What It Is

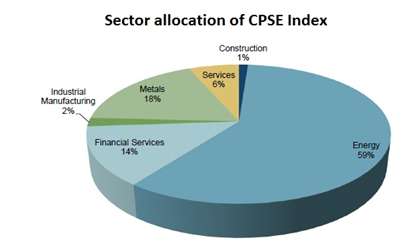

An Exchange Traded Fund (ETF) that has a basket of 10 public sector stocks that will track the CPSE Index.

This index, which will be used to facilitate the Government of India’s initiative to disinvest some of its stake in large public sector companies, currently has a basket of large stocks that are low on valuations as the sectors in which they operate – power, oil and gas, and capital goods are out of favour.

What You Get

• A basket of large public sector companies that are high on dividend yield and low on valuations, when compared with the market. Please see the table above to see the difference in valuations of the CPSE index with the rest of the market.

• Discount of 5% on the “Reference Market Price” of the shares in the index shall be offered to all investors during the NFO.

• The ETF is eligible for tax benefits under the Rajiv Gandhi Equity Savings Scheme 2013, if you are a first time investor in shares by opening a new demat account, or have not used your demat to buy any shares/securities.

• Get Loyalty Units – One Loyalty Unit will be allocated for every 15 units held by retail investors continuously from the Allotment Date to the Loyalty Unit Record Date, which will be 1 year from the NFO allotment date.

NFO Pricing

The price allotted to you will be the average (volume weighted average price) price of each of the stocks traded in the exchange during the NFO period, that is March 19-21. A discount of 5% will be applied on each of these to give you the final allotment price of the ETF.

You can invest a minimum of Rs. 5000 and in multiples of Re 1 thereafter.

Suitability

• If you are looking to invest in shares of large public sector companies at a discount to market price.

• If you are looking for exposure to cyclical themes such as power, and oil and gas, that may be beneficiaries of regulatory changes and economic recovery.

• If you are looking for high dividend yield companies – the dividend yield of the CPSE Index is at present 3.77% as against 1.49% for the Nifty basket.

• If you are looking for tax benefits under RGESS.

The NFO opens on March 19 and closes on March 21. You can click here to start investing.

For more information on the product, please click here.

Investing in NFO is made simple with FundsIndia. Open a free FundsIndia account in less than 20 minutes for NFO investing.

there is nothing attractive to an investor herein.the only beneficiery is the govt.govt companies cannot give you returns as much as returns unless there is monopoly.the risk is always there.

A retail investor is getting a sure shot 12% profit even if the index doesn’t move the whole year and you are saying there’s nothing attractive for an investor. In addition to it the divident yields of constituent companies are extremely high which only increases the profit margin.

The most attractive thing about this index is retail investors can get exposure to best companies in oil & gas and energy sectors which are expected to benefit post the General elections led by new government’s strong investment led policies. Continuation of diesel deregulation is a step in right direction…it gives a good portfolio diversification also

Whats the core advantage of this product ??? Its just like equity buying.

How much investment required ? What charges ?

Return on investment ?

Hello Bhaval, You get a basket of stocks as is the case with any ETF. ETF is a equity product, only, it is not a stock, it is a portfolio of stocks. Min investment is 5000. expense ratio is max of 0.49%. Nobody can predict return on investment with stocks/portfolio of stocks. There is no guaranteed returns. thanks, Vidya

Retail investors can invest a minimum of 5000 and maximum of 2 lacs.

the advantage of this product is that u get the benefits of investing in a MF scheme having bluechip high divident paying companies along with the benifits of owning equity stocks which can be traded just like stocks.

The annual AMC charges are capped at 0.49%.

Hi! I have demat account in another company and was not allowed to invest online as they said it was to be submitted offline in forms. Is it true, it was supposed to be submitted using forms and not online anywhere?

Hi Navdeep, If you have an online broking account, you could well have applied online. thanks

The ETF is trading 53% above its issue price. Those who invested in the NFO would have made good profit.

I invested and sold 2/3rd of the units at 55% profit. Dont see much upside from here.

How come FundsIndia is not offering the ETF this time around?

Hello Santosh, We do not offer new/follow on offers. When it is traded on the BSE, it is available.

How come FundsIndia is not offering the ETF this time around?

Hello Santosh, We do not offer new/follow on offers. When it is traded on the BSE, it is available.

there is nothing attractive to an investor herein.the only beneficiery is the govt.govt companies cannot give you returns as much as returns unless there is monopoly.the risk is always there.

A retail investor is getting a sure shot 12% profit even if the index doesn’t move the whole year and you are saying there’s nothing attractive for an investor. In addition to it the divident yields of constituent companies are extremely high which only increases the profit margin.

Whats the core advantage of this product ??? Its just like equity buying.

How much investment required ? What charges ?

Return on investment ?

Hello Bhaval, You get a basket of stocks as is the case with any ETF. ETF is a equity product, only, it is not a stock, it is a portfolio of stocks. Min investment is 5000. expense ratio is max of 0.49%. Nobody can predict return on investment with stocks/portfolio of stocks. There is no guaranteed returns. thanks, Vidya

Retail investors can invest a minimum of 5000 and maximum of 2 lacs.

the advantage of this product is that u get the benefits of investing in a MF scheme having bluechip high divident paying companies along with the benifits of owning equity stocks which can be traded just like stocks.

The annual AMC charges are capped at 0.49%.

Hi! I have demat account in another company and was not allowed to invest online as they said it was to be submitted offline in forms. Is it true, it was supposed to be submitted using forms and not online anywhere?

Hi Navdeep, If you have an online broking account, you could well have applied online. thanks

The most attractive thing about this index is retail investors can get exposure to best companies in oil & gas and energy sectors which are expected to benefit post the General elections led by new government’s strong investment led policies. Continuation of diesel deregulation is a step in right direction…it gives a good portfolio diversification also

The ETF is trading 53% above its issue price. Those who invested in the NFO would have made good profit.

I invested and sold 2/3rd of the units at 55% profit. Dont see much upside from here.