Company Overview:

Electronics Mart India Ltd (EMIL) was set up in the year 1990 by Pavan Bajaj and Karan Bajaj. It is the 4th largest consumer durable & electronics retailer in India and the largest player in the Southern region in revenue terms with dominance in the states of Telangana and Andhra Pradesh. With a concentration on major appliances (such as air conditioners, televisions, washing machines, and refrigerators), mobile phones, small appliances, IT, and other products, the company offers a wide variety of goods. It stacks over 6000 stock keeping units (SKUs) across consumer durables and electronics spread across more than 70 brands; both Indian and foreign.

Investment Rationale:

Diversified Portfolio: As of Aug’31, 2022, the company operates and manages 112 stores with a retail business area of 1.12 million sq. ft., located across 36 cities/urban agglomerates. The Company has a long-standing relationship with leading consumer brands which enables them to procure products at competitive rates. EMIL retails a diversified product portfolio of consumer durable items, which include mobiles, large appliances such as air conditioners, refrigerators, and other small appliances. The company retails products of well-known brands such as Sony, LG, Oppo, and Vivo among others. Apart from its generic brand of Bajaj Electronics used to market all products, the company has also created two niche retail brands. It has specialized stores under the name “Kitchen Stories” which cater to kitchen specific-requirements. In addition, there is also a specialized store format called “Audio & Beyond” which is focused on high-end home audio and home automation solutions and products.

Financial Track Record: Electronics Mart India has generated good revenue growth in the last 4 years. The company’s 3 Year revenue CAGR (FY19-22) stands at 38% and PAT CAGR stands at 29%. For FY22, the company reported a 35.8% YoY growth in its revenue from operations at Rs.4349 crs. The company also reported a 76.2% YoY increase in the net profits at Rs.104 crs for the same period. Of course, the net margins at 2.39% may be low, but that is generally the nature of the retail business. Sales of mobiles during FY22 were Rs.1395 crs, the largest contributor to the overall revenue of the company. The mobiles also remained the fastest growing segment, reporting a 22% CAGR over FY19-FY22.

Flexible Business Model: The company operates with a mix of ownership and lease rental models. In order to optimise profitability, operational flexibility, and ensure the perfect store locations (in densely populated neighbourhoods and residential locations), the company has a flexible strategy of owning or leasing the premises according to availability, cost, and other considerations. Out of the total 112 consumer durable and electronic retail stores, 93 retail stores have been taken on lease and 11 retail stores are owned by the company and eight retail stores are partly owned and partly leased.

Key Risks:

Geographical Concentration Risk – The majority of the company stores’ concentration is in Andhra Pradesh and Telangana. It currently plans to expand in other regions too, however such investments may or may not be successful.

Competitive Risk – The traditional organised brick-and-mortar players face stiff competition from e-commerce players and other smaller unorganised players. Although the market is currently dominated by brick-and-mortar players as physical stores enable customers to touch and feel the product they are buying, guidance given by sales representatives also instills confidence in first-time buyers.

Outlook:

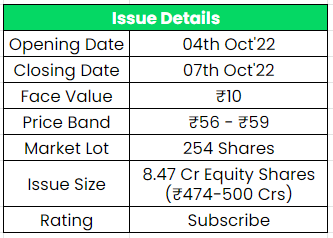

The IPO being entirely a fresh issue would enhance the share capital of the company and hence it would be EPS dilutive for the shareholders. The company has only one listed end-to-end peer named “Aditya Vision” according to its DRHP. The company has stiff competition from Reliance digital (a subsidiary of Reliance retail), Croma, Vijay Sales, Girias, Viveks, etc. If we annualize FY23 earnings and attribute it to the post-IPO fully diluted equity capital base, then the asking price is at a P/E of around 13.95x. Based on FY22 earnings, the P/E stands at 21.85x which is very less compared to its closest peer Aditya vision which is trading at 48.5x P/E for the same period. Hence, we provide a ‘Subscribe’ rating for this IPO.

If you are new to FundsIndia, open your FREE investment account with us and enjoy lifelong research-backed investment guidance.