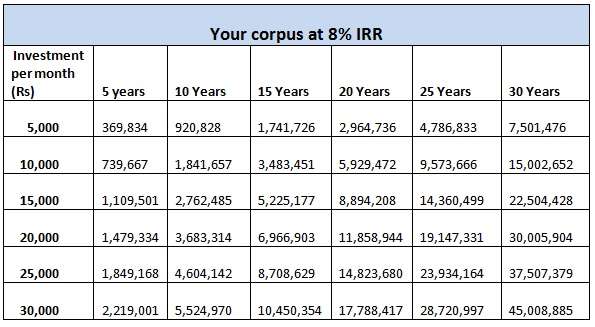

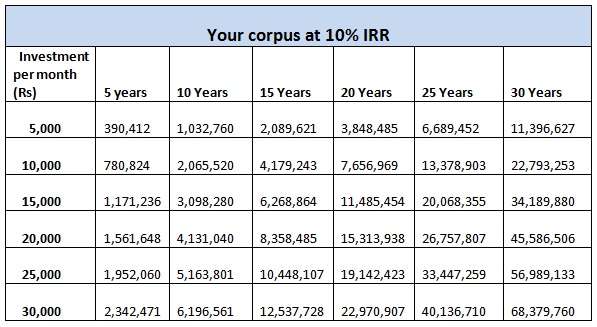

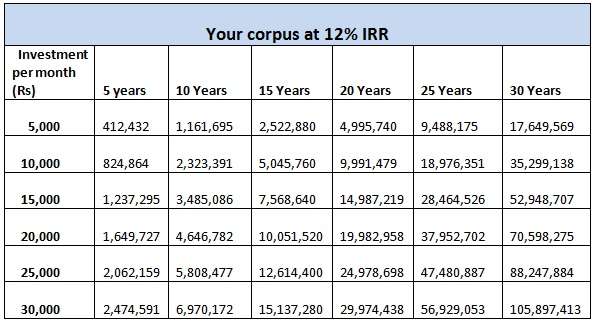

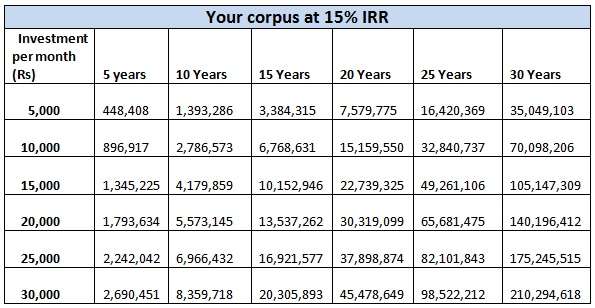

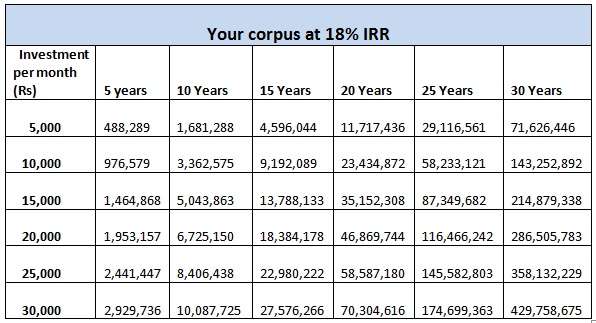

We often talk of the virtues of investing through the systematic investment route (SIP). When you invest a monthly sum, how much can you expect at different rate of returns, over different time frames?

Here’s a ready reckoner that will help you quickly know if you are investing adequately and where you are likely to be over different time frames.

Please note that this is not a forecast on returns. Based on your own return assumptions (for the asset allocation you have chosen), you may refer this for your investment time frame to know where you will be.

Clearly, you will see the significance of investing a sizeable sum if you want to save for large goals or build sufficient wealth.

