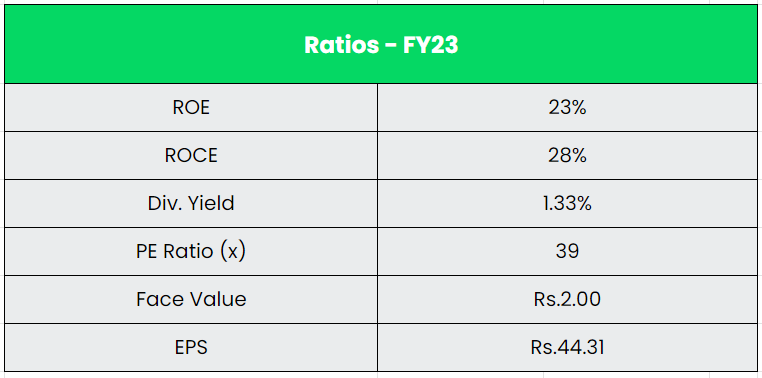

- Financial performance – The 3-year revenue and profit CAGR stands at 14% and 18% respectively between FY20-23. The company has strong balance sheet with debt-to-equity ratio of just 0.05. Average 3-year ROE and ROCE is around 18% and 22% for FY20-23 period.

Industry:

India has become the fastest-growing economy in the world in recent years. This fast growth, coupled with growing working population and rising incomes, a boost in infrastructure spending and increased manufacturing incentives, has accelerated the automobile industry. Indian Auto Component Industry clocks highest-ever turnover of $69.7 Bn, grows 33% in FY 2022-23. The FDI inflow into Indian automotive industry during the period April 2000-June 2023 stood at $35.15 Bn. By 2026, the automobile component sector is expected to contribute 5-7% of India’s GDP. As per the Automobile Component Manufacturers Association (ACMA) forecast, auto component exports from India are expected to reach US$ 30 billion by 2026. The Indian auto component industry is set to become the 3rd largest globally by 2025.

Growth Drivers:

Government of India has allowed 100% FDI under the automatic route for auto components sector. PLI schemes in automobile and auto component sector with financial outlay of INR 25,938 Cr has been introduced under Atmanirbhar Bharat 3.0. The Bharat New Car Assessment Program (BNCAP) will not only strengthen the value chain of the auto component sector, but it will also drive the manufacturing of cutting-edge components, encourage innovation, and foster global excellence.

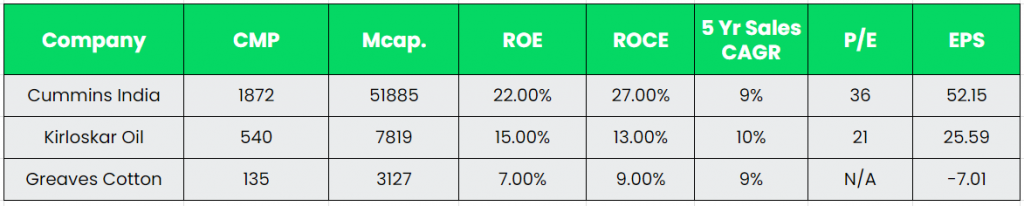

Competitors: Kirloskar Oil Engines Ltd, Greaves Cotton Ltd, etc.

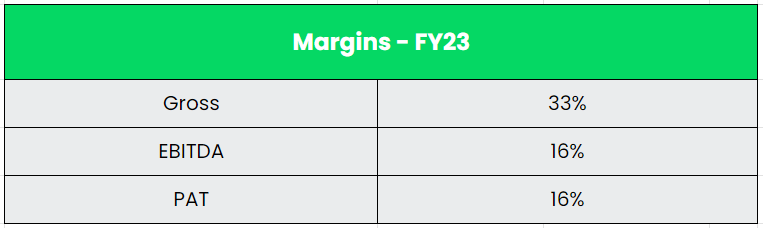

Peer Analysis:

Among the above competitors, Cummins has better return ratios and stable revenue growth than the other two, indicating the company’s financial stability and its efficiency to generate income and returns from the invested capital.

Outlook:

The company has long gestation projects in pipeline, notably the ones secured for the Defence sector. The Index of Industrial Production (IIP), PMI etc. are all indicating a reasonably stable economic outlook for India. The company anticipates the Indian economy on course for growth in the range of 6.3% to 6.8% based on various estimates. It anticipates delivering in domestic markets at 2x of the GDP in terms of growth. The company expects a robust growth in demand of the CPCB-IV+ emission norms compliant products which it recently launched in the market. In the domestic market, the demand for CPCB-IV+ is already higher than what the management had anticipated. The company has started to focus on expanding the CPCB-IV+ business on a global scale to export markets as well, starting with European Union. The company is awaiting approval for their Hotel Load Converters for its projects with Vande Bharat and Electric Locos for trains.

