The large-cap active vs passive debate…

What was our earlier view on Active Large Cap Funds (in Dec-19)?

(Blog Link)

High odds of Active Large Cap funds outperforming their Benchmark Nifty 100 TRI in the next 2-3 years (i.e between 2020-23)!

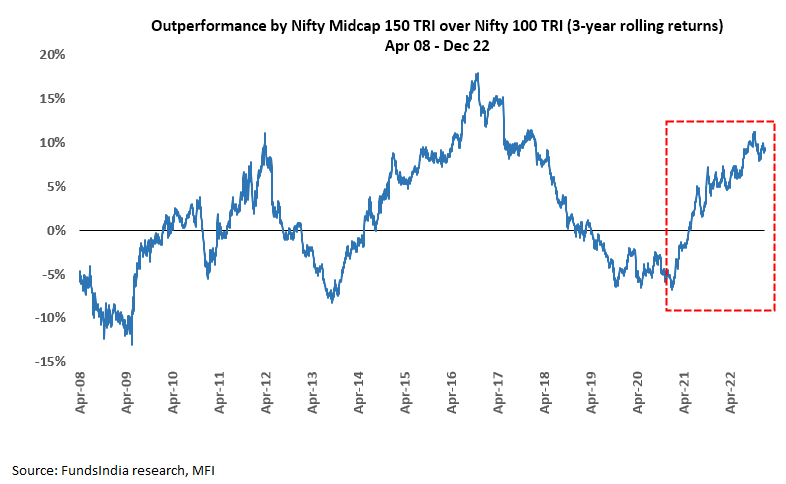

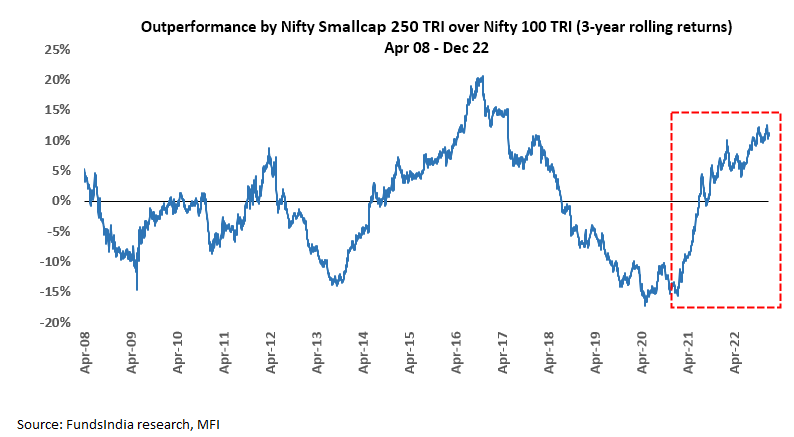

Reason 1: Mid & Small Caps had significantly underperformed Large Caps over the previous 3 years and we expected this to mean revert