Also, it also tells you the need to invest a reasonable sum in equity, if you want your money to work for you. Just take the case of an 8% IRR (a return you might typically get in bank FDs). An investment of Rs 30,000 a month leaves you with a corpus of just Rs 4.5 crore in 30 years.

However, a 12% IRR (which you can achieve with even a 40-50% equity allocation) leaves you with a substantially higher sum of Rs 10.6 crore! That is the kind of returns that you can achieve even with some amount of equity exposure.

Internal rate of return or IRR is the annualised returns for investments made over regular frequencies.

If you notice beyond the 12% IRR, your money almost doubles every five years and with returns beyond that, it more than doubles.

What returns to expect

What returns to expect would depend on two factors: one, your asset allocation ratio and two, the past returns and potential of such asset classes. The higher the equity, the better the chances of your earning double digit returns over 5 years or more.

Historically if you look at the past 20 years that is since 1996, it can be noticed that the broad indices have delivered around 12% to 13% IRR.

But at the same time, if we look at some of the good, steady funds that have existed since then, they give a very promising picture. For example: Franklin India Bluechip, Franklin India Prima and HDFC Equity fund have all delivered in excess of 20% IRR over the last 20 years.

Disclaimer: Returns given here are based are calculations based on said time frame, amount and returns. They should not be construed as being forecasts. Mutual funds are subject to market risks. Please read the scheme information and other documents carefully.

I have one question:

Lets say I started investing in 1 Mutual with Rs. 5000/month keeping a time horizon of 15 years. But after say 5 years, (my investment becomes 3 Lakh aftre 5 years), I find that the fund is not performing well, e.g. as compare to its peers, or change in Market trends (other category fund performing well ), etc.

Now as a SIP investor what possible approaches, I can take? I am asking this as fund value invested (3 lakh) is pretty high now, so re-investing via SIP will not make sense, and on the other hand if market is high than Lumpsum also will not make sense. Please suggest?

1. Investing in a single mutual fund scheme is not recommended. You should diversify your fund among 3-6 mutual fund schemes.

2. It is unlikely that all of those funds would be under-performing at a time. The money should not redeemed only for a short term loss. However, if any of the schemes is not performing well for 1 year or so, then the money invested in that scheme should be redeemed.

Hi Mohit, Always watch the performance of the fund you are investing in for atleast for a two quarters. If you find that the fund is not improving its performance, stop the SIP and find a peer fund that is performing well and start your SIPs in this fund. The accumulated amount in the old fund, you can again see for another quarter or two and if you find that the fund is still not improving in performance, move it to the new fund. Since you are only switching to another fund int the same category, there is no additional risk that you are taking by doing this.

I have one question:

Lets say I started investing in 1 Mutual with Rs. 5000/month keeping a time horizon of 15 years. But after say 5 years, (my investment becomes 3 Lakh aftre 5 years), I find that the fund is not performing well, e.g. as compare to its peers, or change in Market trends (other category fund performing well ), etc.

Now as a SIP investor what possible approaches, I can take? I am asking this as fund value invested (3 lakh) is pretty high now, so re-investing via SIP will not make sense, and on the other hand if market is high than Lumpsum also will not make sense. Please suggest?

1. Investing in a single mutual fund scheme is not recommended. You should diversify your fund among 3-6 mutual fund schemes.

2. It is unlikely that all of those funds would be under-performing at a time. The money should not redeemed only for a short term loss. However, if any of the schemes is not performing well for 1 year or so, then the money invested in that scheme should be redeemed.

Hi Mohit, Always watch the performance of the fund you are investing in for atleast for a two quarters. If you find that the fund is not improving its performance, stop the SIP and find a peer fund that is performing well and start your SIPs in this fund. The accumulated amount in the old fund, you can again see for another quarter or two and if you find that the fund is still not improving in performance, move it to the new fund. Since you are only switching to another fund int the same category, there is no additional risk that you are taking by doing this.

