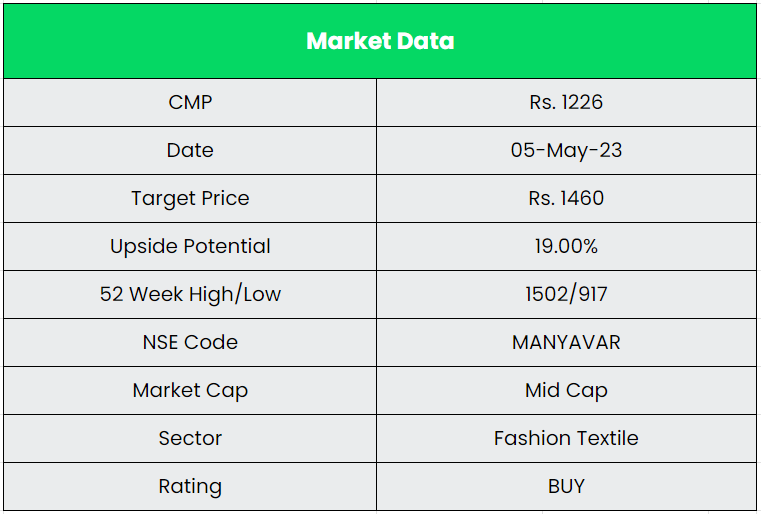

Vedant Fashions Ltd. – Manyavar Ethnic Wear

Headquartered in Kolkata, incorporated in 2002 by Mr. Ravi Modi, Vedant Fashions Ltd. (VFL) offers Indian wedding & celebration wear for men, women & kids. The company focuses on enhancing its leadership position within the organized Indian wedding and celebration wear market through its various brands including its flagship brand Manyavar, Twamev and Manthan within men’s wear and Mohey in the women’s Indian wedding and celebration wear market.

It is the largest company in India in men’s Indian wedding & celebration wear by Revenue, EBITDA & PAT as of FY20 Crisil report. The company has a pan-India presence with a retail footprint of 1.47 mn sq. ft. covering over 245 cities and 649 stores (including international locations such as the US, Canada, UK and the UAE).

Products & Services:

The company is a one stop destination for every occasion with a wide product portfolio under Five brands.

Manyavar – Manyavar is the flagship Mens’ & Kid’s brand in mid-premium Indian wedding & celebration wear price range. It offers Kurtas, Sherwani, Jackets, Indo-western, etc. for Men and Kids.

Mohey – Mohey is an emerging Mid premium brand for Women. It offers sarees, lehengas, Gowns, etc.

Twamev – Twamev is the premium brand for Men. It offers of Kurtas, Sherwani, Jackets, Indo-western, etc. for Men and Kids.

Manthan – Manthan is the value brand for Men. It offers only Kurta.

Mebaz – Mebaz is the mid premium brand offering products for the entire family (Men, Women & Kids) in the South Indian region (AP & Telangana). It includes Kurtas, Sherwani, Jackets, Sarees, Lehengas, etc.

Subsidiaries: As on FY23, the company had only one Subsidiary named Manyavar Creations Private Limited.

Key Rationale:

- Asset Light Business Model – The company follows an Asset light model in both the manufacturing and sales. Most of the company’s manufacturing are carried out by Vendors with whom the company has a long-standing relationship and the rest will be done in-house. The company has around 480+ registered vendors across 45 cities. On the sales part, the company was earlier operated in a business model with a mix of COFO (Company owned Franchise Operated), COCO (Company owned Company Operated) and FOFO (Franchise Owned Franchise Operated). From 2016-17, the company converted its most of the COFO stores into FOFO stores which totally removed the capex and other fixed expense except salary. With the above steps, the company turned out as a successful Asset light model which helps in increasing the profitability.

- Technological Strength – The company is way ahead of its peers in terms of technology. They first study the demand using data analytics and create designs as per the demand unlike others who create the design first. VFL takes the full control of designing, inventory selection and merchandising for its franchisee. The refilling of inventory in the franchisee is also automated by a special algorithm with no human intervention. The algorithm helps decide the store inventory/merchandising based on factors such as locality, taste, and preference in its existing stores and benchmarking with similar locations in new stores. The company also has a special vendor portal to efficiently manage them.

