With the tax-return filing season just a few months away, check out the tax saving ELSS funds for reducing your tax outgo.

You can shortlist one or two funds from fund houses of established pedigree based on their long-run performance track record and a belief in their investment strategy.

Here we review two tax saving ELSS funds- Mirae Asset Tax Saver Fund and Axis Long Term Equity Fund.

1. Mirae Asset Tax Saver Fund – A Consistent Performer

Why?

- Fund manager with a long track record – Over 24 years of market experience (12 years as a fund manager)

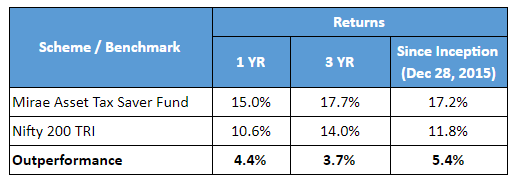

- Consistent performance – 5% CAGR outperformance over the Nifty 200 TRI since 28 Dec 2015

- Investment style – Growth at Reasonable Price

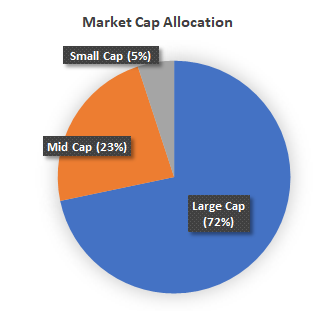

- Multicap portfolio with a large cap bias – 71% portfolio in large caps

- Well-diversified portfolio – Total 56 stocks

- Top 10 stocks – 48% of the portfolio

Snapshot

- Fund Manager – Neelesh Surana, CIO of Mirae Asset

- Fund Launch – 28 Dec 2015 (4-year track record)

- AUM – Rs. 2,671 Crores

- Market Cap Allocation – 71% Large cap / 23% Midcap / 5% Smallcap

- 1yr / 3yr Returns (CAGR) – 15.0% / 17.7%

Experienced Fund manager with a proven track record

Mirae Asset Tax Saver fund is managed by Neelesh Surana (Chief Investment Officer) who also manages other flagship schemes such as Mirae Asset Large Cap Fund and Mirae Asset Emerging Bluechip Fund.

Performance Snapshot:

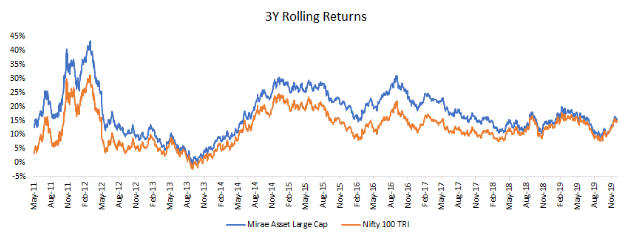

While 4 years is a short time to evaluate the consistency of performance of an equity fund, we can take a look at another similar fund, Mirae Asset Large Cap Fund that Neelesh Surana has been managing since Apr-2008.

There is a 77% portfolio overlap between Mirae Asset Tax Saver and Mirae Asset Large Cap Fund, and hence the latter can be considered a good proxy for understanding the potential of Mirae Asset Tax Saver.

On a 3-year rolling return basis, the Mirae Asset Large Cap Fund has outperformed the Nifty 100 TRI 100% of the time with an average outperformance of ~5.3%.

Also since its inception in April 2008, Mirae Asset Large Cap Fund has delivered outperformance of ~5.3% (15.6% CAGR vs 10.3% Nifty 100) based on point-to-point returns.

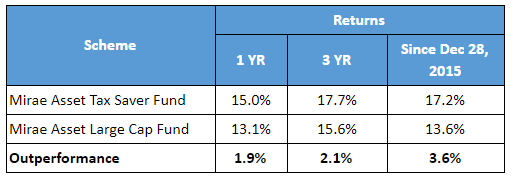

Mirae Asset Tax Saver, given its small size and no market cap restrictions also has the advantage of taking higher exposure to mid/small caps if required. Currently, this tax saving ELSS fund has around 30% in mid and small caps (vs 15% in Mirae Asset Large Cap fund). This gives the fund a possible potential for higher outperformance.

The performance data also alludes to this as shown in the below table

About the fund manager

Neelesh Surana – Chief Investment Officer

He joined Mirae Asset in 2008. In his capacity as CIO, Neelesh spearheads the research and fund management functions. An engineering graduate with an MBA in Finance, Neelesh has over 24 years of experience in equity research and portfolio management.

Investment Approach

The investment approach is centred around participating in high-quality businesses up to a reasonable price and holding the same over an extended period of time.

The scheme tries to identify companies which have a sustainable competitive advantage – stocks which have strong pricing power and are sector leaders.

