Coromandel International Ltd – Farmer First

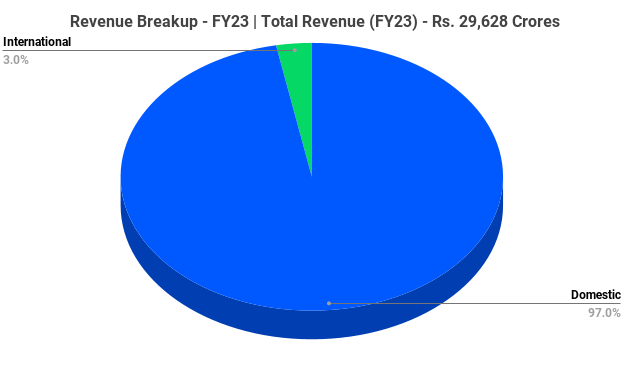

Coromandel International Limited (Coromandel), a part of Murugappa group, is a major provider of agricultural solutions, offering diverse products and services across the farming value chain. It specializes in fertilizers, crop protein, bio pesticide, specialty nutrients, organic fertilizers, etc. The company is world largest neem based biopesticide manufacturer and nation’s second largest private sector Phosphatic Fertiliser company. It has fertilisers manufacturing capacity of 4.5 million tonnes per annum. It is one of the top 5 crop protection companies in India with a manufacturing capacity of 90,000+ tons per annum. Coromandel has the country’s largest Agri-retail chain with over 750+ stores. The organization has divisional offices across Bangalore, Vijayawada, Pune, Indore, Noida, and Kolkata. Its extensive product line is distributed in over 80 countries worldwide.

Products and Services:

The company predominantly has two business segments – Nutrients & allied products and Crop Protection. The Nutrients and allied products segments comprise of fertilisers, speciality nutrients and organic fertiliser products. The Crop Protection business produces biopesticides, insecticides, fungicides, herbicides and plant growth regulators and markets these products in India and abroad. The company also have retail business with around 750+ outlets across India offering oil Testing, Crop Diagnostics and Farm Mechanization services.

Subsidiaries: As on FY23, the company had 13 subsidiaries, 2 associate companies and 1 joint venture.

Key Rationale:

- Market leader – Coromandel holds the top position as the single largest producer of Single Super Phosphate (SSP) in the country with a consumption-based market share of 13.80%. Being the leading private sector player in the Indian phosphatic industry, it holds a consumption-based market share of 17.20% in NPK & DAP segment. It is one of the market leaders in the specialty nutrient sector. It is also the largest neem based Azadirachtin manufacturer globally with significant presence in the US, Canada and Europe.

- Backward integration – The company has been undertaking projects to strengthen backward integration and ensure uninterrupted supply of key raw materials through self-reliance in its operations. During the Q2FY24, the company commissioned its third state-of-the-art Sulphuric Acid Plant (SAP-3) at Vizag claiming a capacity of about 1650 tons per day with investment of Rs.400 crores. With this, Coromandel sulfuric acid capacity will increase to 11 lakh tons per annum from 6 lakh tons per annum, supporting its requirements towards downstream processes involving phosphoric acid and phosphatic fertilizer production. It has also set up 6 million litre per day desalination plant at Vizag enabling the plant to achieve close to 1/3rd of its water requirement through seawater.

- Expansion projects – The company acquired 45% equity stake acquisition in BMCC (Senegalese Rock Phosphate mining company) at an outlay of Rs.150 crores, meeting one-third of company’s rock phosphate requirement. On the technical front, the business has successfully commissioned a “Multi Product Facility” at Ankleshwar plant to bolster Crop Protection business. The company also invested in Daksha, a differentiated drone startup. It has also acquired 16.53% equity in XMachines, an AI-based robotics startup. There is also a nano DAP plant that is coming up in Kakinada. In the bio product business, company has introduced Neem oil-based pesticide Azamax during the first half and plans to introduce non Azadirachtin in the second half.

- Q2FY24 – During the quarter, the company reported a consolidated total income of Rs.7033 crores versus corresponding Rs.10145 crores of Q2FY23. The decrease in revenue is mainly on account of drop-in subsidy rates in the fertilizers business compared to last year and a subpar monsoon. Revenue from the subsidy-based business stood at 84% during the quarter, much lower than 89% in Q2FY2023. EBITDA for the period was Rs.1059 crores marking a marginal increase of 0.2% YOY compared to Rs.1057 crores of Q2FY23. As compared to Q2FY23, net profit in Q2FY24 increased by 1.90% to Rs.755 crores. EBITDA margin stood at 15% and net profit margin at 11%.

