Imagine allocating your assets not only across global equities but also across debt instruments globally. That is what DSP BR Global Allocation Fund will seek to do. This open-ended fund-of-fund NFO from the DSP BR house will invest in a parent international fund, BlackRock Global Funds – Global Allocation fund (BGF-GAF).

The new fund offer will close the initial offer on August 14 and be once again available for investments after the NFO.

The fund

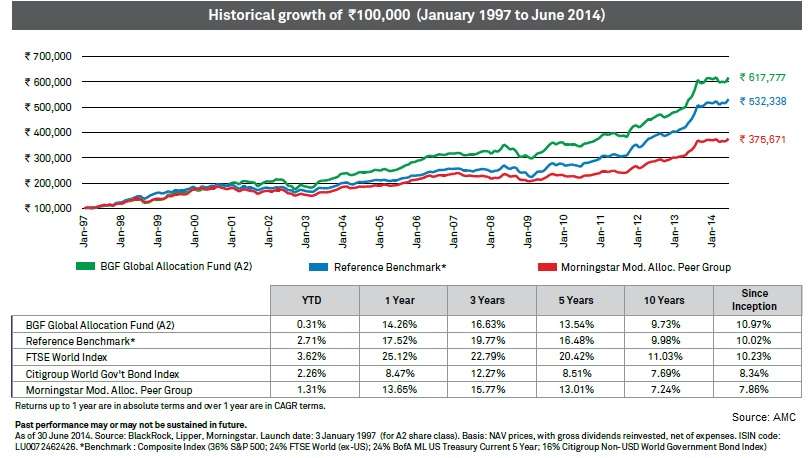

The parent fund will invest in global equities and debt across markets spanning US, Europe, Japan and other regions. The parent fund seeks to generate competitive returns with risks lower than a traditional equity portfolio. The parent fund has a long track record, having been launched in 1997.

For this purpose, it will take a call between asset classes – equity and debt depending on valuations of markets across regions as well as the risks involved. Again, within equities, it will go underweight or overweight on regions, depending on potential to generate returns with reasonable risk. A similar approach will be taken to invest in debt instruments across regions.

Being an international fund, under the new tax laws, any sale of the fund within 3 years will entail short-term capital gains tax at your slab rate. Benefits of indexation for long-term capital gains (over 3 years) will be available.

Investment strategy

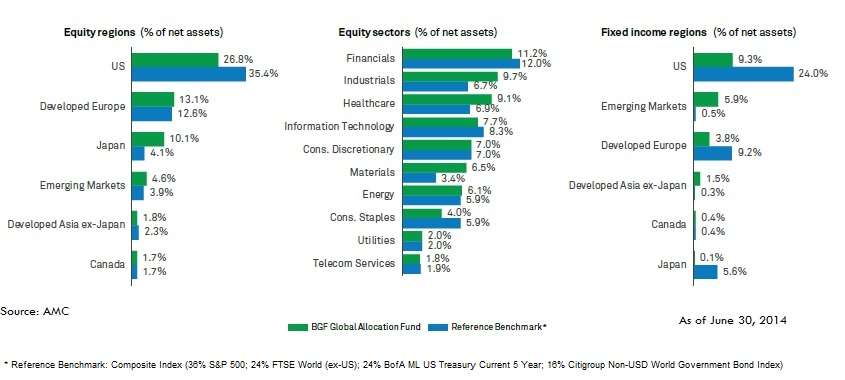

As of June 2014, allocation by the parent international fund to US equities was among the highest although the fund was underweight in the region when compared with the benchmark as a result of perceiving US equities to be fairly valued. The parent fund was instead overweight on markets in Europe as well as Japan.

Japan for instance, saw a turnaround in the equity markets post elections in 2012. The recent weakening of the yen has also made the export-intensive Japanese corporate more competitive.

In Europe while economic conditions have not seen any significant improvement, relatively better valuations of quality companies, compared with those in the US has led to European stocks being picked.

In terms of asset allocation, the fund had about 58% of asset in equities, 21% in debt and 21% in cash, clearly suggesting that it has an underweight position in equities and debt and is holding cash expecting volatility.

Given above is the region-wise and sector allocation of the parent fund as of June.

Performance

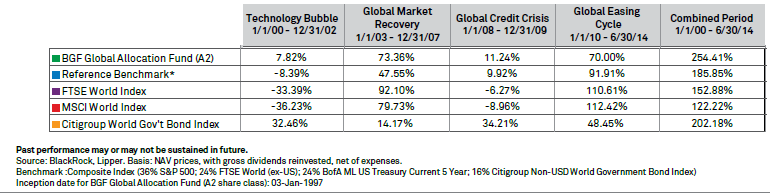

As is the case with asset allocation funds, investors should not expect equity-like returns in funds that seek to manage asset allocation. The ability of the fund to contain downfalls during market volatility or crisis scores over high returns in rallies. Given below are data about the parent fund’s long-term performance and also how it performed in various economic/business cycles.

Suitability

If you are looking to diversify into global markets (especially ones such as Japan for which there is no exclusive international fund locally, at present) and at the same time wish to do so in an asset allocated manner (where your equity debt allocation is based on valuations) then DSP BR Global Allocation may be a fund to watch for.

But ensure that you build a core portfolio with domestic equity funds with a sound track record, before crossing the shores.

Disclaimer: Past performance may not be indicative of future returns. Please read the SID before investing. All returns are sourced from AMC documents.

Investing in NFO is made simple with FundsIndia. Open a free FundsIndia account in less than 20 minutes for NFO investing.

FM identified the new tax laws only for non-equity funds, so now international equity funds are also considered as ‘non-equity’ funds? Just because their taxation matches debt funds that should not make them ‘non-equity’..

Yes, international equity funds are not classified as ‘equity’ for tax purposes. TO be an equity fund at least 65% of the fund’s assets should be invested in domestic equity stocks. It is rather unfortunate but that is how the law is. Thanks, Vidya

FM identified the new tax laws only for non-equity funds, so now international equity funds are also considered as ‘non-equity’ funds? Just because their taxation matches debt funds that should not make them ‘non-equity’..

Yes, international equity funds are not classified as ‘equity’ for tax purposes. TO be an equity fund at least 65% of the fund’s assets should be invested in domestic equity stocks. It is rather unfortunate but that is how the law is. Thanks, Vidya