I have one question:

Lets say I started investing in 1 Mutual with Rs. 5000/month keeping a time horizon of 15 years. But after say 5 years, (my investment becomes 3 Lakh aftre 5 years), I find that the fund is not performing well, e.g. as compare to its peers, or change in Market trends (other category fund performing well ), etc.

Now as a SIP investor what possible approaches, I can take? I am asking this as fund value invested (3 lakh) is pretty high now, so re-investing via SIP will not make sense, and on the other hand if market is high than Lumpsum also will not make sense. Please suggest?

After 5 yrs withdraw your investment of 3 Lakhs

Recycle SIP portfolio for the rest of accruals in Same MF

Distribute your own 3 Lakhs in different MFs at 1 lakh each in 50% debt & 50% Eqities as per the prevailing market trends at that time.

Idea is to plan & distribute your risk factor & chance of higher yield returns.

Repeat the same once in 5yrs cohort.

Apologies for the late reply.

A better way to do this is to initially allocate your money across equity and debt based on your risk appetite. This can be done for both SIPs and lumpsums. You can review your portfolio once in a year. And you can move your money across equity and debt in case of any significant changes to the initially allocated proportion. As your risk appetite changes with time you can reallocate your investment accordingly between debt and equity to match your risk.

This is a very insightful information esp, for investors new to MF/SP. Great work !

Thanks guys for clarification. I have one more question:

From diversification , what is better approach:

Large Cap 40%

Mid/Small Cap 40%

Diversified 20%

OR

Large Cap 20%

Mid/Small Cap 40%

Diversified 40%

Mohit – It is entirely your call based on your time frame, goal and risk appetite. If you do not like volatility, you should hold more largecaps. In general we do not suggst more than 20-30% in midcaps as you already get some in diversified funds as well. thanks, Vidya

In general:

Risk/ Return is in the following order

Small cap > Mid cap > Large Cap ~= Diversified (Equity-oriented)

Now, you need to figure out the allocation depending upon your risk-taking ability.

Thanks guys for clarification. I have one more question:

From diversification , what is better approach:

Large Cap 40%

Mid/Small Cap 40%

Diversified 20%

OR

Large Cap 20%

Mid/Small Cap 40%

Diversified 40%

Mohit – It is entirely your call based on your time frame, goal and risk appetite. If you do not like volatility, you should hold more largecaps. In general we do not suggst more than 20-30% in midcaps as you already get some in diversified funds as well. thanks, Vidya

In general:

Risk/ Return is in the following order

Small cap > Mid cap > Large Cap ~= Diversified (Equity-oriented)

Now, you need to figure out the allocation depending upon your risk-taking ability.

I have one question:

Lets say I started investing in 1 Mutual with Rs. 5000/month keeping a time horizon of 15 years. But after say 5 years, (my investment becomes 3 Lakh aftre 5 years), I find that the fund is not performing well, e.g. as compare to its peers, or change in Market trends (other category fund performing well ), etc.

Now as a SIP investor what possible approaches, I can take? I am asking this as fund value invested (3 lakh) is pretty high now, so re-investing via SIP will not make sense, and on the other hand if market is high than Lumpsum also will not make sense. Please suggest?

After 5 yrs withdraw your investment of 3 Lakhs

Recycle SIP portfolio for the rest of accruals in Same MF

Distribute your own 3 Lakhs in different MFs at 1 lakh each in 50% debt & 50% Eqities as per the prevailing market trends at that time.

Idea is to plan & distribute your risk factor & chance of higher yield returns.

Repeat the same once in 5yrs cohort.

Apologies for the late reply.

A better way to do this is to initially allocate your money across equity and debt based on your risk appetite. This can be done for both SIPs and lumpsums. You can review your portfolio once in a year. And you can move your money across equity and debt in case of any significant changes to the initially allocated proportion. As your risk appetite changes with time you can reallocate your investment accordingly between debt and equity to match your risk.

This is a very insightful information esp, for investors new to MF/SP. Great work !