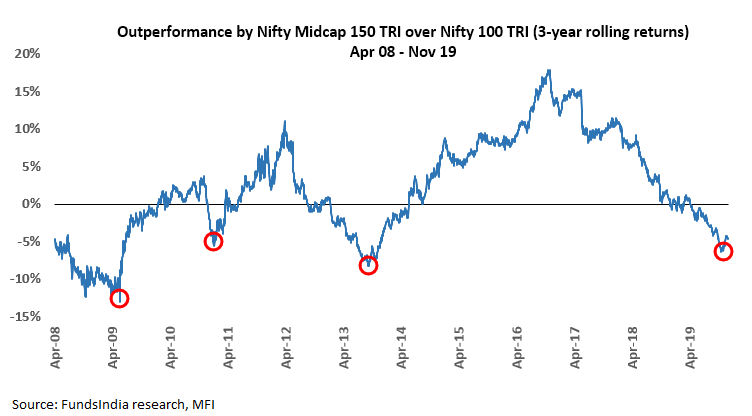

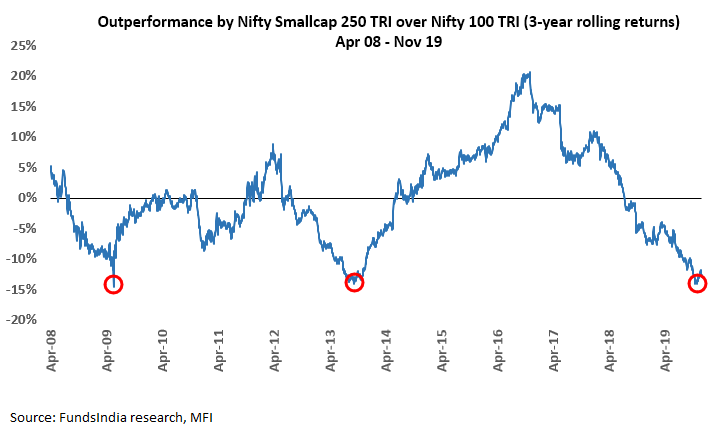

- Active Large Cap funds usually have around 10-20% of Mid & Small Cap exposure. This had a negative impact on the performance of Large Cap funds compared to the pure-play Large Cap indices since the Mid & Small Cap segments underperformed Large Caps in the previous 3 years.

- However, historically Mid/Small Cap vs Large Cap performance tends to be cyclical. We were expecting a trend reversal over the next 3-5 years where mid/small caps outperform large caps.

- We expected Active Large Cap funds to have a positive upside from their Mid & Small Cap exposure.

