Unless you are living under a rock, by now, your whatsapp and social media feeds would have flooded you with the latest SEBI announcement on restructuring multi-cap mutual funds. While social media has gone berserk trying to analyze the impact, here is our humble take on the new move.

The Backdrop

What happened?

SEBI on 11-Sep-2020, came out with a new circular to restructure multi-cap funds. As per the circular – multi-cap funds need to have a minimum 25% in small-cap, 25% in mid-cap and 25% in large-cap by Jan-2021. The remaining 25% can be as per the fund manager’s choice.

What’s the big deal?

Earlier, for multi-cap funds there was no SEBI mandated restriction in terms of percentage allocation to large-cap, mid-cap, and small-cap (Note: Top 100 stocks as per market capitalisation are large-cap, 101 to 250 ranked stocks are mid-cap, the rest are small-cap).

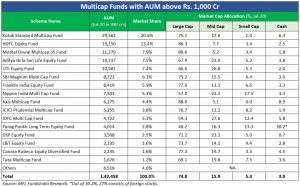

Most multi-cap funds have around 70-80% in large caps and 10-20% in midcaps and 5-10% allocation in small caps as seen below.

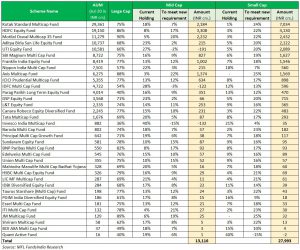

So going forward, to adhere to the new rules, multi-cap funds will have to significantly increase their exposure to small-cap stocks to bring it to a minimum of 25% allocation. In case of mid-caps the increase required is not that dramatic as in the case of small-caps.

Based on data ending Jul-2020, below is the approximate excess amount that needs to be parked in small-caps and mid-caps.

A staggering ~INR 28,000 crs worth of small-cap stocks needs to be bought in the next 5 months. In mid caps, it is far lower at ~INR 13,000 crs.

Now comes the most important question:

How does this impact your portfolio and what should you do?

As we discussed in our earlier post here, at FundsIndia we use a ‘Thinking Fast and Thinking Slow Approach’ to make decisions. Let us see how this approach, as always, helps us this time around…

Initially, when we read the SEBI announcement on Friday, our initial thoughts went like this…

THINKING FAST:

Huge inflows into the small-cap segment:

The data clearly shows that there is going to be a large inflow of money (~INR 28,000 crs) into the small-cap segment.

To put that in context, the AUM of the entire small-cap mutual fund category adds up to around INR 52,223 crs. Small-cap funds don’t invest 100% into small caps. They have roughly 71% exposure to small-caps i.e., around INR 36,961 crs (remaining in mid and large-caps)

The new expected inflows over the next 5 months is a whopping 76% of the total small cap exposure in small cap funds.

Thinking Fast Conclusion:

- Rally expected in mid and small-cap stocks. Hurray! Let me go and load my portfolio with small-cap funds/stocks immediately.

- Large sized multi-cap Funds will find it difficult to take exposure to small caps in such a short span of time leading to high impact costs – reduce exposure to large sized multi-cap funds.

Hang on, let us also THINK SLOW!

THINKING SLOW:

Assumption:

The common consensus is that multi-cap fund managers will have to sell off large-cap stocks and buy small-cap stocks to meet the regulatory requirement.

Thinking Slow approach helps us take a pause and ask the next question –

Will the large inflows to small-caps really happen?

We think this is not a given as the assumption that all the current multi-cap funds will remain as multi-cap funds may be tested. In our view, Asset Management Companies with large sized multi-cap funds may end up repositioning the current multi-cap funds via the below options –

1. Asset Management Companies can reposition/merge/swap the multi-cap schemes into other categories –

- Shifting to a new category that has lower restrictions:

– Many fund houses can shift their multi-cap funds to categories like Large & Mid-cap or Value or Thematic (under the guise of ESG tag).

