Presenting FundsIndia’s new Back to Basics series. Crafted for those new to the world of mutual funds and investing, this series will cover the basic facts you need to know. In this Back to Basics article, we answer two key questions: what are mutual funds and why people should invest in them.

These days, you’re constantly bombarded with messages every day asking you to invest your money. Be it your parents, your friends, or ads (like AMFI’s Mutual Funds Sahi Hai series) on TV and online – everyone has one common message for you: You need to start investing. But with so many options available in the market, how does one decide which way to go? Let us help you decide through an example:

Imagine you have a time machine and use it to go back in time to 2007. Your plan is to invest some money then, so you get richer in the present day. So, you invest Rs. 1 lakh each in a fixed deposit (FD), in gold and in equity mutual funds.

10 years later, you decide to withdraw that money. You’ll get Rs. 1.92 lakh from your FD, Rs. 2.85 lakh from gold, and Rs. 3.85 lakh from your mutual fund investments, after taxes*.

Now ask yourself this: if you were to invest today, which option would you prefer: FDs and gold with lower returns and taxation or mutual funds with higher returns and better tax efficiency?

What is a mutual fund?

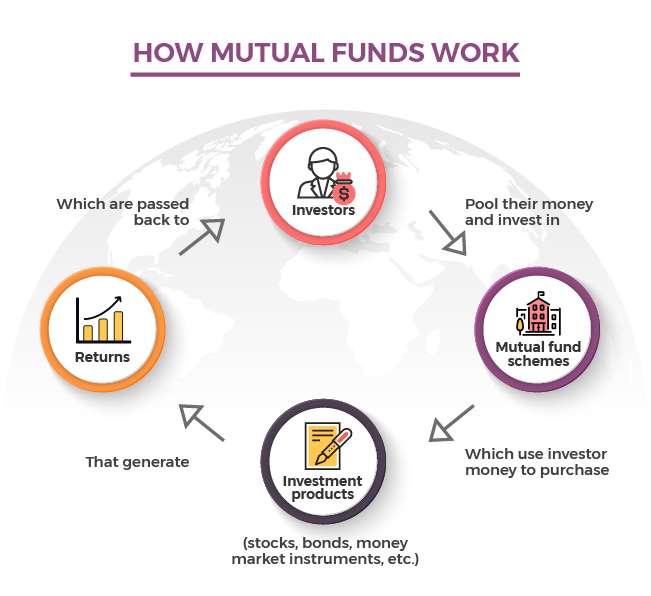

A mutual fund is a product that pools money from many people and invests it in a wide variety of stocks, bonds, and other investments. They are managed by people called ‘fund managers,’ who are experts at managing money and investments.

Mutual funds make it easier for you to build wealth. All you need to do is invest your money in a fund of your choosing, and your fund manager takes care of the rest.

Consider this example: Investing in stocks and bonds on your own is like driving your own vehicle – you have full control, but you need expertise and must pay full attention to the road. Plus, you need to pay for fuel, maintenance, repairs – not to mention you need to buy the car itself – and none of that comes cheap.

Investing in mutual funds (read more about passively managed fixed income), on the other hand, is like taking a shared cab from your favourite cab hailing service. You don’t have full control, but it’s cheaper and you don’t need to worry about driving, figuring out a route or even maintaining the car – your driver (the mutual fund manager) will take care of everything.

So, when you invest in mutual funds, you get to enjoy greater comfort and lesser stress.

Why invest in mutual funds?

As shown in the opening example, if you consider growth alone, mutual funds are one of the best investment products in the market. However, growth is not the only advantage they offer. Here are a few others:

-

Easy to enter: Most mutual funds allow investors to start a Systematic Investment Plan (SIP) for as low as Rs. 1,000 a month. This means you can get started with mutual funds by saving less than Rs. 35 a day. And while Rs. 35 a day seems like a small amount, when invested right, it can help you build a lot of wealth! Of course, there is no upper limit to how much you can invest in mutual funds, nor is there a limit to how much you could earn from mutual funds. So, you can start with as much or as little as you want!

-

Higher returns: As already demonstrated in the example above, mutual funds tend to offer better returns than other investment options. Example: Rs. 10,000 per month invested in mutual funds grows to nearly Rs. 1 crore in 20 years! That’s Rs. 50 lakh more than what you’d get from a recurring deposit**.

-

Personalisation: Unlike other investments where you have little to no flexibility, here you can choose the type of fund you want, the investment duration, amount, and much more – depending on your needs. In short, with mutual funds, you can get an investment plan that’s tailor-made for you.

Need a little more information? Here are 7 reasons why you should invest in mutual funds.

How to start investing in mutual funds

Of course, just knowing a little about mutual funds is not enough. There are several kinds of funds in the market, each suited for a different need, and picking the right mutual fund among them can be difficult if you’re not experienced enough. Plus, you cannot simply Google for a good set of funds as everyone’s investment requirements are different. Advice that suits one person may not suit you.

That’s why you need to enlist the help of a good financial advisor to help you pick the best funds for your needs. At FundsIndia, we offer our investors personalised investment advice through both, a technology-driven robo advisory service – Money Mitr, and dedicated personal advisors.

Both these services are offered free of charge! By making use of them you can easily pick the best funds for you and start investing in minutes.

Want to start investing right away? Click here to get started.

*Mutual fund returns are based on average historical returns of equity funds recommended by FundsIndia for a 10-year period ending March 15, 2017 (these funds delivered an average annualised return of 14.5%). FD returns calculated using 2007’s 10-year FD rate of 8.5% (Source RBI). Returns have been shown post-tax assuming a 30% tax-bracket (gold taxed at 20% with indexation).

** Mutual fund returns assumed at 12% per annum. RD returns calculated using 10-year TDR rate of 6.25% from SBI (applicable as of October 2017). At the end of 20 years, MF investment value = Rs. 99,91,479, and RD investment value = Rs. 47,84,545. You can use our SIP returns calculator to calculate the final value of investments for different SIP values and tenures.