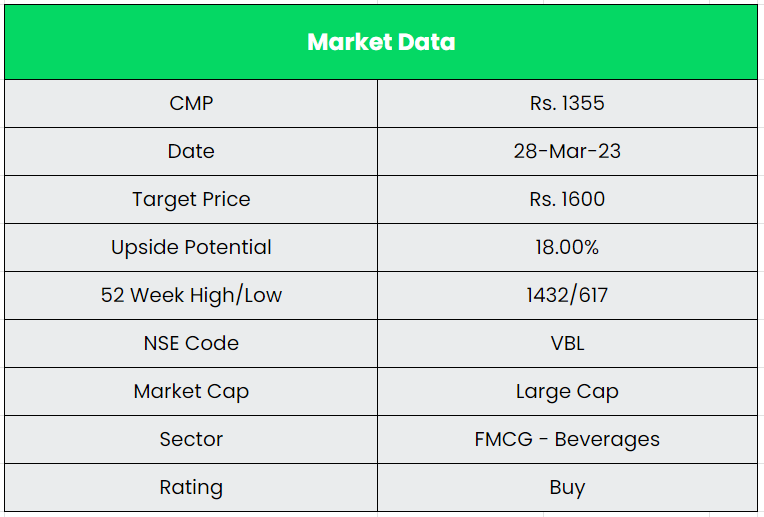

Varun Beverages Limited. – The PepsiCo Bottler

Varun Beverages Ltd (VBL) has been associated with PepsiCo since the 1990s and is a key player in beverage industry and one of the largest franchisees of PepsiCo in the world. As on date, VBL has been granted franchises for various PepsiCo products across 27 States and 7 Union Territories in India. VBL has 31 manufacturing plants in India and 6 manufacturing plants in international geographies (two in Nepal and one each in Sri Lanka, Morocco, Zambia, and Zimbabwe).

VBL’s share of PepsiCo beverages volume sales increased from ~ 26% in Fiscal 2011 to ~90% now. Although, India is VBL’s largest market, it has also been granted the franchise for various PepsiCo products for the territories of Nepal, Sri Lanka, Morocco, Zambia, and Zimbabwe. The company has 110+ depots, 2,400+ primary distributors, 2,500+ owned vehicles and 925,000+ installed visi-coolers. The company is serving 1.4 bn+ consumers through 3 mn+ retail outlets in 6 countries.

Products & Services:

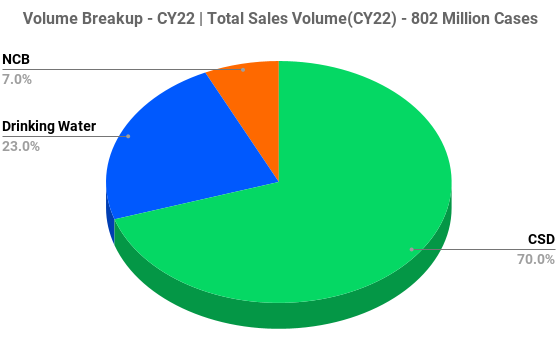

The Company produces and distributes a wide range of carbonated soft drinks (CSDs), as well as a large selection of non-carbonated beverages (NCBs), including packaged drinking water sold under trademarks owned by PepsiCo.

CSD – Pepsi, Diet Pepsi, Seven-Up, Mirinda Orange, Mirinda Lemon, Mountain Dew, 7up, Sting, etc.

NCB – Tropicana Slice, Tropicana Juices (100%, Delight, Essentials), Nimbooz, Slice, as well as packaged drinking water under the brand Aquafina. It also has dairy based beverages under the brand Cream bell.

Subsidiaries: As on CY22, the company has a total of 8 subsidiaries, one step down subsidiary, 1 Associate company and 1 joint venture.

Key Rationale:

- Largest PepsiCo Franchisee – The company has become a near monopoly through its PAN India Presence by controlling ~90% of PepsiCo’s beverage sales volume in India. The remaining sales were generated by either other franchisee or direct operators by PepsiCo. The group continues to derive efficiencies from backward integration of operations – with facilities to manufacture crown corks, polyethylene terephthalate (PET) pre-forms, corrugated boxes, shrink-wrap sheets, plastic cap closures and plastic shells. During Q1CY22, the new backward integration plant in Jammu & Kashmir commenced commercial production with a total of 3 Backward integrated plants.

