Value-averaging investment plan (VIP) and Value-averaging transfer plan (VTP)

Value-averaging investment plan is a relatively new method of investing in the equity markets. It can be applied to a wide variety of investment instruments like

stocks, mutual funds etc.

At FundsIndia, we offer this method of investing using the equity mutual funds that are available on our platform. We also offer a variant of this method using

the transfer process as opposed to the investment process.

In this article, we provide a brief overview of these methods, and the process to set one up using the FundsIndia platform.

Value-averaging investment plan

Description

Value-averaging investment plan (VIP) is a method of investing in the market that tries to lower the cost of purchase of units more effectively than a regular systematic investment plan. In this method, the amount of money invested on a monthly basis is flexible and varies within a range of minimum and maximum. In contrast, the amount of money invested using SIP is constant every month.

How does the amount change every month? What is the basis for calculating how much gets invested in the scheme a given month? The answer is that it depends on the performance of the scheme in the previous month. Every VIP is set-up using four values:

1. A initial or a nominal value

2. An expectation of return from the investment

3. A maximum value

4. A minimum value

If the fund performs better than the expected value in the previous month, then the amount invested in the subsequent month would be proportionally LOWER. If the fund performs worse than expected in the previous month, then the amount invested in the subsequent month would be proportioanally HIGHER.

However, the amount invested will not go below the minimum value specified and it will not go above the maximum value specified.

For more details regarding FundsIndia's VIP implementation, please read this article <<link to article>>

Advantages

The advantage of VIP is that it reduces the cost of entry into the market over the long term, and consequently the rate of return on the portfolio will likely be higher than regular SIP. However, please note that since the amount of investment can keep varying, the total amount invested would be different, and consequently the total returns (gain or loss) would be different than the SIP as well.

When to use

VIP is suited for investors who can tolerate investing different sums of money each month. For beginning investors, our advice is to start with SIP, and later, add one or two schemes to the VIP method. This way, an investor can compare the performance and process of the two plans, and decide what is best for them.

How to setup

Setting up a VIP in FundsIndia is pretty simple. At the outset, you would need to first select an equity fund (growth option only) on which you are planning to setup the VIP. Once you know the fund you are going to use for this purpose, please follow these steps:

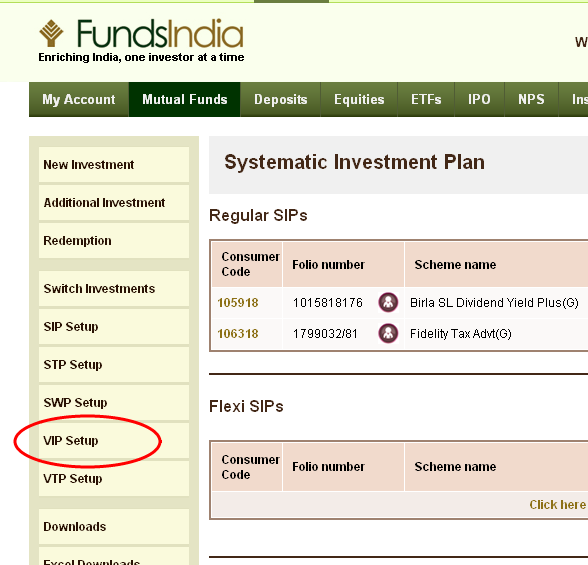

1. Login to your account, and click on 'Mutual funds' from the top bar

2. Select 'VIP setup' from the left menu

3. In the next page, first, you will be asked to select the investor whose name the folio will be on.

4. After that, you can select the number of installments for this VIP - this refers to the number of months the SIP is scheduled to run. Typically investors choose anywhere between 12 months (1 year) to 120 months (10 years). You will also be asked to specify the bank account to use for the debits.

5. Now, you will need to specify the VIP specific parameters. First, you will need to specify the expected annual return from this folio - a value between 15% and 25% would be advisable here.

6. Then you can choose the scheme for this VIP setup.

7. For the scheme, the minimum, and maximum investment amount needs to be specified as well. The monthly investment will be within this range.

8. The next page will ask you to confirm the details of your VIP setup. Please verify the scheme, amounts and the date to confirm.

9. In this page, you can also choose whether you want FundsIndia to send you the ECS mandate form for your signature, or if you would like to send it yourself.

