Couple of weeks ago we looked at volatility and consistency of returns of a mutual fund and how to choose a mutual fund based on these parameters. We discussed about standard deviation, which is a measure of risk. But how do you know risk delivered returns? sharpe ratio helps know this.

It simply tells you the excess returns that you earn over a risk-free instrument for every unit of risk taken. A higher ratio means the fund delivered more for the quantum of risk it took.

By excluding the risk free return that you would get in a government instrument, the ratio actually takes the excess returns generated by assuming risks. And this excess return per unit of risk (measured by volatility – standard deviation) is the sharpe.

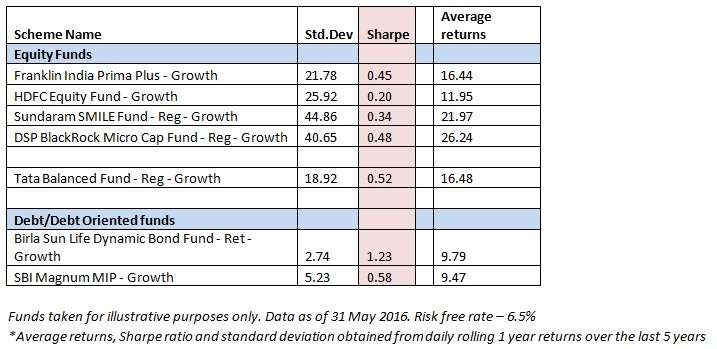

Sharpe explains whether you are compensated well enough for the risk taken. Let us take a look at some fund example and see how it works.

As we look at the illustration, it is important to note that comparisons across categories will not be meaningful as different categories assume different levels of risk.

Now let us look the first two funds from the above table: Franklin Prima Plus and HDFC Equity are multi cap funds. It can be seen that the Franklin fund delivered higher average returns with lower volatility (read standard deviation) hence has a significantly higher sharpe ratio compared to the HDFC Equity fund. In a similar way, it can also be inferred that the DSP Black Rock fund which is a micro cap fund has delivered better returns with lower volatility compared with the Sundaram fund thereby returning a higher sharpe ratio.

You can notice the debt fund in the above illustration has a higher sharpe as a result of lower standard deviation. In other words, they take very little risk. But this cannot be compared with the equity category; as you will see that the actual returns in a debt fund is lower than with equities. This only indicates that a high sharpe ratio can also be a result of very low volatility and consistent returns above the risk free rate and precisely the reason why it should not be used to compare across categories.

While Sharpe ratio is a good measure to understand if a fund is delivering returns commensurate to the risks taken, it does have some limitations. Some of the shortfall of this ratio is that:

(i) Since this is a standalone ratio it will not tell you much. It has to be seen in comparison to its peers or the fund’s benchmark. Also, it needs to be compared with the right peers to help you in your decision.

(ii) Sharpe ratio per se does not talk of the volatility of the fund, instead it indicates how well you are compensated for the risk taken. Hence, if a fund is very volatile in the short term but still delivers over the long term, it might still have a high sharpe ratio. However, if you cannot stomach such short-term volatility, then this ratio may mislead you.

It is important to use a single source for comparing the Sharpe ratio across peers and its benchmark. The shape ratio in the fund fact sheet may differ from what is stated in a rating website. This is so since different sets of data (time frames and also frequency of testing) would be used by different sources that give Sharpe ratio. Hence stick to one source and make the comparison within the right categories to use this metric well.

pl give equivalent of sharpe ratio in debt funds to chose safe debt funds

regards

Satyandra, as explained in the article, there is not a single number or a range of sharpe ratio that we can look for in a category of mutual fund. Pick a fund, check if its sharpe ratio is better/higher than its peers in its category.

Nice and concise information on Sharpe Ratio. Good one.

pl give equivalent of sharpe ratio in debt funds to chose safe debt funds

regards

Satyandra, as explained in the article, there is not a single number or a range of sharpe ratio that we can look for in a category of mutual fund. Pick a fund, check if its sharpe ratio is better/higher than its peers in its category.

Nice and concise information on Sharpe Ratio. Good one.

kindly explain treynor,jensen beta and standard deviation , variance all in detail.

Thank You

Raj, We have covered standard deviation in our previous post. Here is the link : https://blog.fundsindia.com/blog/mutual-funds/mutual-funds-and-volatility/9250. With respect to the rest of the ratios we would be covering them in future posts.

kindly explain treynor,jensen beta and standard deviation , variance all in detail.

Thank You

Raj, We have covered standard deviation in our previous post. Here is the link : https://blog.fundsindia.com/blog/mutual-funds/mutual-funds-and-volatility/9250. With respect to the rest of the ratios we would be covering them in future posts.

Seems to be a good ap for raw investor Like me. What should be the minimum investment to start with. ?

Praveen Dhir.

The minimum investment is what you deem fit based on your objectives. But it has to be a minimum of Rs 5000 via lump sum and Rs 1000 in SIP.

Seems to be a good ap for raw investor Like me. What should be the minimum investment to start with. ?

Praveen Dhir.

The minimum investment is what you deem fit based on your objectives. But it has to be a minimum of Rs 5000 via lump sum and Rs 1000 in SIP.