At a time when duration is the preferred strategy in the debt fund market, we recommend that investors supplement it with some accrual funds as well (for those wanting to know how duration and accrual strategy vary please read this article). Within the accrual strategy, for investors looking at sustained higher returns, long after the interest rate cycle falls, the credit space provides an opportunity. However, this space must be explored with caution as very high risks do not always provide commensurate returns.

UTI Income Opportunities, an income accrual fund with some penchant for credit risk is an option for investors looking for sustained returns without the high risks that credit funds usually sport. Investors need to have a minimum 3-year time frame to invest in this fund.

Why accrual now

The demonetisation of currency has had a sharp impact on yields with the 10-year 6.97% 2026 yield now at 6.3%. That has meant a quick rally, with funds in the dynamic bond category delivering 2.5% on an average in just a week’s time. Even so, debt fund managers opine that there is a high possibility of further rate cuts post demonetisation and this can result in further easing of yields. That means the duration play is not yet over.

But what has happened is that the rate rally has been hastened by the unexpected event of demonetisation. That means, while your portfolio will sport high returns and will continue to do so for a good number of quarters in future, you will also have to gear up to having a more sustained return strategy once the story from the bond rally is over. Towards this, accrual options are a good add-on to any debt portfolio.

Within the accrual space, you have two options – one, go with low credit risk funds which have quality papers and slightly higher average maturity or go with funds that take exposure to lower rated papers. For risk-averse investors, we would recommend only the former – HDFC Medium Term Opportunities being a preferred fund for us in that space. But that would also mean settling for slightly lower returns as rates fall. Besides, many dynamic bond funds will partly sport a low-risk accrual portfolio once the rate rally is over and they reduce their portfolio duration. The second option is to explore the credit risk space selectively. Here, for those willing to take some risks but not too high, UTI Income Opportunities would fit the bill.

The fund and performance

UTI Income Opportunities is not among the top performing funds in the credit opportunity space. Our choice of the fund is simply based on few metrics: one, the fund’s average (last 1 year) holding of papers rated AA or lower is among the lowest in this category (barring IDBI Corporate Debt Opportunities, which has a track record of less than 3 years). Two, its average maturity of 2.4 years and yield to maturity of 9.18% also score well on the risk-return metric. Both of these mean for a lower credit risk, lower duration and decent yield, the fund is a good choice if you do not want to go overboard on the risk metric.

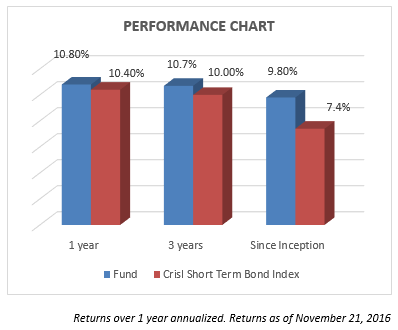

UTI Income Opportunities delivered 10.7% in the last 1 year, marginally higher than the category average of 10.5%. We would still think this performance is commendable as most of the funds in that space sport a far higher risk profile. It’s returns since inception (November 2012) is 9.8% compounded annually.

UTI Income Opportunities has not delivered any negative returns on a rolling 1-year return basis, when rolled daily in the past 3 years. As opposed to this, you will find that dynamic bond funds, despite their high returns, have sported negative 1-year returns in the past.

In fact, on a rolling 1-month basis, the fund had negative returns on just 3 occasions in the past 3 years – once in July 2013 and on 2 days in February 2016. Both were periods of steep increase in yields. This record is far better than many other peers.

Portfolio

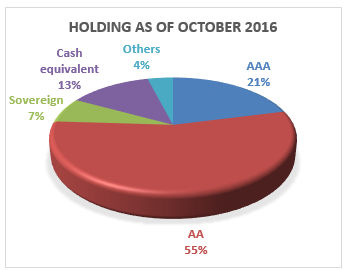

UTI Income Opportunities held about 55% in AA/AA- and AA(SO)/AA(S0)- rated instruments as of October 2016. AAA/A1+ rated papers accounted for about 21% of the portfolio. While quite a few of these companies are NBFCs that are in the business of lending for home purchase, giving that much of it is retail lending, we do not see any adverse impact of demonetisation on these instruments. However, in general, for all finance companies (which form a good chunk of any debt portfolio), the forthcoming quarters would be testing times of how their loan repayments pan out. To this extent, any near-term shocks or downgrades in some of the instruments cannot be ruled out. However, if the fund is held over the tenure recommended, it would provide enough time to get over any such shocks.

UTI Income Opportunities held about 55% in AA/AA- and AA(SO)/AA(S0)- rated instruments as of October 2016. AAA/A1+ rated papers accounted for about 21% of the portfolio. While quite a few of these companies are NBFCs that are in the business of lending for home purchase, giving that much of it is retail lending, we do not see any adverse impact of demonetisation on these instruments. However, in general, for all finance companies (which form a good chunk of any debt portfolio), the forthcoming quarters would be testing times of how their loan repayments pan out. To this extent, any near-term shocks or downgrades in some of the instruments cannot be ruled out. However, if the fund is held over the tenure recommended, it would provide enough time to get over any such shocks.

The fund is managed by Ritesh Nambiar. The assets managed as of October 2016, was Rs. 1856 crore.

FundsIndia’s Research team has, to the best of its ability, taken into account various factors – both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts’ expectations about future events. They should not, therefore, be the sole basis of investment decisions. To know how to read our weekly fund reviews, please click here.