Using Portfolios

The FundsIndia platform was created primarily as a mutual fund platform. It is tailored for how people should ideally use their mutual fund investments. The

"Portfolio" feature of FundsIndia is the central pillar of this usability.

A Portfolio at FundsIndia is simply a grouping of different mutual fund holdings. It is similar to the concept of a 'Folder' or 'Directory' in a computer. Just

like a computer folder can have different types of files from different sources, a FundsIndia portfolio can have different types of mutual fund holdings from

different AMCs. The way these portfolios can be used is entirely upto the investor.

This feature is a very simple concept, but can be used very powerfully. Let us look at what it is and how to effectively use it.

Goal oriented investing

Typically, when people invest in mutual funds using non-online mode - using paper forms and cheques, their folios in different mutual funds are all over the

place. Usually, people either maintain computer files (spreadsheets) to track what is where, or more often, they use a big file folder to keep all their

statements together in one place.

Such an organization of their holdings does not really serve the purpose of long term investments well. Long-term investments are often made with a goal and a

time-frame in mind. Like 'I need this investment to mature in 10 years with a certain amount so that I can use it for a specific expense, like a child's higher

studies, or to buy a house'. Having a loose collection of physical statements makes it hard to keep track of the folios, much less keep track of their current

values with respect to the goal of the investment.

FundsIndia's online system easily solves one aspect of this problem. No longer does one need to maintain physical copies of statements. All their holdings are

available in one place - in their online FundsIndia account. Thanks to the family account consolidation, investors can get a quick snapshot of all their family

investments in a single place.

However, this still does not solve the issue of tracking investments made from a goal-oriented perspective. If an investor has a set of holdings that he or she

is doing an SIP on to meet a financial goal, how can this be tracked effectively?

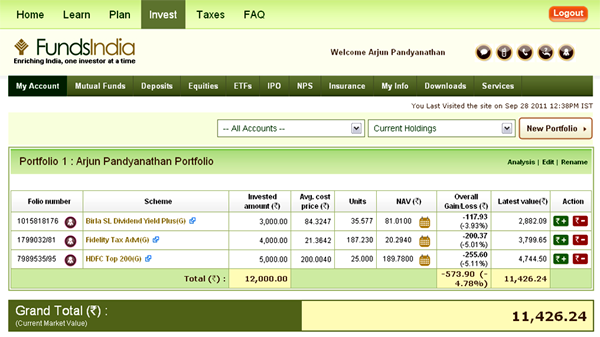

Here is where the concept of Portfolio comes in handy. At FundsIndia, you can group your various schemes/holdings into what we call 'Portfolios'. An investor

can create an empty portfolio at any time, and move some of their investments there, and start tracking its value separately. One can also set a monetary goal

and a time frame for a portfolio, and, at the click of a button, see where the portfolio is currently with respect to the goal (by clicking on the 'Analysis'

link on the top of the portfolio table - please see image).

Other ways to use portfolio

Different investors use the portfolio concept differently. We have observed that some investors use it for the above mentioned goal-oriented investing purpose,

but that is not the only way. Some people use it to separate their investments by their holding profile. For example, keep all the investments made in the name

of a husband in one portfolio, and those of the wife in a separte portfolio.

Some people use it to separate the investments by asset type - all the liquid funds in one portfolio, all tax saving funds in another portfolio etc.

Some people use it to separate by type of investments - all short term investments in one portfolio, all long term, retirement investments in another portfolio.

This would also help them separate the risk levels of each portfolio differently and invest accordingly.

And, there are those that use a mix-and-match approach. Some of the portfolios are goal-oriented, some are investment type oriented, and some are based on who

is investing.

In summary, this simple feature allows the investor to manage a large number of mutual fund investments in an effective, efficient manner without cluttering

their 'My Account' page, and also increase their ability to make smart investment decisions.