- Swap with another scheme in a different category:

– Many fund houses can swap their multi-cap funds with lower sized funds in categories like Large & Mid-cap or Value/Contrarian.

- Merging with another scheme in a different category:

– They can also merge with their other scheme under Large cap or Value/Contrarian or Large and mid-cap category.

If the large multi-cap funds decide to take the above route, it could drastically lower the inflow expectations into the small-cap segment from the current INR 28,000 crs.

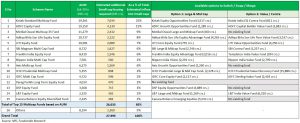

In the below table, you can see the different options available for various funds to reposition to a different category.

Further, the large 5 funds account for INR 17,800 crs or 64% of the expected inflows into small-caps and the large 10 funds account for INR 24,000 crs or ~85% of inflows. If a few of these funds decide to recategorize, this can completely change all the assumptions on inflow numbers.

2. SEBI can relax the timelines

- SEBI may also extend timelines to ensure smoother transition – this will imply the flows get spread out over a longer time frame.

- AMFI is expected to make its case to SEBI as no fund would like to do anything that could hurt the interests of the existing investors. If there is merit in their arguments, SEBI could consider making the necessary adjustments. Going by SEBI’s past history, we would assign this a low probability.

Once you take all the above possibilities into account, the expectation on the actual inflows from multi-cap funds into the small-cap segment may get tempered to a large extent.

So while there is always a possibility of near term rally in the small-cap segment led by inflow hopes, as we explained above, if the actual inflows are much lower than expected, the entire rally may fizzle out quickly (if not supported by fundamentals).

Our Two Cents:

When it comes to your multi-cap funds – the course of action to be taken can be summed up as: “WAIT TILL CLARITY!”

What about small-cap exposure? Should you increase them?

As always our advice remains boringly consistent – Stick to your original small & mid-cap allocation percentages decided as per your long term plan. If your long term allocations based on your risk profile says no allocation to small-caps – then it continues to be a “no”. If it was 10% of equity allocation then it continues to be 10%. You get the drift.

But that being said at the end of the day we are all humans and behavioral science proves that we all have the inherent temptation to fall for narratives and the lottery effect. The lottery effect implies that we are often willing to accept a high probability of poor returns for a small chance of earning large returns.

So if you are tempted to test the new narrative in small caps, this is nothing to worry about. It simply means you are human!

But before you go and overdo this temptation, here is how you can handle this:

Create a separate account and name it “Play Money”. This bucket will be used as an emotional release valve whenever you are tempted to go into a new hot theme or market grapevine. Don’t allocate more than 5-10% to this bucket.

Within the context of this bucket, you can increase your small-cap allocation if you want to try your luck.

Thus while your long term plan remains broadly unchanged, this will also create some excitement and bragging rights for you, if in case the small caps happen to move in the near term. If it doesn’t work out, you still have 90% of your portfolio sticking to the original long term plan limiting your damages.

Summing It Up:

Key Takeaways

- Asset Management Companies have a lot of options such as 1) Shifting to a new category, 2) Merging with another category scheme, 3) Swapping funds across categories, 4) Asking SEBI for timeline extension etc.

- In our view, the actual inflows into small caps may be much lower than consensus expectation (~INR 28,000 crs).

- A near term rally cannot be ruled out in the small-cap segment given the expectation of higher flows – but how long it will last will finally depend on whether the flows really come through and whether long term fundamentals support underlying valuations.

Action Points

- Do not take any immediate decision (exit/reduce/switch) on your multi-cap funds – it is better to WAIT FOR MORE CLARITY on how each fund house is planning to handle this transition and then decide on a case by case basis.

- Tempting as it is to increase the small-cap allocation, our suggestion is to stick to the % allocation decided as per your long term plan (if your long term allocations based on your risk profile says no allocation to small caps – then it continues to be a “no”).

- If the temptation is too high, create a “Play Money” bucket at 5-10% of your equity portfolio and limit your adventures to this bucket.