- New Entrants – The company begins distribution of Lays, Doritos, and Cheetos on 1st January 2023 in Morocco. VBL currently is importing the products, however, as the business stabilises VBL plans to manufacture these products locally in Morocco. During CY22, the company commenced commercial production of Kurkure Puffcorn at the manufacturing plant in Kosi, Uttar Pradesh for PepsiCo. This is the first non-beverage category from VBL to reduce the seasonality of the beverage business. Other than the manufacturing of snacks portfolio, Pepsico does not intend to provide distribution rights of snacks in India to VBL.

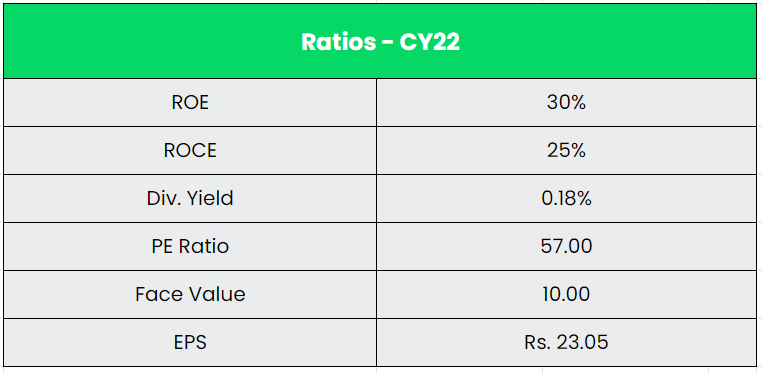

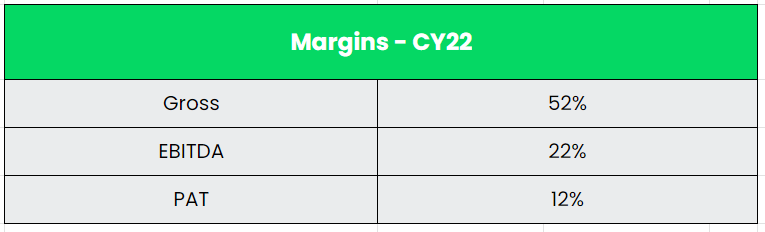

- CY22 – During CY22, the company’s sales volume grew 41% YoY to 802 million cases supported by strong demand in India as well as abroad. This resulted in a strong revenue growth of 49% YoY to Rs.13173 crs for the same period. Realisation (Revenue per unit case) at Rs.164 in CY22, increased by 6% from Rs.155 in CY21 due to price hike in selected SKUs (Stock Keeping Unit) and improvement in few SKUs. The Gross margin of the company in CY22 is at 52.47%, down 180 bps from CY21 due to inflated environment. On the contrary, EBITDA margin improved by ~250 bps to 21.7% in CY22 on account of strong operating leverage. The net profit increased by a whopping 108% YoY to Rs.1550 crs in CY22.

- Financial Performance – The company has generated a massive Revenue and PAT CAGR of 27% and 49% over the period of CY17-22. The company is a huge cash generating machine with an Operating Cashflow CAGR of 24% for CY17-22. The company has generated Rs.1000+ crs of Operating cashflow for the consecutive fourth year. The company’s debt stood at Rs.3695 crs as on CY22 with a debt-to-equity ratio of 0.7x.

Industry:

The food and beverage industry in India is becoming more and more profitable. It makes up around 3% of India’s GDP and nearly 2/3 of the country’s whole retail market. Moreover, India has the potential to become a global hub for Non-Alcoholic beverages category like Carbonated soft drinks, fruit-based beverages, dairy based beverages, etc. According to the report by economic policy think tank ICRIER, “the size of the market was estimated at Rs.671 billion (Rs.67,100 crore) in 2019, which is projected to reach around Rs.1,472.33 billion (Rs.1,47,233 crore) in 2030, in the realistic scenario.” Bottled water and carbonated soft drinks still account for the bulk of the non-alcoholic beverages sector, the report said, adding that the market for juices, energy drinks, tea, milk and coffee-based beverages and organic drinks is expanding. In CY 2022, the domestic soft drinks industry experienced a year of robust growth, following two years of impact from the Covid-19 pandemic in the key summer season.

Growth Drivers:

- Urbanization is playing a significant role in the growth of the industry, as more people move to urban areas and have greater disposable income.

- Over 50% of India’s population falls within the working age group, resulting in an increase in disposable income and a shift in spending habits.

- The increase in electrification in Indian villages along with improved electricity supply will further aid in the penetration of cooling systems in these regions, thereby promoting the expansion of the industry.