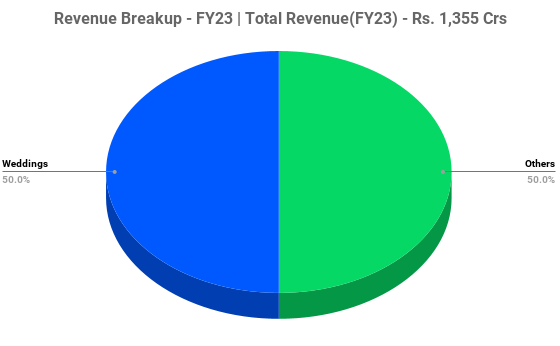

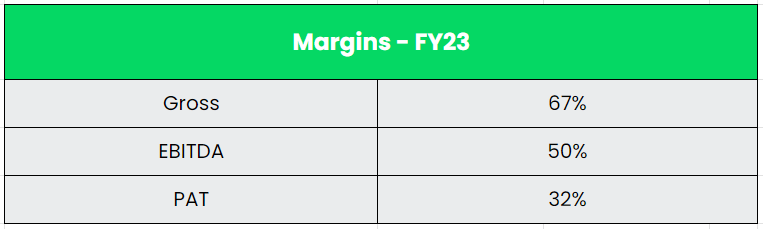

- Q4FY23 – Company expanded its retail footprint presence by adding ~75 k sq. ft. retail area in Q4FY23 and 2.04 lacs sq. ft. retail area in FY23, with total retail presence of 1.47 mn sq. ft. as of Mar’2023. It also expanded its international presence with new stores in London (UK) and Canada in Q4 FY23, and has presence in 4 International Countries (USA, UAE, Canada and UK. The company recorded the SSSG (Same Store Sales Growth) of 14% in Q4FY23 compared to Q4FY22 and 18.1% in FY23 compared to FY22. The revenue from operations of the company has grown at 15% YoY to Rs.342 crs in Q4FY23 and 30% YoY to Rs.1355 crs in FY23. The EBITDA margin for FY23 improved by ~190 bps to 50% from 48% in FY22. The profit after tax of the company had a massive growth of 36% YoY to Rs.429 crs in FY23 from Rs.315 crs in FY22.

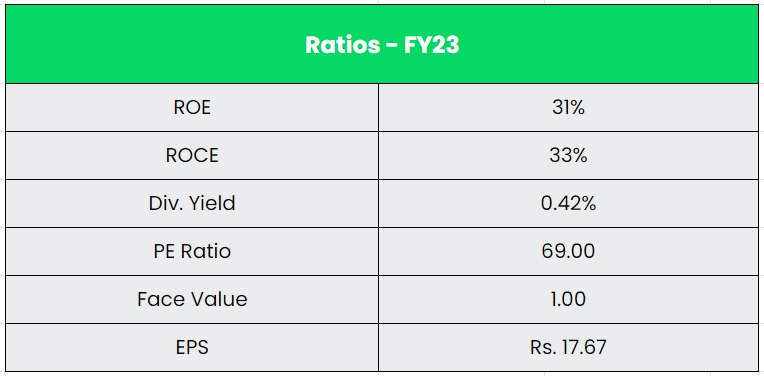

- Financial Performance – The asset light model and the efficiency in the operations are the two reasons which made the company to generate consistent growth in the margins and the earnings. The minimal capex for the company also attributed to a strong cash conversion. The company’s revenue and PAT CAGR stands at 12% and 24% between FY18-23. The operating cashflow of the company have grown at a CAGR of 55% for the same period from Rs.52 crs in FY18 to Rs.470 crs in FY23. The Operating Cashflow to PAT (CFO/PAT) ratio stands at 110% in FY23 which indicates that the company is extremely good at converting accounting profit into cash. The same ratio for the average of last five years (FY19-23) stands at a whopping 122%.

Industry:

India’s textiles sector is one of the oldest industries in the Indian economy, dating back to several centuries. The Indian textile and apparel industry is expected to grow at 10% CAGR from 2019-20 to reach US$ 190 billion by 2025-26. India has a 4% share of the global trade in textiles and apparel. India’s textile and apparel exports (including handicrafts) stood at US$ 44.4 billion in FY22, a 41% increase YoY. The total Indian ethnic wear market as on FY20 stands at Rs.1,800 bn, out of which the celebration and occasion wear segment accounts for Rs.1,020 bn. The total Indian ethnic wear industry is expected to grow at a CAGR of 6% to Rs.2400 bn by FY25. The men’s occasion and celebration wear segment, which stood at Rs.133 bn in FY20, reported 6% CAGR in the last five years. As per CRISIL, the market size of the wedding/celebration wear segment is expected to increase to Rs.1,325-1,375 bn with a 15-17% CAGR over FY22-FY25.

Growth Drivers:

- India is huge market for market for celebration/wedding wear industry with around 9.5-10 million weddings per year.

- Average spending on bride/groom outfits in urban India ranges around Rs.50k-100k. The higher average spending in the outfits & apparels are a result of improved income levels among the consumer. Any further increase in the income levels will lead to increase in discretionary spending.

- The wedding and celebration market is witnessing a shift from the earlier tailor-made wear to the ready-to-wear segment, thereby benefitting branded readymade players which has multiple product varieties.

Competitors: Trent, ABFRL, TCNS Clothing, etc.

