News flash: Your fund manager isn’t the only person responsible for the profitability of your investments; you are too! Yes, instead of just logging in to your FundsIndia account and looking at your Dashboard to see how much returns you’ve earned in the last 24 hours, it’s time you increase the profitability of your investments by doing something really simple. It’s time you group to grow.

Remember the first rule of successful investing? It is to set a goal. Your goal could be anything – you could be saving up to buy a new mobile phone, or to go on a vacation next year, or for your children’s higher education. You could be saving up for one of these goals, or for all of them, or even more goals!

Now, once you know WHY exactly you’re investing, a lot of things fall into place. You’ll be able to easily identify:

1. Time-frame – When do you want to achieve your goal? Are you investing for the long-term or the short-term? These questions will help you determine your choice of investments.

2. Risk – Usually, when saving for short-term goals, it is best to avoid risky investment options like equity mutual funds. You could go for safer investment options like, say, debt mutual funds.

3. Amount – You need to have a target number in mind for your goal. This number should be practically set for all practical reasons, without being too ambitious. Also, do make sure you account for inflation when you set a target amount for your goal. For instance, you may want to invest for your child’s higher education which is about 10 years away. While the cost of higher education may amount to Rs. 10 lakh now, assuming inflation at the rate of 6 per cent per annum, you will have to save Rs. 18 lakh to sufficiently cater to the cost of your goal.

4. The funds – Once you put all the above points together, you’ll be able to identify the type of funds you can invest in, and the number of funds that you require in order to accomplish your goal within the stipulated time period. Now is the time for you to group to grow.

In order to ensure you successfully invest for your goal, it is critical that you do the following:

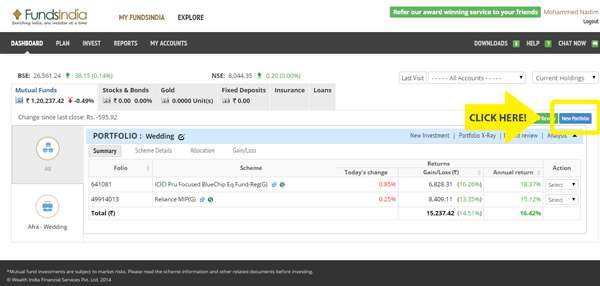

1. Create a portfolio – You can maintain as many portfolios as you want depending on the number of goals you want to achieve. It is highly recommended that you build and manage one portfolio per goal as it will ensure ease in investing, maintening and tracking. To create a portfolio, you just have to login to your FundsIndia account. In the Dashboard page, you’ll find the button – ‘New Portfolio’ on the right side of the page.

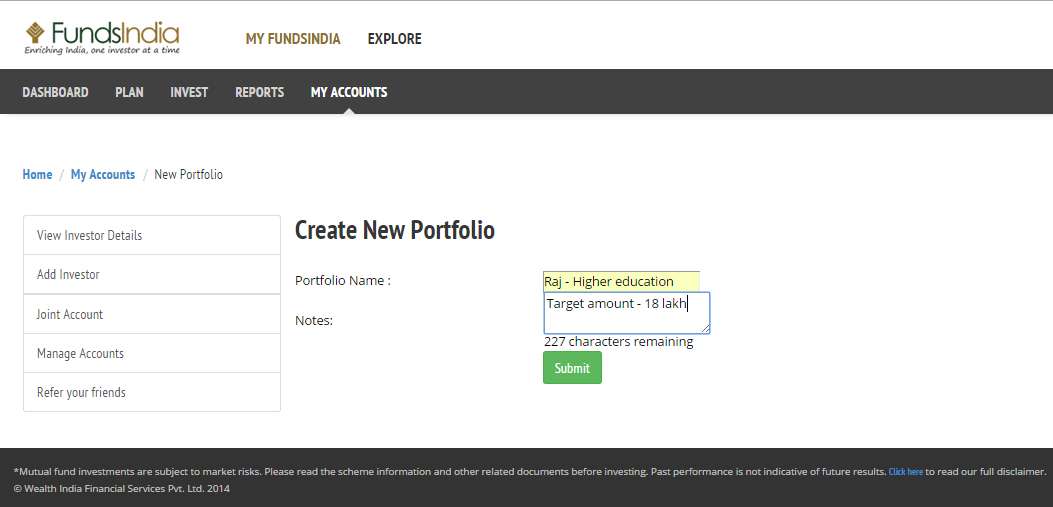

2. Describe your goal – On clicking the ‘New Portfolio’ button, you’ll be taken to a page where you can enter the name of your new portfolio, and a short description for the same. You can use the description field to enter your target amount, or / and any other information pertaining to your goal and portfolio. After entering this information, click ‘Submit’.