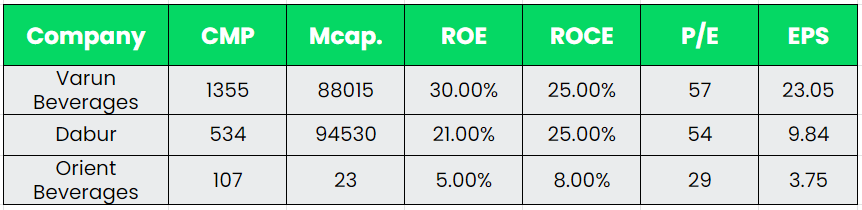

Competitors: Dabur, Orient Beverages, etc.

Peer Analysis:

VBL has no direct listed competitor and the only direct peer is Coca-Cola (Unlisted) which is the First largest company in the soft drinks industry. Coca-Cola and PepsiCo together account for ~90% of total CSD demand in India. For our comparison, we took Dabur (Real fruit Juice) and Orient beverages (Franchisee of Bisleri). Orient is relatively a tiny company which competes with the Aquafina segment of VBL and a small part of the dabur’s revenue from Real brand competes with VBL’s Tropicana.

Outlook:

VBL has grown both organically and inorganically over the years, largely driven by strong demand, new products and increasing geographical coverage. During CY18-CY22, VBL acquired new territories such as Jharkhand, Chhattisgarh, and Bihar; additional areas in Maharashtra, Madhya Pradesh, Karnataka, Gujarat, Kerala, Tamil Nadu and Andhra Pradesh; and five union territories of Daman & Diu, Dadra and Nagar Haveli, Puducherry (except Yanam), Andaman & Nicobar Islands and Lakshadweep. The sales volume of the company has grown at a CAGR of 24% from 279 million cases in CY17 to 802 million cases in CY22. For FY22, Sting contributed ~10% of the overall sales where its distribution reach stands at ~2 mn outlets vs. the company’s overall 3 mn outlets. The Management guided that the company plans to increase the overall reach to 3.5 mn outlets in CY23 and plans to add 40,000-50,000 visi coolers annually going forward. With more hotter summer predictions in 2023 from several weather agencies, the demand for CSD is looking brighter this year. This coupled with the company’s recent acquisitions such as south and west territories, the revenue growth and market share gain of the company is highly inevitable. In the dairy beverage segment, the company restricted itself to the northern region and slowly roll out to PAN India by CY24.

Valuation:

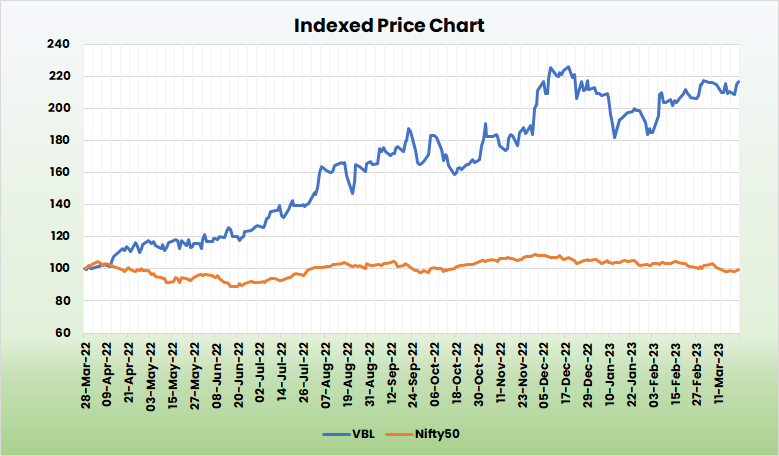

VBL is a strong player in the CSD category with robust fundamentals and consistent performance. The long summer, extensive reach, growing market share and product diversification are the key positive drivers of the company’s growth going forward. We recommend a BUY rating in the stock with the target price (TP) of Rs.1600, 45x CY24E EPS.

Risks:

- Dependency Risk – Entire business is solely dependent on its relationship with PepsiCo and hence any changes in contractual agreement with Pepsi can significantly hamper growth.

- Lifestyle shift – Increasing awareness with respect to sugary products on account of increasing population with diabetes will affect the consumption of sugared drinks like CSD and thus affect the volumes of the company.

- Seasonality Risk – Though VBL has started diversifying its product portfolio from CSD, the seasonality factor from its major revenue contributor remains a key risk for the company.