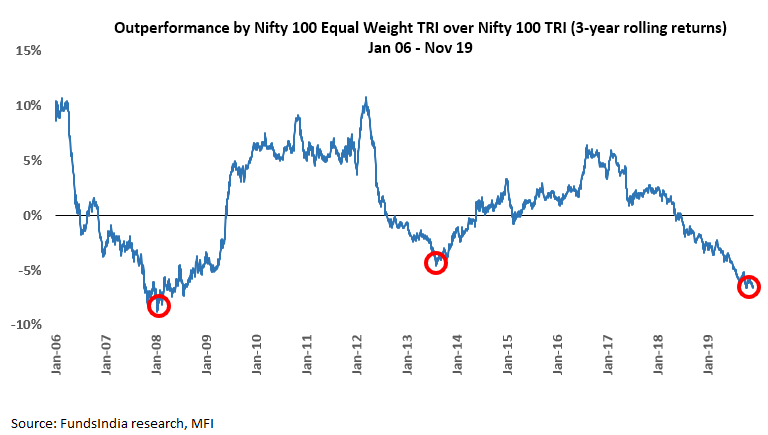

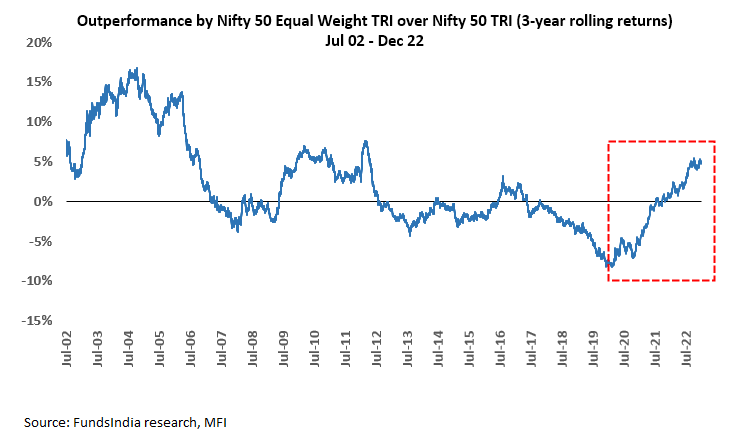

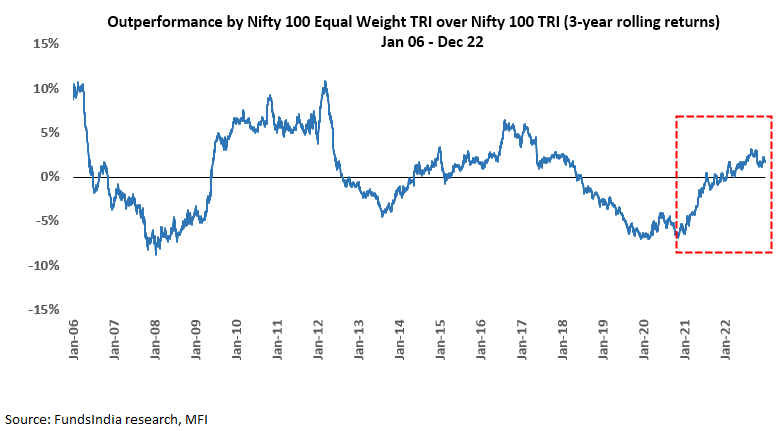

Reason 2: Phase of extreme polarisation between 2017-2019 i.e few top stocks drove the index returns – led to the underperformance of diversified active large-cap funds. We expected this to mean revert.

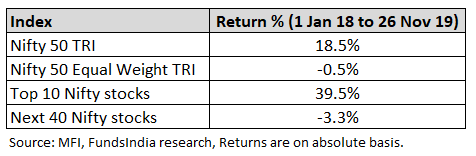

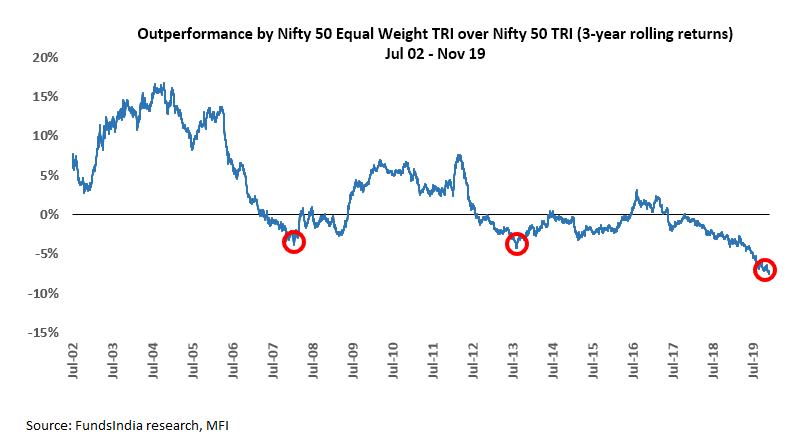

- Polarised markets refer to periods when few top stocks drive a large part of returns. Between 2017-19, Nifty 50 TRI returns saw significant polarisation – top 10 stocks drove a significant part of the returns. This led to the Nifty 50 TRI significantly outperforming the broad-based Nifty 50 Equal Weight TRI.

- Due to the impact of polarisation, diversified Large Cap funds underperformed their benchmarks in the short run.

- However, over the long term, both Nifty 50 TRI and the broad-based Nifty 50 Equal Weight TRI indices had historically provided similar returns.

- We expected this Extreme Polarisation in the Large Cap Index to mean revert and Active Large Cap funds to have a positive upside as the polarization reduces and returns get more broad based.

Did our rationale play out as per our expectations?

Both views have played out as expected.