10. If you choose to send the form yourself (faster to process), you can select that option and hit 'Confirm'. Your ECS form will be generated and be made available in the 'Downloads' section of your account.

11. If you choose to request FundsIndia to send the form, we will do so at the end of the business day to your registered address.

12. Once confirmed, you will need to make the initial payment to setup the VIP folio. You will be taken to your netbanking payment gateway to complete the transaction.

13. That's it, the VIP setup in FundsIndia is complete!

Please note that the ECS mandate generated will be for the maximum amount specified above. However, we will only debit the amount required for each VIP installment and not more.

Now, all you would need to do is simply sign the ECS mandate form and send it back to us for registration. You DO NOT require to get any banker signature in the form. We will take care of it. The registration process takes about 4 weeks to complete after we receive the signed mandate form from you. The VIP debits/investments will start immediately thereafter.

A note about VIP calculation: Please note that in most cases, we need to send the monthly debit request to the bank seven days in advance of the actual debit date. Since we need to send the exact amount of investment in this request, the VIP calculation will happen in advance of the actual debit and investment date for the VIP.

Monthly Process

After the VIP is registered, and the schedule commences, there is very little to do for the investor on a monthly basis. We will send an email to you before the date of the monthly debit to let you know the amount of that month's debit. You will need to ensure the availability of that amount in the ECS debit account for the VIP processing to proceed without issues.

Value-averaging transfer plan

Description

Value-averaging transfer plan (VTP) is exactly similar to VIP in terms of the concept of investment. However, the method of investing is different in VTP. Here,

money is not debitted from the bank account on a monthly basis, but it is transferred from a liquid/debt fund to the equity fund for investing.

In this method, an investor would either need to invest a bulk amount in a liquid fund and setup a VTP to the equity fund, or do an SIP in a liquid fund, and

then setup a VTP to the equity fund (by giving sufficient gap between the date of liquid fund SIP, and the date of VIP).

Advantages

The advantage of VTP over VIP is that the date of value-averaging calculation is exactly the same day as the date of investment. In the case of VIP, the

calculation is done ahead of time, and thus might not exactly match the valuation on the date of investment. In the case of VTP, the calculation is done on the

same day as that of the investment.

When to use

Any investor who can either invest a bulk amount in a liquid fund or an investor who can do an SIP of the maximum amount of VIP setup into a liquid fund on a

monthly basis can use the VTP method of investing to their advantage.

How to setup

Setting up VTP is very similar to setting up VIP. However, an investor would first need to make a liquid fund investment in the SAME mutual fund as the equity

fund that they want to value-average into. For example, if the value averaging scheme chosen is DSP Blackrock Top 100 fund, then the investor would first need

to make an investment in and create a folio in DSP Blackrock Liquidity fund.

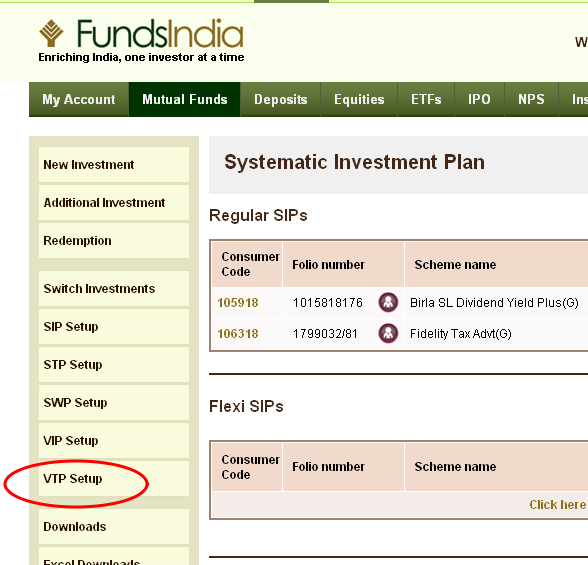

Once this is done, the investor can choose ' VTP Setup' from the 'Mutual funds page' and go ahead with setting up a VTP. The input parameters

are the same as the VIP setup. Also, since this is a switch, no initial payment needs to be made using net banking.

Monthly process

After the VTP is registered, and the schedule commences, there is very little to do for the investor every month other than monitor the investments to ensure

that the investments are made properly. They would also need to ensure that enough funds are available in the source (liquid) fund to take care of subsequent

VTP installments.