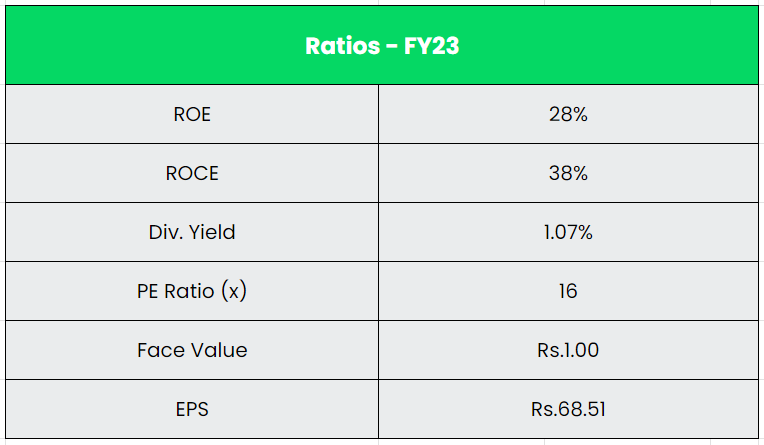

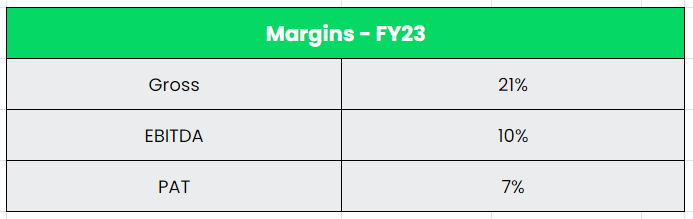

- Financial Performance – The 5-year revenue and profit CAGR stands at 22% and 25% respectively between FY18-23. The company has strong balance sheet with debt-to-equity ratio of just 0.05. Average 5-year ROE and ROCE is around 27.2% and 30.70% for FY18-23 period.

Industry:

India is one of the major players in the agriculture sector worldwide and it is the primary source of livelihood for ~55% of India’s population. The agriculture sector in India holds the record for second-largest agricultural land in the world. According to Inc42, the Indian agricultural sector is predicted to increase to US$24 billion by 2025. India’s chemical industry is the fourth largest producer of agrochemicals and is manufacturing more than 50% of technical-grade pesticides. Chemicals industry in India has been de-licensed except for few hazardous chemicals. India’s agrochemical sector is projected to grow at 8-10% CAGR till 2025.

Growth Drivers:

100% FDI is allowed under the automatic route in the chemicals sector (except in the case of certain hazardous chemicals). Between April 2000-June 2023, FDI in agriculture services stood at US$ 4.75 billion. In the Union Budget 2023-24, Rs. 1.24 lakh crore (US$ 15.9 billion) has been allocated to the Department of Agriculture, Cooperation and Farmers’ Welfare and Rs. 8514 crore (US$ 1.1 billion) has been allocated to the Department of Agricultural Research and Education. In 2022, the Government of India launched Kisan Drones for crop assessment, digitization of land records, and spraying of insecticides and nutrients.

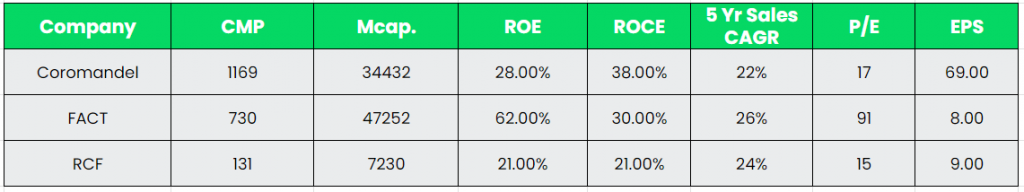

Competitors: Fertilizers & Chemicals Travancore Ltd (FACT), Rashtriya Chemicals & Fertilizers Ltd (RCF) etc.

Peer analysis:

Among the above competitors, with a reasonably steady revenue growth, Coromandel has better return ratios and robust earnings potential, indicating the company’s financial stability and its efficiency to generate income and returns from the invested capital.

