Some Concerns Running In Your Mind…

Concern 1: Bear markets usually have a lot of false upside rallies. What if this turns out to be one?

As seen from previous bear markets, there are usually several false upside rallies before the actual recovery. What if the current rally is a false rally?

Concern 2: A huge disconnect between ground reality and the equity markets

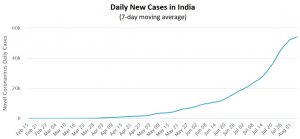

Coronavirus still not under control…

Economic Slowdown across the Globe…

Job losses and Pay cuts…

Hmm…Looks like a false rally indeed…

Concern 3: Some experts predict that the markets will fall

Inevitably in recent times, you would have come across several “doomsday” experts coming out with scary predictions.

Putting all this together

You must have heard different variations of the above arguments in recent times.

The simple conclusion – “The market will fall. Let me move out of equity markets!”

Before you rush into this decision, HANG ON…There is more than what meets the eye!

This decision while it looks pretty obvious to make at the first instinct, once you deep dive there are several nuances to this.

4 Challenges To Executing This View…

Challenge 1: Market recoveries have historically happened amidst bad news. How do you know if this is real or false?

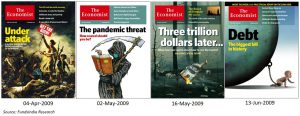

In the previous market crash in 2008 led by the Sub prime crisis, the markets recovered much ahead of the actual economy.

The magazine covers in 2009 give us a sense of how scary the news was, while the market silently started to recover in the middle of all this.

Markets are usually forward-looking and recover much ahead of the actual economic recovery. Historically bear market recoveries both in India and other global markets, have happened amidst bad news.

This means a disconnect between the economy and the market is an inevitable part of any recovery.

So the first challenge is how do we know for sure if this is real or false except in hindsight?

Challenge 2: Central Banks Liquidity infusion has historically led to market recovery

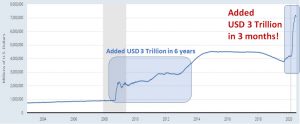

This time the monetary stimulus has been unprecedented and the pace of response has also been extremely fast.

To get a perspective of the speed of the US Fed’s stimulus response sample this – what took three years and seven months in the Great Depression, took one year and six months in 2008, and only one month in the current crisis.

History shows us that, as soon as central banks and policymakers step in to print and spend, there is an immediate upside in equity markets. The stimulus puts a floor on equity declines, kicking off a new rally.

Challenge 3: What about the Experts? Ahem…Ahem…

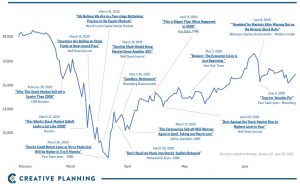

Source: Creative Planning

While there is enough evidence that no one can predict the markets consistently, the above chart is a good reminder of how sometimes even the best ones get it completely wrong.

Challenge 4: How do you get back in?

Let us say, you were right and the market falls as you predicted.

But the real challenge is when do you get back in?

Every time the market falls, your mind naturally tries to extrapolate and expects a further fall as the news flow continues to remain bad. If the fall continues, this strengthens your views and then you start to get overconfident. The market is behaving just like you predicted.

And then something like 23-Mar-2020 happens!

This is the toughest part for someone trying to get out of the market before a fall and get in before a rise.

The market rally of the past few months is an excellent reminder of why it is so difficult to get back in.

Putting all this together…

Phew! While initially, it looked like moving out of equities was a no-brainer decision, as we add other pieces of the puzzle, it seems like moving out of equities may not be the best decision.

So here comes the million-dollar question –

What do we do?

Here is where we think humility and an approach that favors preparation over prediction can be a good way to navigate the current uncertain environment.

Preparing vs Predicting…

Approach 1: Predict for a precise outcome and position portfolio

In this approach the idea is to try and predict every possible factor which can impact the markets over the short run, and take a view on the short term market direction.

If the view is that the markets will go down then sell equities and vice versa!

Simple right.

Let us find out what needs to go into our prediction machine…

What goes in?

- How will the virus spread in the coming months?

- When will a treatment that improves the mortality rate be discovered?

- When will we get a vaccine?