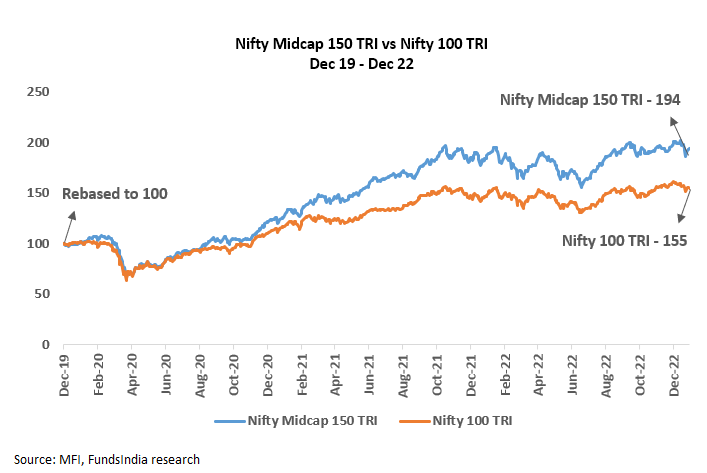

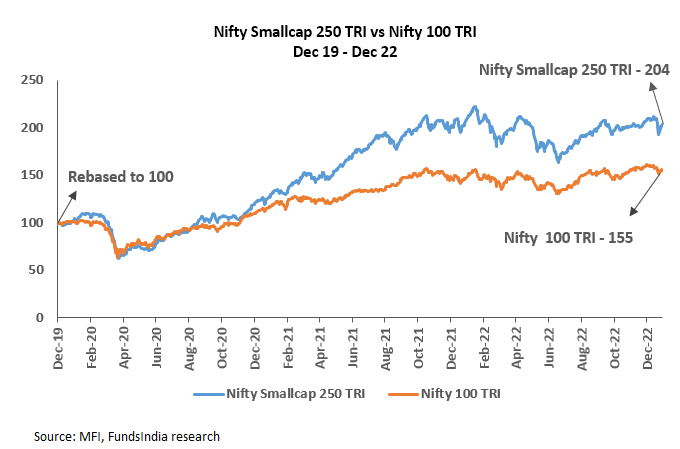

- Mid & Small Caps outperformed Largecaps

Mid Caps started to outperform Large Caps as expected

Small Caps started to outperform Large Caps as expected

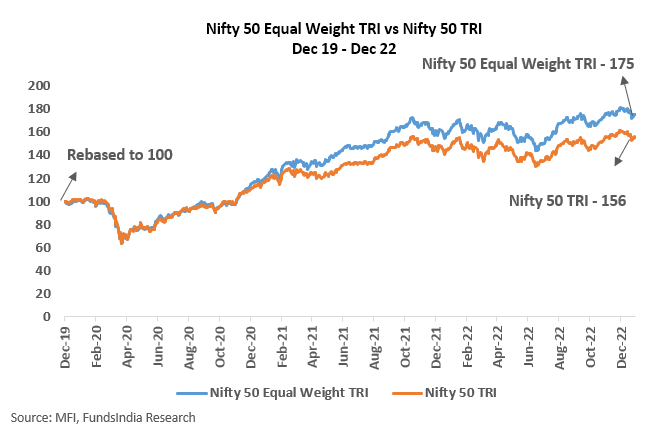

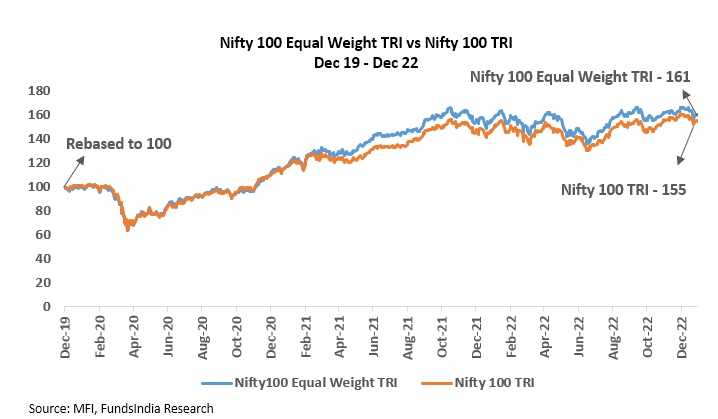

- Polarisation in the top 10 stocks reduced and performance got broad-based

Nifty 50 Equal Weight TRI has outperformed Nifty 50 TRI as expected

Nifty 100 Equal Weight TRI has outperformed Nifty 100 TRI as expected

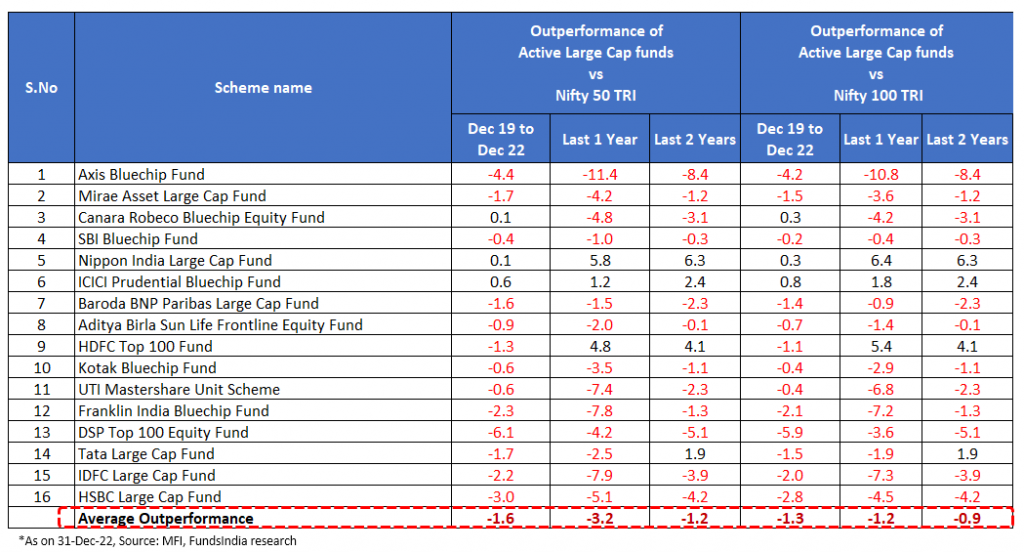

Did this translate into Large Cap Active fund outperformance?

This is where we were surprised. Despite all the above factors turning favorable and the environment becoming conducive, Large Cap Active funds still underperformed Nifty 50 TRI.

While our rationale played out as expected, Active Large Cap funds are still struggling to outperform their Passive peers…

