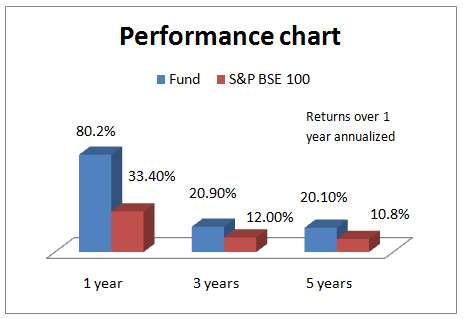

If you are looking to save taxes under Section 80C of the Income Tax Act and are also looking for high-returning options, then the ELSS fund, Reliance Tax Saver, may be right up your radar. With returns of 20.9% compounded annually in the last 3 years, the fund beat its category average by 6 percentage points and its benchmark S&P BSE 100 by about 9 percentage points.

Tax-saving option

Investment in the fund enjoys tax deduction of up to Rs 1.5 lakh under Section 80C of the Income Tax Act. In the recent July 2014 Budget, investments allowed as deduction under Section 80C were increased to Rs 1.5 lakh from Rs 1 lakh earlier. This is effective April 1, 2014. That means, if you are in the 30% tax bracket, you can save Rs 15,000 more using Section 80C investments now, therefore taking your total tax savings to up to Rs 45,000 under this option.

As you may be aware, tax-saving funds enjoy the least lock-in (3 years) period, as compared with other traditional options such as NSC, PPF or 5-year bank deposits. Added to this, ELSS funds also enjoy capital gains exemption at the time of sale (making the gains tax free) and also have a record of providing superior returns, given that they are essentially equity funds.

If you have to make your investments under Section 80C, you would do well to start investing now as equity markets may also offer conducive opportunities now than later next year.

Performance

Reliance Tax Saver is a high beta, aggressive fund and is known to do well in rallying markets, but also fall hard in down markets. Hence, you would do well to use the SIP route to ensure you average costs in the fund.

An SIP in the fund over the past 3 years would have delivered a good 37% IRR, at least 6 percentage points higher than peers such as ICICI Pru Tax Plan and of course, far higher than its own point-to-point 3-year annualised return of 20.9%. The higher return through SIP suggests that the fund is volatile and hence, its NAV provides higher averaging opportunities.

For those looking for less aggressive options, you may wish to choose other tax-saving funds from our Select Funds list.

Since, you would have to hold a tax-saving fund for at least 3 years, we looked at the rolling 3-year returns (rolled daily) of the fund. It beat its benchmark 88% of the times, which is a fairly good record. However, again, rolling 1-year returns show much higher volatility.

Portfolio

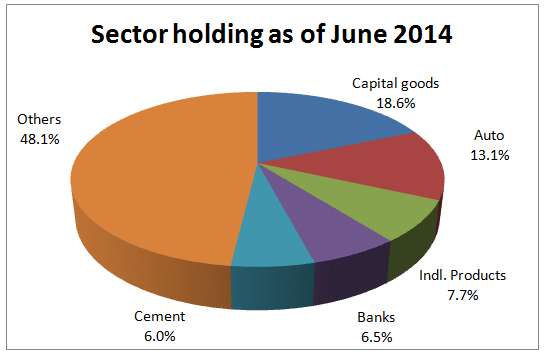

Reliance Tax Saver’s phenomenal return over the past year was possible primarily because of an early build-up of a super-growth, super-cyclical portfolio, well before the actual rally in such sectors began.

For instance, even a year ago (June 2013), the fund had auto, capital goods and other industrial products as its top 3 sector exposures. In the above period, banking was only its fourth largest sector with just about 8% exposure. This strategy though, helped it withstand the banking rout well, although it underperformed overall in 2013 as it lost out on rallies in the IT and pharma spaces. Still, post September when the cyclical rally took off, the fund’s portfolio took flight with élan.

As of June 2014, the fund had a high-quality capital goods portfolio with cash-rich MNC names such as Honeywell Automation India, Siemens, Schneider Electric Infrastructure and Alstom T&D India. Strangely though, the top exposure was a desi stock – TVS Motor Company with as high as 10% holding. This stock, jumped 5 times in the past year.

The fund is managed by Ashwani Kumar.

To know how to read our weekly fund reviews, please click here.

Disclaimer: Returns mentioned are past returns and are not indicative of future performance.

it is a good fund as explained. there is thrill in investing in the fund on account of its roller- coaster ridte.i like it and invest in .thanks for bringing about the fund to the forefront.

can i start sip with reliance tax saver if i’m not tax payer or 10% tax bracket?

Hello Trolok,

If you have no need for tax deduction benefit, then unless you don’t mind the 3-year lock-in that comes with ELSS, you can consider open-ended equity funds too. Vidya

Hi Vidya,

Your blogs are so good and upto the content. But I have one suggestion for you.

Please include expense ratio parameter as part of mutual fund analysis. If you are long term investor a percentage extra in expense ratio will eat lot of your profit.

I consider expense ratio as one of the big parameter.

Hope in future article it will taken into account.

Regards,

Rajasekar M

Rajasekar, Thanks and appreciate the suggestion. I see your point.

Our fund selection process very much takes into account expense ratio. Also the finl returns on an NAV is post expense rati. Hence it is automatically taken care of. Investors tend to confuse expense ratio as a charge further on the returns we state (on NAV after expenses) if given in the analysis write-up. Hence, the intention is not to confuse investors. In the links given for each fund, you can get into our scheme explorer and check out the expense ratio and all other info on the fund. thanks, Vidya

Why this fund is not performing comparing to its peer?. I invested around 1 year ago but since then its in -ve.

Hello Sir,

Reliance TAx Saver is a high risk fund. That means in a rally it delivers more than peers but in market fall (such as the one year to date), it tends to fall more. That is the nature of the fund. It is otherwise fine. Give it time, if you are holding it for the long haul. Vidya

it is a good fund as explained. there is thrill in investing in the fund on account of its roller- coaster ridte.i like it and invest in .thanks for bringing about the fund to the forefront.

can i start sip with reliance tax saver if i’m not tax payer or 10% tax bracket?

Hello Trolok,

If you have no need for tax deduction benefit, then unless you don’t mind the 3-year lock-in that comes with ELSS, you can consider open-ended equity funds too. Vidya

Hi Vidya,

Your blogs are so good and upto the content. But I have one suggestion for you.

Please include expense ratio parameter as part of mutual fund analysis. If you are long term investor a percentage extra in expense ratio will eat lot of your profit.

I consider expense ratio as one of the big parameter.

Hope in future article it will taken into account.

Regards,

Rajasekar M

Rajasekar, Thanks and appreciate the suggestion. I see your point.

Our fund selection process very much takes into account expense ratio. Also the finl returns on an NAV is post expense rati. Hence it is automatically taken care of. Investors tend to confuse expense ratio as a charge further on the returns we state (on NAV after expenses) if given in the analysis write-up. Hence, the intention is not to confuse investors. In the links given for each fund, you can get into our scheme explorer and check out the expense ratio and all other info on the fund. thanks, Vidya

Why this fund is not performing comparing to its peer?. I invested around 1 year ago but since then its in -ve.

Hello Sir,

Reliance TAx Saver is a high risk fund. That means in a rally it delivers more than peers but in market fall (such as the one year to date), it tends to fall more. That is the nature of the fund. It is otherwise fine. Give it time, if you are holding it for the long haul. Vidya