Outlook:

With the expansion and backward integration plans the company is undertaking, we expect a robust performance in the future years. The newly introduced Nano DAP fertilizer has received positive feedback from customers and is expected to generate additional sales volume once the Kakinada plant with an expected capacity of 1 crore 1 litre bottles per year gets commissioned. The company has given an EBITDA guidance of Rs.5000 per tonne for the current financial year. The company’s investment in Daksha, a drone-based startup has started to secure orders for its agriculture drones and from Indian army for medium altitude, light weight and heavyweight logistic drones. The company also benefits from the strategic importance of the industry to the government of India (GoI), considering fertiliser is an essential commodity.

Valuation:

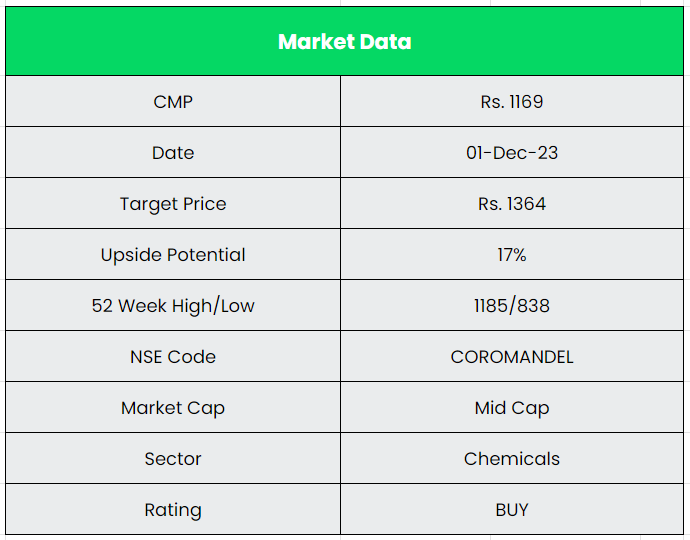

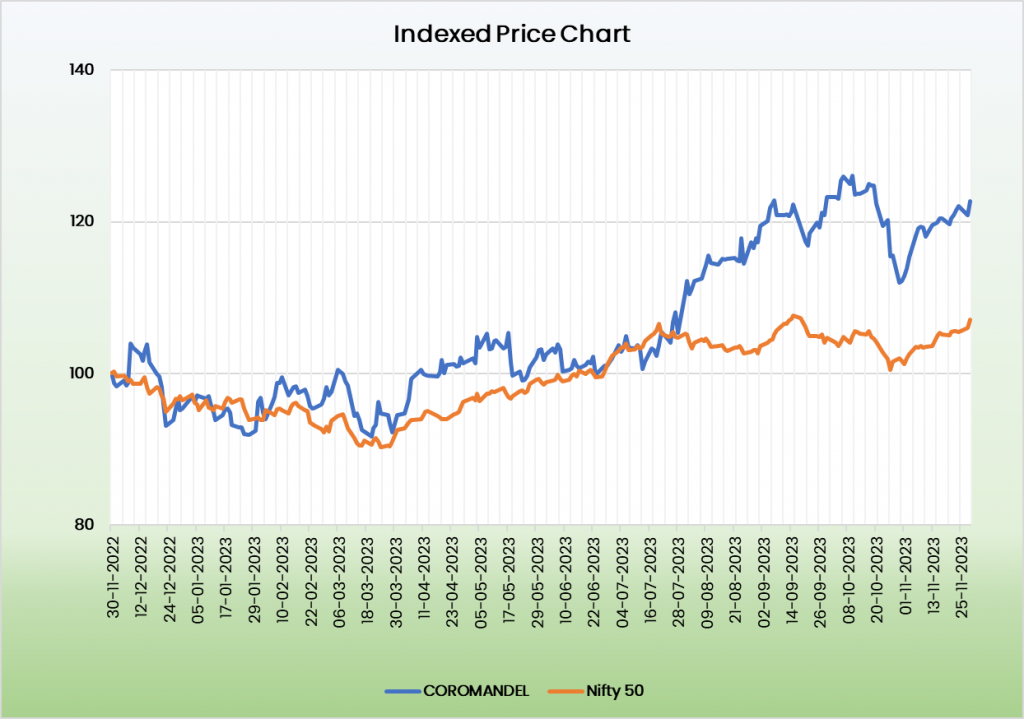

Coromandel, with its strong leadership position and backward integration projects of key raw materials, we expect the company to deliver consistent and sustainable performance. We recommend a BUY rating in the stock with the target price (TP) of Rs.1364, 17x FY25E EPS.

Risks:

- Monsoon risk – Change in climate/monsoon failure and reservoir level will be a key factor determining the company’s performance.

- Regulatory risk – The fertiliser industry is highly susceptible to regulatory changes, and this might result in limitation/ban of certain products, affecting revenue.