- How will the Global Central Bankers act?

- How will the Global Governments respond?

- Future lockdowns?

What comes out?

Since none of us have clear answers on how the above 6 will evolve, our prediction machine suffers from garbage-in-garbage-out syndrome.

So the simple outcome from the prediction machine is: No one Knows!

Anyone who predicts with certainty as to how the market will perform over the next 6 to 12 months is simply making a…you guessed it right – A GUESS!

So if this ‘PREDICT & POSITION’ is really a game of guessing, it is definitely not an approach you would want to use for managing your hard-earned money?

That leads to our second more ‘saner’ approach!

Approach 2: Prepare and Position for different outcomes

While predicting the short run is not our forte, over the long run the market outcomes are reasonably predictable.

In this approach, instead of trying and positioning to maximize returns for the next 6-12 months, the idea is to extend time frames and position the portfolio for a 5-7 year view (where the ability to predict is a lot better).

But at the same time, we also need to ensure we are able to stick to the plan in the short term without which long term returns are just in paper.

This is where the approach also emphasizes on minimizing regret (vs maximizing returns) by preparing for different short term outcomes.

How do we do this?

In times of uncertainty, it’s best to fall back on two factors which have a strong record in predicting long term outcomes – Valuations + Earnings Growth.

What are Valuations & Earnings Growth telling us?

When it comes to the current rally, eventually, fundamentals will have to catch up. Earnings growth led by economic recovery will be required for the current rally to sustain

- Valuations (except for PE ratio due to depressed earnings) remain close to long term average (measured via MCAP/GDP, Price to Book).

- Earnings growth are at cyclical lows – while near term earnings are anyone’s guess (and most likely will be disappointing) we expect earnings growth to pick up over the next 3-5 years led by low base, low-interest rates, pick up in credit growth, lower corporate taxation, pickup in earnings for corporate lenders, low commodity prices aiding margins.

- Overall, we continue to suggest sticking to your long term equity allocation levels with a 5-7 year view – at the current levels valuations are not high enough to go underweight nor are they low enough to go overweight.

- For example, if at the start of the year you had 50% in Equities and 50% in Debt in line with your long term asset allocation, continue with the same asset allocation. Do not be overweight and make your equity allocation to say 65% or underweight and make it to say 35%.

- That being said, the markets may remain volatile in the near term as earnings growth may be patchy and will continue to be driven by news flows.

Managing regret via preparing for different short term outcomes

Now, to be clear, the point isn’t to assure you the market will go up from here in the next 6-12 months – we can’t make that prediction. The idea is to take a long term view based on valuations and earnings but at the same time also be prepared for different short term outcomes.

When it comes to the short term – the focus is more on positioning the portfolio for minimizing the regret rather than maximizing the returns.

But how?

Think through “the regret of seeing your portfolio go down” by ‘x’ amount if markets decline from here, say by 20%, 30%, 40%.

Similarly, think through “the regret of missing out the gains”, if the markets continue to rally from here, say by another 20%, 30%, 40% in the next 6-12 months.

The key is to strike a balance between – the regret of missing out if markets rally from here vs regret of markets correcting further.

Check if your current asset allocation helps you strike a balance between both the possible regrets.

Once this is done, put in place:

‘What-If-Things-Go-Wrong’ plan for a market decline

- If market levels are at 20% decline from peak then move x% from debt into equities

- If market levels are at 30% decline from peak then move y% from debt into equities

- If market levels are at 40% decline from peak then move z% from debt into equities

This exercise forces you to think through and be prepared for various short term outcomes.

Overall, a long term view (based on valuations and earnings growth) will help you in building a solid asset allocation foundation for the portfolio. The regret minimization framework and what-if-things-go-wrong plan will help you to psychologically handle the short term unpredictability and stick to the long term asset allocation plan.

Summing it up…

While we don’t know what the next few months will bring, history suggests the future is likely to be bright for those who have a plan, stay disciplined, and remain invested.

As boring as it sounds, finally it boils down to a simple common sense approach

- Stick to your original asset allocation – Don’t be overweight or underweight equities

- In the short-run, focus on regret minimization rather than return maximization

- Put in place a ‘What-If-Things-Go-Wrong’ plan