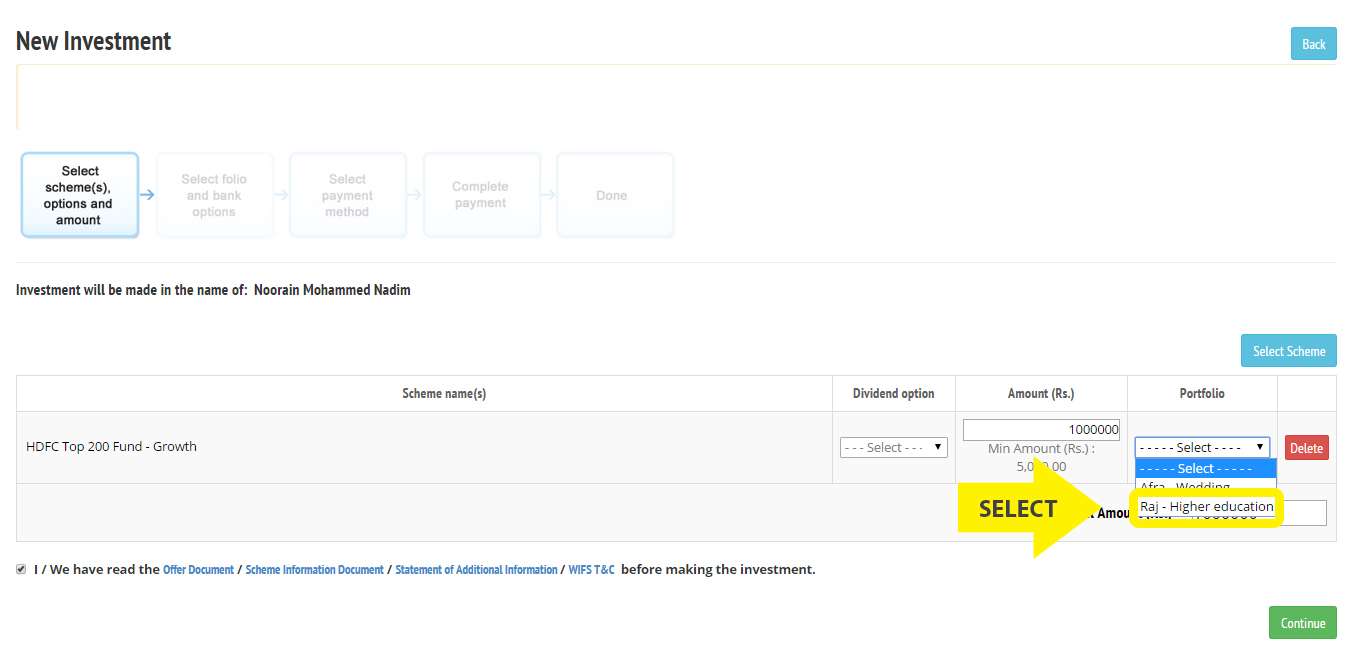

3. Invest for your goal – To do this, you’ll have to add investments to your portfolio. When you select any mutual fund for investment, either through the lump sum or Systematic Investment Plan (SIP) route, you can select the portfolio for which you’re investing from a drop-down menu. Voilà! Your investment will be added to it.

4. Monitor and maintain – FundsIndia.com gives you unprecedented power in monitoring the performance of your portfolio to make sure you efficiently manage your investments. We’ll tell you more about the powerful portfolio tools that come with your FundsIndia account in the posts to come.

It’s time you get responsible for the performance of your investments. Set goals, and group your investments for them in portfolios and watch them grow. After all, successful investing is just simple investing.

Thanks, but the monitoring can be improved with following features as well

1. Instead of showing unrealized short/long term amount it can show no.of units that can be redeemed safely without incurring short term taxation for equity and correspondingly for debt funds as well

2. Showing how long a fund was invested with Avg. no. of days against each fund (CAMS shows it)

3. Annual returns achieved by each of the portfolio for the last few years it was invested

4. We may have multiple portfolios, but the dashboard does not show XIRR for the combined portfolios.

Some of these were requested earlier too, but were not heeded to hope this time it is different!

Sheetal,

Appreciate your inputs. My comments on your inputs are as below

1. Agreed. We are currently working on displaying this in the redemption flow. We will see how we can include this in the dashboard as well.

2. I have seen this in CAMS but I am not sure how useful this will be especially for SIP investments. I will discuss with my team and decide how to take this forward.

3. This is an interesting suggestion. I will check with my team on the feasibility and explore how we can do this.

4. This is something we have been working on and should be able to provide in the next 1-2 months.

Thanks FI, that was encouraging.

Currently, you don’t allow an investment to split among different portfolios. When can we have that option?

Anil,

It is possible to invest in a single scheme in 2 portfolios. You can choose the new investment option, select the scheme you want and choose the portfolio into which you want to make the purchase. Write to us at contact@fundsindia.com if you need further guidance on this.

Regards,

Team FundsIndia

I would like to know on how to split my existing investments into different portfolios. I don’t want to take the next purchase into a different portfolio.

You can do this. Please send a mail to contact@fundsindia.com with the split you want and we can make the change for you.

Thanks, but the monitoring can be improved with following features as well

1. Instead of showing unrealized short/long term amount it can show no.of units that can be redeemed safely without incurring short term taxation for equity and correspondingly for debt funds as well

2. Showing how long a fund was invested with Avg. no. of days against each fund (CAMS shows it)

3. Annual returns achieved by each of the portfolio for the last few years it was invested

4. We may have multiple portfolios, but the dashboard does not show XIRR for the combined portfolios.

Some of these were requested earlier too, but were not heeded to hope this time it is different!

Sheetal,

Appreciate your inputs. My comments on your inputs are as below

1. Agreed. We are currently working on displaying this in the redemption flow. We will see how we can include this in the dashboard as well.

2. I have seen this in CAMS but I am not sure how useful this will be especially for SIP investments. I will discuss with my team and decide how to take this forward.

3. This is an interesting suggestion. I will check with my team on the feasibility and explore how we can do this.

4. This is something we have been working on and should be able to provide in the next 1-2 months.

Thanks FI, that was encouraging.

Currently, you don’t allow an investment to split among different portfolios. When can we have that option?

Anil,

It is possible to invest in a single scheme in 2 portfolios. You can choose the new investment option, select the scheme you want and choose the portfolio into which you want to make the purchase. Write to us at contact@fundsindia.com if you need further guidance on this.

Regards,

Team FundsIndia

I would like to know on how to split my existing investments into different portfolios. I don’t want to take the next purchase into a different portfolio.

You can do this. Please send a mail to contact@fundsindia.com with the split you want and we can make the change for you.