Confession time – we got our call wrong.

But what did we miss?

Two Challenges and the Cruel math of Outperformance

While the environment did turn favorable for Largecap Active funds, we underestimated the high outperformance threshold set by two major challenges.

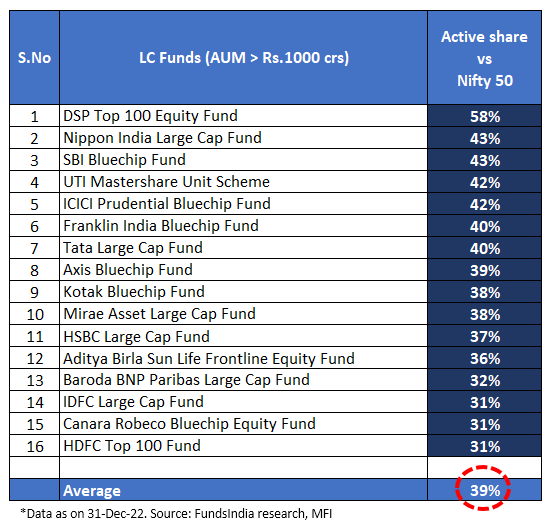

Challenge 1: The Curse of Low Active Share (read as high portfolio overlap with index)

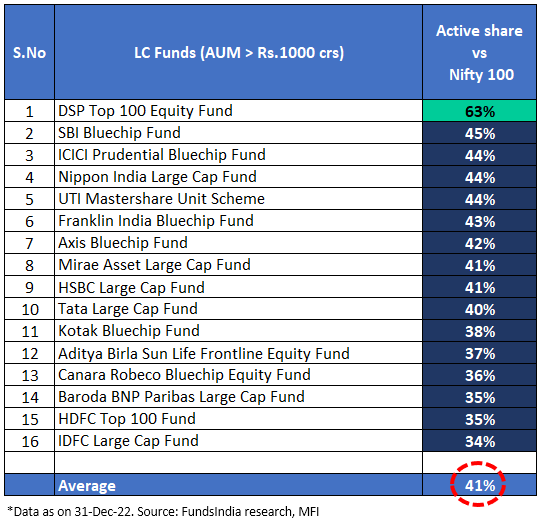

- Active share measures how much a fund’s portfolio differs from its benchmark index. Higher the active share, higher the differentiated portfolio and hence better chances for outperformance

- As seen from the above table, all the funds (AUM > Rs.1000 crs) have a low active share around 40% (barring DSP Top 100 Equity Fund). In other words, ~60% of the portfolio for most Active Large Cap funds are similar to the index.

