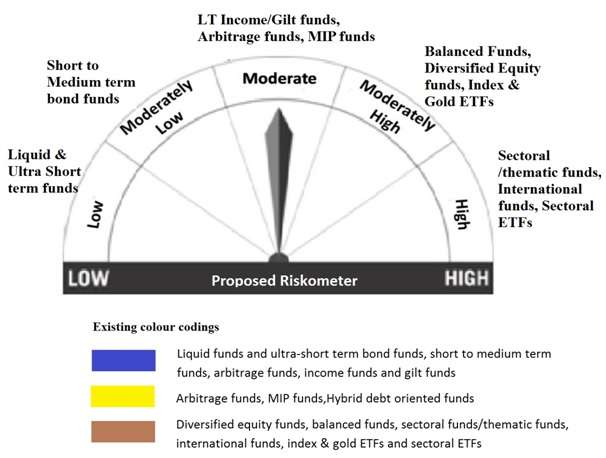

SEBI reviewed the system of product labelling in mutual funds early this month and has proposed to change the existing three-colour risk labelling to a riskometer, which consists of five risk levels. It will look like a car speedometer and indicates the risk level of the scheme and hence the name!

The new riskometer seek to help investors gauge the level of risk in a particular scheme. The new guidelines will come into effect from July 1, 2015.

Existing colour labels are more subjective; not uniformly followed by AMCs and subject to their own interpretation of risk.

For instance, most AMCs position their schemes either in the Blue or Brown label and very few schemes are positioned in yellow label. Some AMCs categorize even an MIP fund with 25% equity exposure as low risk; at par with a liquid fund. But in reality, MIP funds are at least couple of notches riskier and that has been brought out in the Riskometer.

SEBI and AMFI seek to do away with varying practices in labelling products with this new riskometer.

Riskometer certainly provides better clarity and uniform norm to AMCs to position each product in the appropriate risk buckets. To this extent is reduces confusion for investor as well.

However, it is important for you to know that riskometer alone will not help select the right product, it is just a first step to choose a broad fund category fitting your investments goals, time frame and risk appetite. For instance, while the riskometer would place a mid-cap fund and a large-cap fund in the same risk bucket, your ability to take these 2 funds and the proportion they should be allocated would depend on your goal, time frame, perhaps age and risk appetite.

To this extent, you will be better off checking with your advisor about the nature of a fund, when it comes to actual portfolio construction. Else, you would have go through the scheme information document to know the nature of the scheme and also whether it invests currently based on what is stated there.

While the riskometer seeks to simplify fund categorization, your effort to understand a product before you invest in it cannot diminish as a result of this.