Portfolio Positioning

Overweight: Pharma (6.5%), Textiles (3.7%)

Underweight: Financials (36.6%), Energy (11.2%), Telecom (0%)

Multicap portfolio with large cap bias

Well Diversified portfolio

- Total Number of Stocks – 56

- Top 10 – contribute to ~48% of the portfolio

- Top 20 – contribute to ~71% of the portfolio

- Top 3 Sectors – Financials, Energy and FMCG. They contribute to ~58% of the portfolio

2. Axis Long Term Equity Fund – Focused fund with a Quality bias

Why?

- Positioned to play the ‘Quality’ style of investing – High portfolio ROCE at ~20%

- Fund manager with long term track record – 17 years of equity experience (11.5 years as a fund manager)

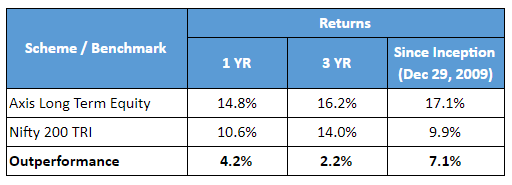

- Consistent performer – 7.1% CAGR outperformance over the Nifty 200 TRI since 29 Dec 2009

- Investment style – Quality + Growth

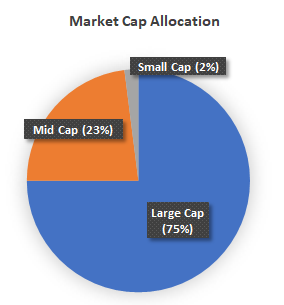

- Multicap portfolio with large cap bias – 75% in large caps

- Concentrated portfolio with 30-35 stocks

- Buy and Hold strategy – ~75% of the current portfolio of stocks has been held for more than 5 years

Snapshot

- Fund Manager – Jinesh Gopani, Head (Equity), Axis Mutual Fund

- Fund Launch – 29 Dec 2009 (10-year track record)

- AUM – INR 21,492 Crores

- Market Cap Allocation – 75% Large cap / 23% Midcap / 2% Smallcap

- 1yr / 3yr Returns (CAGR) – 14.8% / 16.2%

An experienced Fund manager with a proven track record

Jinesh Gopani, Head – Equity of Axis Mutual Fund, has been managing this tax saving ELSS fund for nearly 9 years since Apr-11. As head of the equity investment division, he also manages other key funds like Axis Focused 25 and Axis Growth Opportunities.

Performance snapshot

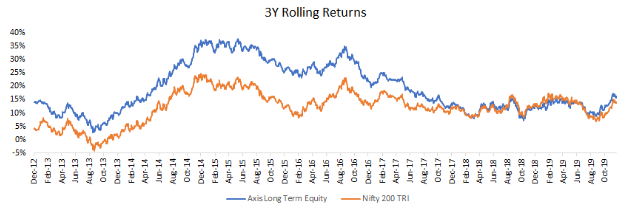

On a 3-year rolling return basis, Axis Long Term Equity Fund has outperformed the Nifty 200 TRI 86% of the time with an average outperformance of ~7.0%.

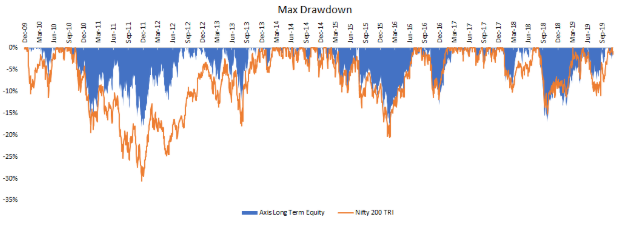

As seen above, the fund has fallen relatively lower than the index during periods of market declines, indicating the high-quality nature of the portfolio.

About the fund manager

Jinesh Gopani – Head (Equity)

He joined Axis Mutual Fund in 2009 as Senior Fund Manager. In 2016 he was promoted as Head – Equity, responsible for the entire equity investment division of Axis Mutual Fund. Jinesh, a post-graduate with MBA in Finance, has over 17 years of experience in equity research and portfolio management.

Investment Approach

The fund follows the Quality style of investing – investing in high-quality growth companies. The fund takes a very focused approach of investing in 30-35 stocks.

The fund manager’s expertise in picking high-quality businesses with relatively high growth potential can be seen from the proven track record of more than 10 years.

The fund also follows a buy and hold strategy with low portfolio churn. This is evident from the fact that the fund’s Oct-19 portfolio retains 75% of the portfolio stocks it held 5 years back (Oct-14).

Portfolio Positioning

Overweight: Financials (41.0%), Consumer Goods (16.8%), IT (13.4%), Automobile (9.4%)

Underweight: Energy (3.4%), Pharma (1.4%), Construction (1.2%), Cement (0%), Metals (0%), Telecom (0%)

Multicap portfolio with large cap bias

Concentrated Portfolio

- Total Number of Stocks – 32

- Top 10 – contribute to ~66% of the portfolio

- Top 20 – contribute to ~91% of the portfolio

- Top 3 Sectors – Financials, Services and Automobile. They contribute to ~63% of the portfolio