DSP Value Fund – A differentiated play on ‘Value’ theme with geographical diversification and cash calls in expensive markets

FundsIndia View: Positive

DSP Mutual Fund is launching a ‘value’ oriented equity fund – ‘DSP Value Fund’.

NFO Period: 20-Nov-2020 to 04-Dec-2020

The fund is built based on 3 principles:

- Quality at Reasonable Price: Invest in ‘good’ companies at ‘good’ prices

- Global Diversification: Diversify globally (upto 35% via global value managers) and within India

- Keep cash at the right time: At extreme valuations, the fund will reduce exposure to equities to reduce downside risk

What is Value Investing?

Value investing is one of the oldest, most researched & most fundamental stock picking style. Value Investing primarily operates on the premise: Figure out the value of something, and then pay a lot less for it. This style of stock picking involves picking fundamentally strong companies that appear to be trading for less than their intrinsic or book value. It also means avoiding good companies that are trading at higher valuations.

There are several variations to applying this investment philosophy. Let us find out what is DSP’s version

DSP Framework for Value Investing

- Finding quality companies at a sensible price as opposed to finding mediocre companies for cheap prices

- Holding cash in expensive markets when there is a dearth of value opportunities

- Looking for Value in India and Overseas

- Managing risks through adequate diversification and position sizing

- Combining the strengths of qualitative and quantitative investment approaches

Reasons to consider Value Investing now?

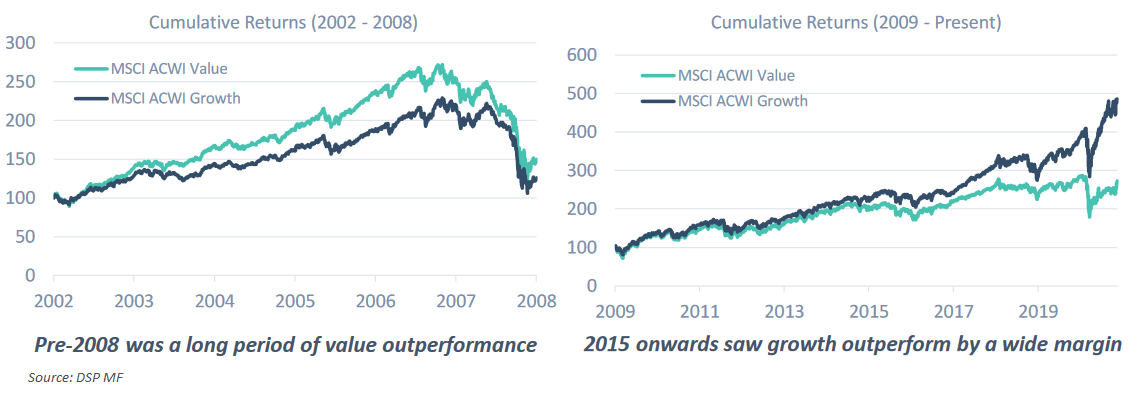

The value style has been underperforming the broader index, both in India and globally, for the past few years. As seen in the below chart, globally MSCI All Country World Value index outperformed MSCI All Country World Growth index between 2002 to 2008 but has been underperforming since 2009.

Given the long phase of underperformance and historical evidence of value outperforming over the long run, we expect mean reversion to happen in the coming years (both globally and domestically) which could result in significant outperformance owing to the expected rerating in value stocks.

Why do we like DSP Value Fund?

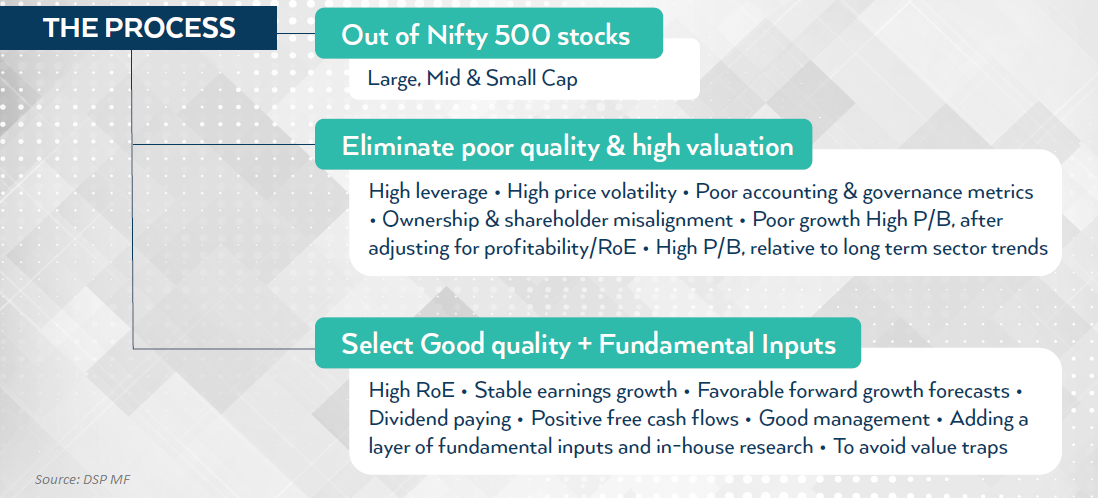

1. Domestic Exposure via rule based approach with qualitative overlay

Investment Process:

The fund uses a rule-based approach initially to select the portfolio. Post this, the fund management team offers a qualitative input to remove any possible value traps. So this combines the best of both worlds in terms of rule-based emotion-free investment process and human judgment to capture the nuances.