Valuation:

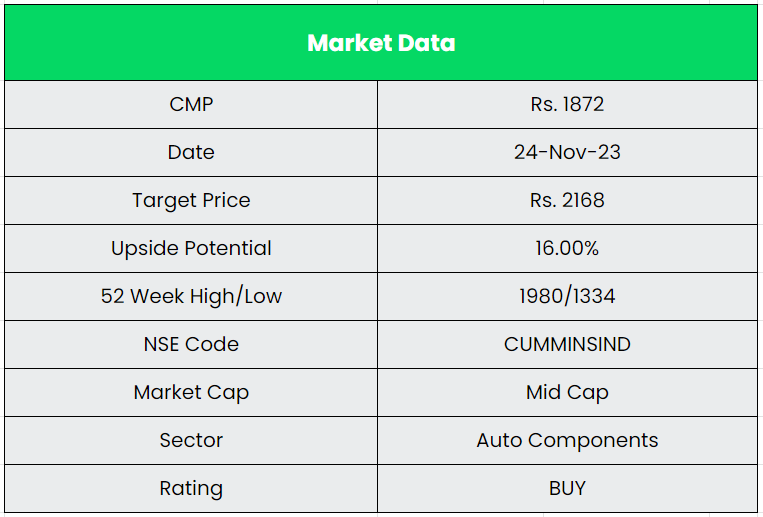

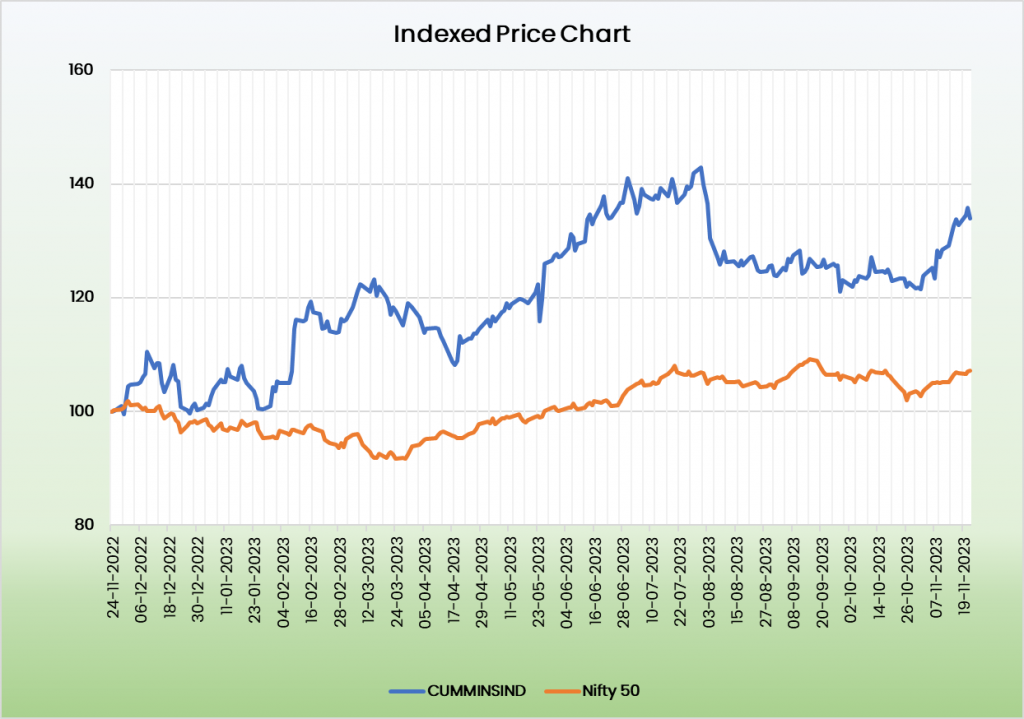

We believe Cummins India Limited is in a position for robust growth in the coming years. It’s growing market share in the existing business and upcoming projects the company has in pipeline places it in a position for a strong growth potential. We recommend a BUY rating in the stock with the target price (TP) of Rs.2168, 17x FY25E EPS.

Risks:

- Forex Risk – The company has significant operations in foreign markets and hence is exposed to forex risk. Any unforeseen movement in the forex market can adversely affect the company.

- Supply chain risk – The company is still working on the issues to tackle its ability to have supply available to meet unconstrained demand.