- This trend of low active share has been exacerbated by the SEBI categorization norms announced in 2018. This has narrowed the universe (at least 80% of the portfolio has to be in the top 100 stocks based on market capitalisation) and reduced the flexibility to increase mid and small-cap exposure in large caps as it is capped at 20% of the portfolio.

- This makes the task difficult for a fund manager as they have to outperform the index with just a small portion (~40%) of the differentiated portfolio.

Challenge 2: High Expense Ratio

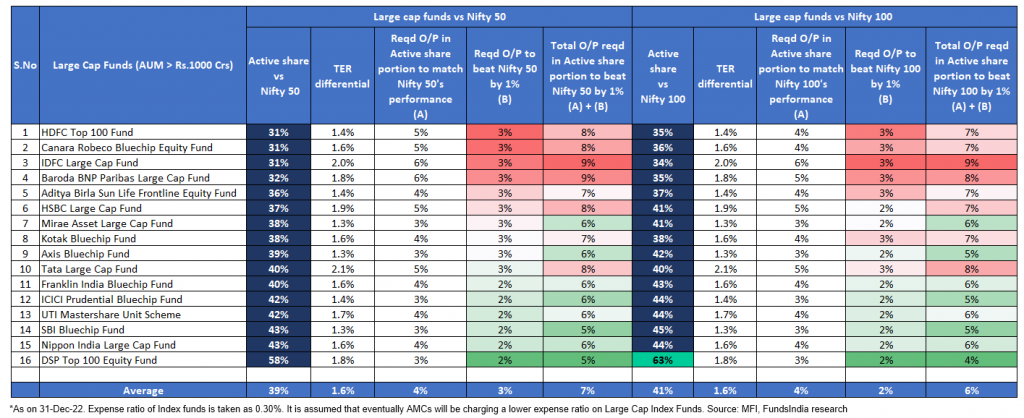

- Active large caps are more expensive than passive funds – Average expense ratio of Active Large cap funds at 1.9% is significantly more expensive compared to passive funds (eg: UTI Nifty 50 Index fund at 0.3%). While some passive funds have higher expense ratios, our assumption is that with increasing competition you will find several funds at 0.3% expense ratio or lesser.

…Leading to the cruel math of outperformance

- As seen from the above table, there is an average difference of 1.6% in expense ratio between actively managed Large Cap funds and Passive Index funds.

- The differentiated portfolio (i.e active share) is also low at ~40%.

- This increases the burden of an active fund manager, as the fund manager must provide an outperformance of around 3-4% every year on the Active share portion just to match the index returns.

- Further, the fund manager must provide an outperformance of around 5-7% every year on the Active share portion to actually beat the index by just 1%!!

Our Current View

Odds are stacked against Active Large Cap Funds – Prefer Passive Large Cap Funds or Active Flexicap Funds

- Relatively high expense ratios and low active share make it extremely difficult for Active Large Cap funds to consistently outperform their passive peers. To put that into context, at the existing active share levels of ~40% and expense ratio differential of 1.6%, a large cap fund manager must provide an outperformance of around 5-7% every year on the Active share portion to actually beat the index by just 1%!!

- While there may be a few active large-cap funds that may still outperform (by using levers of increasing active share, concentrated portfolio, or contrarian approach), it will be behaviorally challenging to stick to these funds as the performance is expected to be cyclical and large outperformance may come in spurts following periods of underperformance.

- Given the above context, we prefer to gradually move out of Active Large Cap funds and instead invest in Passive Large Cap Index funds or Active Large Cap Biased Flexi Cap Funds (60-80% large caps with the flexibility to increase mid/small cap allocation) for participating in the large-cap segment.

What will make us change our view?

- Increase in Active share: If the Active share of Active Large Cap Funds increases above 60%, we’ll revisit our view

- Lowering of Expense ratios: If the Expense ratio gap between Active & Passive Large Cap fund reduces, we’ll revisit our view