2. Global Exposure (0 to 35%) via iconic global value fund managers

The fund has an unique advantage of investing in value stocks across the world by investing upto 35% in overseas companies. Thus providing investors the below benefits

- Diversification from home country risk

- Access to global best-in-class companies and managements

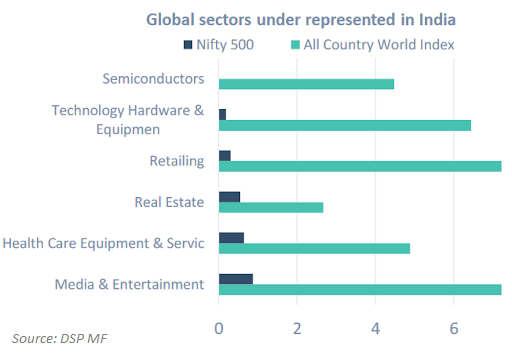

- Access to sectors where opportunities may be limited in India. For example, Semiconductors – a sector that plays a major part of everybody’s day-to-day life has negligible presence in India. The below chart indicates the sectors that are heavily under-represented in the Indian listed space.

The global portfolio of the fund will be invested in some of the best value funds managed by iconic fund managers (such as Berkshire Hathaway, RIT Capital, Marathon Asset Management etc).

- Berkshire Hathaway – Promoted by Warren Buffett who is a strong proponent of the value style of investing and has been successfully following the same for decades

- RIT Capital – one of the UK’s largest investment trusts, with a market capitalisation of around £3 billion

Bottomline – Global diversification into iconic global value fund investors + opportunity to invest in sectors that are under represented in India.

3. Negligible or Nil Exposure to Lenders

Another key differentiator of the fund is – No exposure to lenders (Banks and NBFCs) in its portfolio. The financial sector already forms a large part of almost every diversified fund given the large representation in the index. Thus every investor’s portfolio by default has an average of 25-35% exposure to the financial sector. So broadly from a diversification point of view, global exposure and no exposure to lenders make it a differentiated offering and can reduce the volatility profile of the fund.

4. Keep CASH at the right time

When markets become very expensive and value opportunities are scarce, the fund can reduce equity exposure via cash calls. This can help reduce downside risk as the fund will take cash calls when the markets are expensive and reinvest when the prices turn reasonable again. That being said this can be a double-edged sword and can also be a near term drag on the portfolio returns if market rallies despite higher valuations.

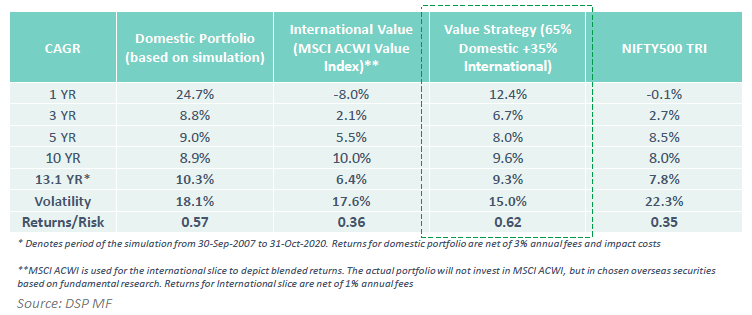

Backtested Performance:

Long term outperformance…

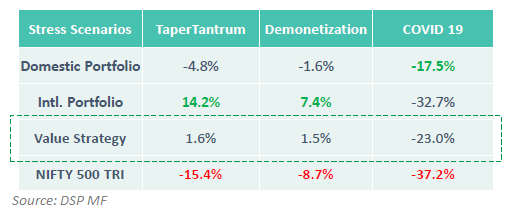

With far lower declines during market falls

What are the key risks?

- Cash Calls: Sometimes, the markets may continue to rally despite higher valuations and cash calls if not used prudently can become a drag on the portfolio return

- Delay in the expected recovery of ‘Value’ investing style: While long term evidence strongly supports value investing, the last few years has been tough for this style both in India and globally. While we expect mean reversion and recovery in performance at some point in time in the future, the exact timing is difficult to predict. This may test your patience.

Summing it up

- DSP Value Fund – A Unique Well Diversified ‘Value’ fund ideal for long term investors with high degree of patience and positioned for lower volatility and smoother investment journey

- The key differentiators that make the fund attractive are

– Buys Quality Companies but not the most expensive i.e. avoids buying cheap bad companies or expensive very good companies

– Domestic portion will be largely managed based on ‘rules’ along with qualitative active management skill to decide final portfolio

– Global diversification – around 1/3rd of the portfolio will have exposure to funds/shares of iconic global value managers such as Berkshire Hathaway (Warren Buffet), RIT Capital etc.

– Cash for the right time – when Indian markets become expensive and value opportunities not easily available, the fund can keep some cash in hand and be prudently cautious to minimize drawdowns

- Backtested Performance indicates long term outperformance and lower downside during falls aided by global diversification and cash calls

Overall, we think DSP Value Fund is a truly differentiated, unique offering relevant to ‘PATIENT’ Indian investors with a 5 year plus time frame and want to participate in ‘value’ investing style both from an Indian and Global context.