Peer Analysis:

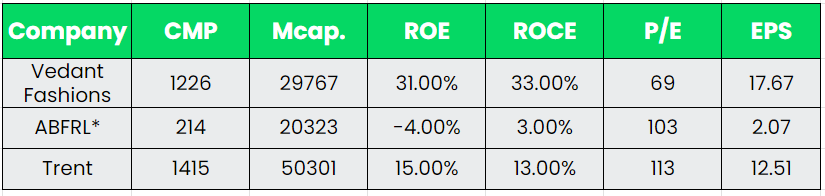

VFL does not have any listed competitor in the full-fledged business of selling Indian Ethnic, wedding and celebration wear space. We thus compare VFL with other listed apparel players. Trent recently entered the ethnic space by launching a brand named ‘Samoh‘ and ABFRL entered the space by acquiring the brand ‘Sabsyachi’. Given the asset-light model, VFL has better margins as well as return ratios, compared to other apparel players.

*We took TTM EPS and FY22 return ratios (ROE & ROCE) for ABFRL

Outlook:

The company has a market share of 10% in the Men’s wedding/celebration wear category which is a highly unorganised space. The branded segment in the same category garners a market share of around 20-25% which shows the huge under penetration and there is a lot of room for the company to grow. The company’s strong design power and decision through data analytics (No discount sales), superior technology for supply chain, Automated vendor system and franchise driven model have supported the growth of its business with robust margins. In the past, the company’s retail footprint has grown at a CAGR of 16%. The management said that their idea is to continue the same level of growth for the next two to three years and are planning to enter to new cities. The company is also working on a digital transformation program. The first phase of the program is in testing which includes improved features in appointments and user interface which is expected to commence by mid Q1FY24. The second phase will refresh the operating platform with improved features related to ordering, return, exchanges, and feedback platform.

Valuation:

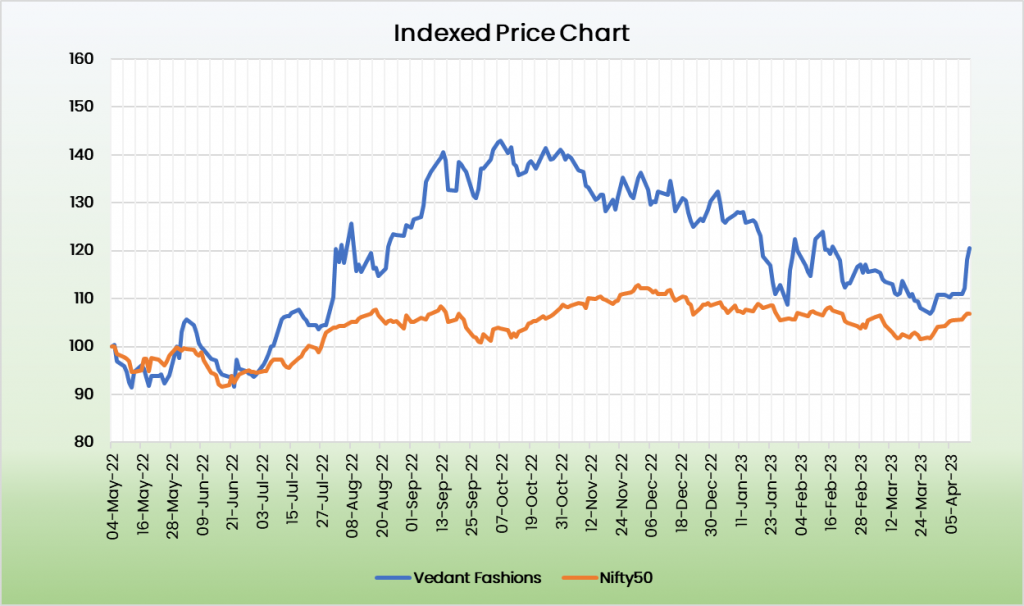

Vedant fashions with its flagship brand ‘Manyavar’ has a long way to grow in the largely unorganized market with less competition in the niche ethnic wear space. The superior margins and healthy return ratios on account of efficient operations demands a premium valuation for the company. We recommend a BUY rating in the stock with the target price (TP) of Rs.1460, 45x FY25E EPS.

Risks:

- Inflationary Risk – Wedding and celebration wear segment comes under discretionary spending and any increase in inflation will affect the demand of the segment.

- Operational Risk – VFL manufactures mostly from third party vendors/jobbers. Cutting, embroidery, stitching and finishing are done by third-party jobbers, according to the standards specified by the company. Any disruption in operations of jobbers/vendors would affect VFL’s performance.

- Competitive Risk – Wedding wear Industry has a mix of both branded and unbranded players. In addition to the competition from local and unorganised players, the company faces competition from big players like Trent, ABFRL, etc.